[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Compounding Lab [@CompoundingLab](/creator/twitter/CompoundingLab) on x XXX followers Created: 2025-07-08 19:01:08 UTC REIT behemoths: Prologis Inc $PLD vs Welltower Inc $WELL Summary: ✔️ Prologis and Welltower are both giants in the REIT sector, but they operate in very different arenas—Prologis in logistics and industrial real estate, Welltower in healthcare and senior living. ✔️ Both have delivered strong earnings growth, with Welltower’s recent rebound outpacing Prologis. ✔️ Valuation metrics show Welltower trading at a premium, suggesting higher growth expectations but also more risk. 📈Financial Comparison Over the past decade, both Prologis and Welltower have delivered similar, modest returns on invested capital, with Prologis showing a 10-year median ROIC of XXX% and Welltower at 3.2%. This reflects the capital-intensive nature of the REIT industry. Looking at earnings and revenue growth, Prologis is forecast to grow EPS by about XXX% annually and revenue by 6.7%. Welltower, however, is expected to deliver much faster growth, with EPS projected to rise XXXX% per year and revenue by 13.7%. Notably, Welltower’s earnings surged by nearly XXX% in 2024, highlighting a strong recovery after a difficult 2022. Historically, Prologis maintained superior profitability with NOPAT margins of roughly 30%, compared to Welltower’s margins of around 21%. 📊Valuation Metrics (as of June 2025) When it comes to valuation, Welltower is priced at a significant premium. Its price-to-earnings ratio is 92, much higher Prologis’s 28, and its price-to-book ratio stands at XXX compared to Prologis’s XXX. This premium reflects market optimism about Welltower’s growth prospects, but it also raises questions about whether such high expectations are sustainable. 🛡️Competitive Positioning Prologis does not seem to have a moat, despite benefiting from its global logistics network and high-barrier-to-entry assets. Its strengths include a diversified tenant base and strong demand driven by e-commerce. However, it remains exposed to cyclical demand and the risk of new warehouse supply entering the market. Welltower, on the other hand, is the leading healthcare REIT, with no moat (but in the process of developing moat built on scale and strategic partnerships). Its strengths lie in its exposure to favorable demographic trends and a diversified healthcare portfolio. The main challenges for Welltower are regulatory risks in healthcare and variability in the performance of its operating partners. ✅ Bottom Line Prologis stands out for its stability and reasonable valuation, underpinned by its dominant position in logistics real estate. Welltower offers higher growth potential, especially as aging demographics drive demand for healthcare and senior living, but this comes at a much higher valuation and with sector-specific risks. Ultimately, you must decide whether you value Prologis’s predictability or Welltower’s growth - and whether the premium for Welltower is justified. _____________________________ Follow for daily actionable investing frameworks  XXXXX engagements  **Related Topics** [pld](/topic/pld) [metrics](/topic/metrics) [coins healthcare](/topic/coins-healthcare) [coins real estate](/topic/coins-real-estate) [logistics](/topic/logistics) [$well](/topic/$well) [reit](/topic/reit) [$pld](/topic/$pld) [Post Link](https://x.com/CompoundingLab/status/1942660241008521656)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-08 19:01:08 UTC

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-08 19:01:08 UTC

REIT behemoths: Prologis Inc $PLD vs Welltower Inc $WELL

Summary:

