[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.7K followers Created: 2025-07-29 12:23:31 UTC BoA says last week clients returned to selling of US equities for the first fourth week in five at -$1.4bn. “Clients sold single stocks after buying the prior week and continued to buy ETFs for the 14th straight week.” “Outflows were led by institutional clients [-$1.9bn], who have been net sellers in XX out of the past XX weeks”. Hedge funds were also net sellers (-$0.4bn) reversing the buys from the previous two weeks [+$0.4bn].” Buying continued to be led by corporates as they exit the blackout window, although there was a slight deceleration to +$1.1bn from at +$1.2bn, but up from a low of +$0.6bn four weeks ago (but vs the 52-wk avg of +$3.3bn)). Retail continued their buying, the 31st week of net inflows in the past 33, decelerating to +$0.9bn from +$1.2bn but above the 52-wk avg of +$0.5bn. Institutional clients have been the only net sellers of US equities the past XX weeks -$20.1bn, vs +$23.3bn from corporates, +$7.3bn from retail, and +$0.3bn from hedge funds. Note: "missing" flows (difference between all flows and "tagged" (identified)) were -$1.1bn, which would need to be subtracted from some (all) of the above.  XXXXX engagements  **Related Topics** [$04bn](/topic/$04bn) [$19bn](/topic/$19bn) [$14bn](/topic/$14bn) [stocks](/topic/stocks) [boa](/topic/boa) [Post Link](https://x.com/neilksethi/status/1950170322558124274)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-29 12:23:31 UTC

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-29 12:23:31 UTC

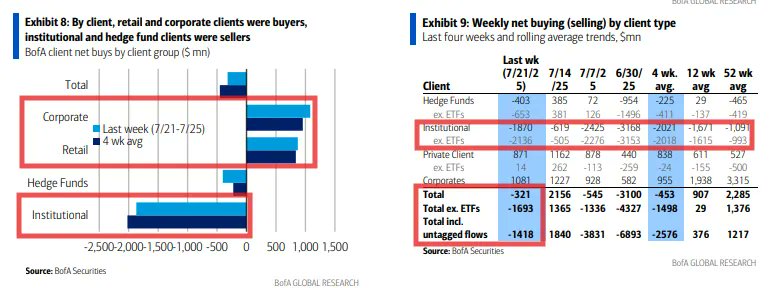

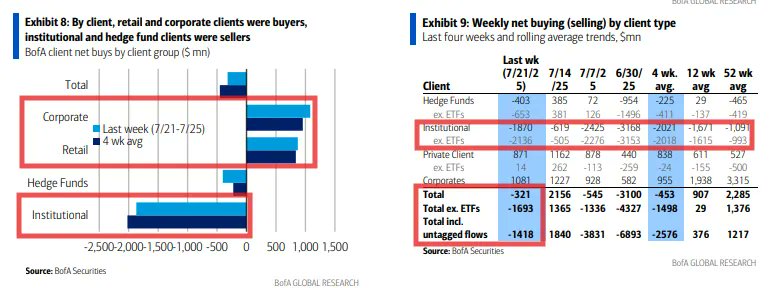

BoA says last week clients returned to selling of US equities for the first fourth week in five at -$1.4bn. “Clients sold single stocks after buying the prior week and continued to buy ETFs for the 14th straight week.”

“Outflows were led by institutional clients [-$1.9bn], who have been net sellers in XX out of the past XX weeks”. Hedge funds were also net sellers (-$0.4bn) reversing the buys from the previous two weeks [+$0.4bn].”

Buying continued to be led by corporates as they exit the blackout window, although there was a slight deceleration to +$1.1bn from at +$1.2bn, but up from a low of +$0.6bn four weeks ago (but vs the 52-wk avg of +$3.3bn)).

Retail continued their buying, the 31st week of net inflows in the past 33, decelerating to +$0.9bn from +$1.2bn but above the 52-wk avg of +$0.5bn.

Institutional clients have been the only net sellers of US equities the past XX weeks -$20.1bn, vs +$23.3bn from corporates, +$7.3bn from retail, and +$0.3bn from hedge funds.

Note: "missing" flows (difference between all flows and "tagged" (identified)) were -$1.1bn, which would need to be subtracted from some (all) of the above.

XXXXX engagements