[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Arya Deniz [@Arya__Deniz](/creator/twitter/Arya__Deniz) on x 1272 followers Created: 2025-07-20 20:22:07 UTC Q2 2025 U.S. Bank Earnings Roundup The four major U.S. banks – JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo – all posted better-than-expected Q2 2025 earnings amid a volatile market backdrop. Robust trading and improved investment banking activity helped drive revenue beats, while net interest income (NII) remained near record levels thanks to resilient loan growth and stable credit quality. Management tones diverged: JPMorgan’s Jamie Dimon struck a cautious note on macro risks even as he raised full-year NII guidance, whereas peers like Citi expressed optimism with aggressive capital return plans. Overall, consumer and business fundamentals stayed strong, credit costs were well-contained, and capital levels remained comfortably above requirements – setting the stage for increased shareholder payouts even as executives stay watchful of economic uncertainties. I’ll dig deeper, but there’s my core takeaway: the U.S. money‑center banks delivered a remarkably resilient Q2, with trading and investment‑banking revenues rebounding strongly, net interest income holding near record levels, and credit costs remaining benign - underscoring the durability of consumer and corporate balance sheets despite ongoing macro uncertainties. While JPMorgan and BofA raised or reiterated NII guidance on sustained loan growth and lower funding costs, Wells Fargo’s cautious NII cut highlights the potential for margin compression in a competitive deposit environment. Citigroup’s outsized buyback and efficiency gains reinforce that capital‑generative franchises can drive shareholder returns even absent explicit guidance.  XXX engagements  **Related Topics** [banking](/topic/banking) [investment](/topic/investment) [vix](/topic/vix) [united states](/topic/united-states) [bank of](/topic/bank-of) [jpmorgan chase](/topic/jpmorgan-chase) [stocks financial services](/topic/stocks-financial-services) [stocks banks](/topic/stocks-banks) [Post Link](https://x.com/Arya__Deniz/status/1947029271563702360)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Arya Deniz @Arya__Deniz on x 1272 followers

Created: 2025-07-20 20:22:07 UTC

Arya Deniz @Arya__Deniz on x 1272 followers

Created: 2025-07-20 20:22:07 UTC

Q2 2025 U.S. Bank Earnings Roundup

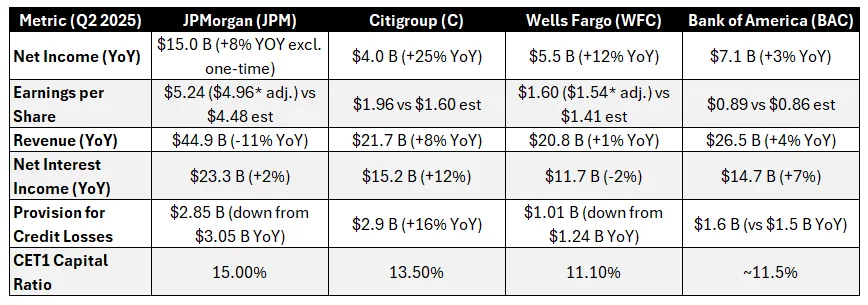

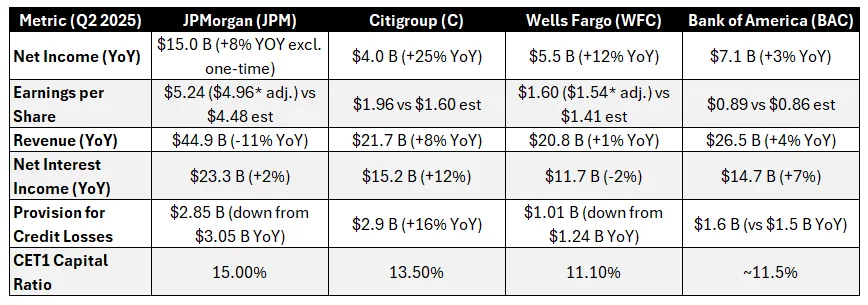

The four major U.S. banks – JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo – all posted better-than-expected Q2 2025 earnings amid a volatile market backdrop. Robust trading and improved investment banking activity helped drive revenue beats, while net interest income (NII) remained near record levels thanks to resilient loan growth and stable credit quality. Management tones diverged: JPMorgan’s Jamie Dimon struck a cautious note on macro risks even as he raised full-year NII guidance, whereas peers like Citi expressed optimism with aggressive capital return plans. Overall, consumer and business fundamentals stayed strong, credit costs were well-contained, and capital levels remained comfortably above requirements – setting the stage for increased shareholder payouts even as executives stay watchful of economic uncertainties.

I’ll dig deeper, but there’s my core takeaway: the U.S. money‑center banks delivered a remarkably resilient Q2, with trading and investment‑banking revenues rebounding strongly, net interest income holding near record levels, and credit costs remaining benign - underscoring the durability of consumer and corporate balance sheets despite ongoing macro uncertainties. While JPMorgan and BofA raised or reiterated NII guidance on sustained loan growth and lower funding costs, Wells Fargo’s cautious NII cut highlights the potential for margin compression in a competitive deposit environment. Citigroup’s outsized buyback and efficiency gains reinforce that capital‑generative franchises can drive shareholder returns even absent explicit guidance.

XXX engagements

Related Topics banking investment vix united states bank of jpmorgan chase stocks financial services stocks banks