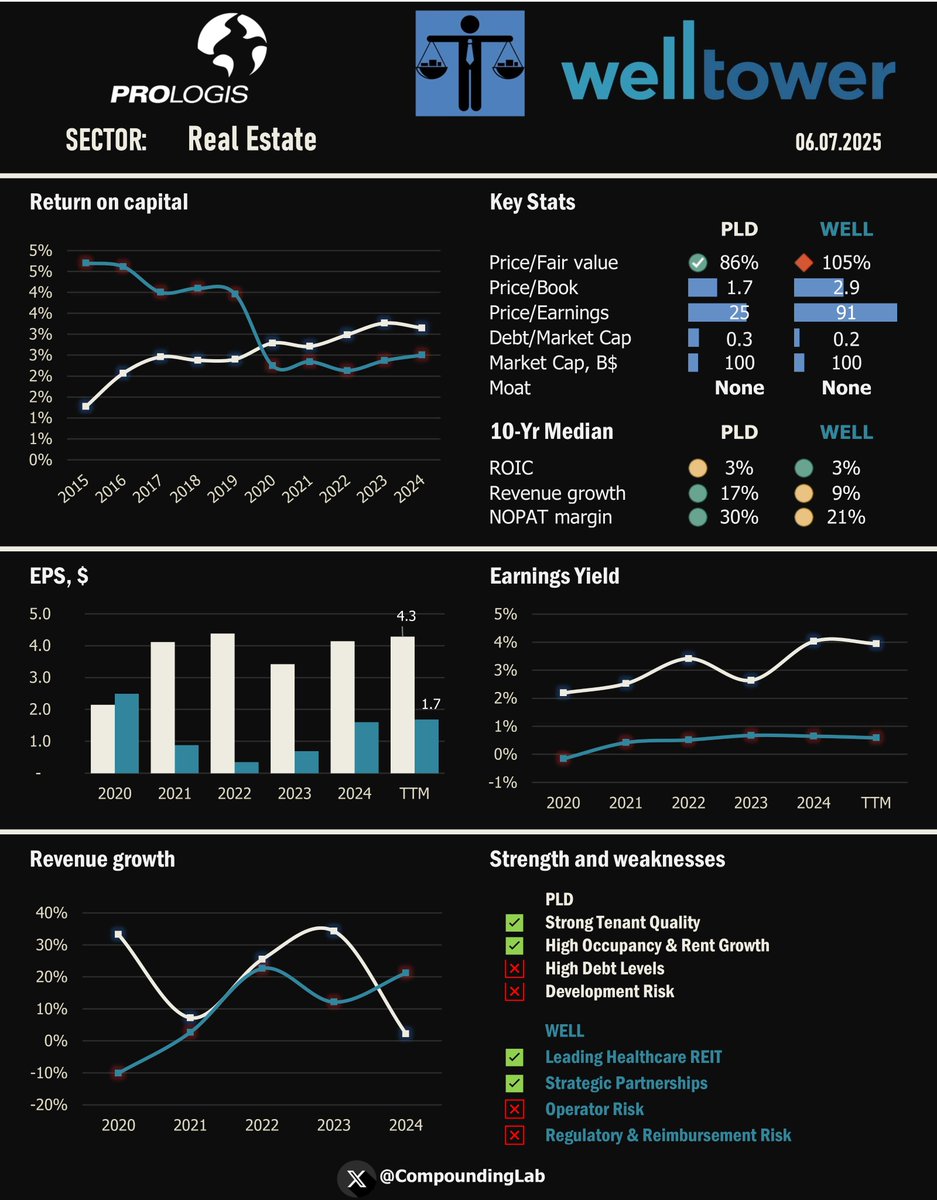

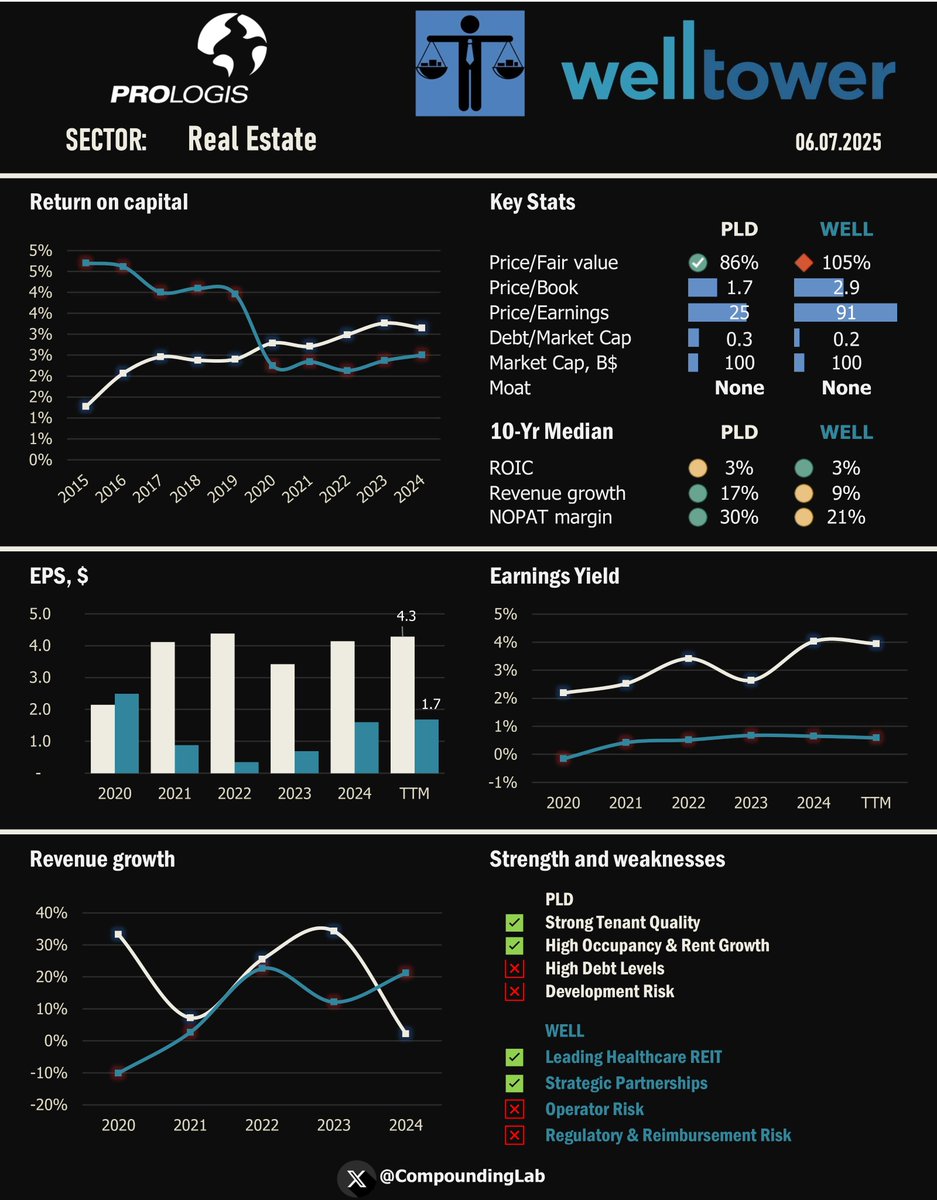

✔️ Prologis and Welltower are both giants in the REIT sector, but they operate in very different arenas—Prologis in logistics and industrial real estate, Welltower in healthcare and senior living. ✔️ Both have delivered strong earnings growth, with Welltower’s recent rebound outpacing Prologis. ✔️ Valuation metrics show Welltower trading at a premium, suggesting higher growth expectations but also more risk.

📈Financial Comparison

Over the past decade, both Prologis and Welltower have delivered similar, modest returns on invested capital, with Prologis showing a 10-year median ROIC of XXX% and Welltower at 3.2%. This reflects the capital-intensive nature of the REIT industry.

Looking at earnings and revenue growth, Prologis is forecast to grow EPS by about XXX% annually and revenue by 6.7%. Welltower, however, is expected to deliver much faster growth, with EPS projected to rise XXXX% per year and revenue by 13.7%. Notably, Welltower’s earnings surged by nearly XXX% in 2024, highlighting a strong recovery after a difficult 2022.

Historically, Prologis maintained superior profitability with NOPAT margins of roughly 30%, compared to Welltower’s margins of around 21%.

📊Valuation Metrics (as of June 2025)

When it comes to valuation, Welltower is priced at a significant premium. Its price-to-earnings ratio is 92, much higher Prologis’s 28, and its price-to-book ratio stands at XXX compared to Prologis’s XXX. This premium reflects market optimism about Welltower’s growth prospects, but it also raises questions about whether such high expectations are sustainable.

🛡️Competitive Positioning

Prologis does not seem to have a moat, despite benefiting from its global logistics network and high-barrier-to-entry assets. Its strengths include a diversified tenant base and strong demand driven by e-commerce. However, it remains exposed to cyclical demand and the risk of new warehouse supply entering the market.

Welltower, on the other hand, is the leading healthcare REIT, with no moat (but in the process of developing moat built on scale and strategic partnerships). Its strengths lie in its exposure to favorable demographic trends and a diversified healthcare portfolio. The main challenges for Welltower are regulatory risks in healthcare and variability in the performance of its operating partners.

✅ Bottom Line

Prologis stands out for its stability and reasonable valuation, underpinned by its dominant position in logistics real estate. Welltower offers higher growth potential, especially as aging demographics drive demand for healthcare and senior living, but this comes at a much higher valuation and with sector-specific risks. Ultimately, you must decide whether you value Prologis’s predictability or Welltower’s growth - and whether the premium for Welltower is justified.

Follow for daily actionable investing frameworks

XXXXX engagements

Related Topics pld metrics coins healthcare coins real estate logistics $well reit $pld