[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Albert Alan [@_AlbertAlan](/creator/twitter/_AlbertAlan) on x 2917 followers Created: 2025-07-08 03:00:51 UTC Dear $CLOV, $ELV, $CNC, $ALHC, $UNH, $MOH, $CVS, $OSCR and $HUM Investors, Tempus AI $TEM is trading at a $10.04B market cap with an average Price-to-Sales of 14.42—an astronomical valuation by any traditional measure. Yet if you dig into the fundamentals, the picture changes drastically. According to our proprietary Financial Data & Analytics Metrics Chart (see image), in 2024 alone, Tempus posted: Net Loss: –$705.81M Free Cash Flow: –$211.17M That’s nearly three-quarters of a billion dollars lost on the bottom line and a quarter-billion in FCF gone—in a single year. While there were sporadic quarters of positive free cash flow, the long-term trend remains decisively negative. So why the love from Wall Street? Nancy Pelosi disclosed a position in TEM—suddenly, the market followed. Others jumped in, riding the momentum without asking why the business is valued as a high-growth darling when the fundamentals say otherwise. This is where experience matters. With over XX years on Wall Street, I’ve seen this movie before. Meanwhile, companies like Clover Health $CLOV—which reported: + $33.29M in Free Cash Flow (2024) – $43.01M in Net Income (2024) And expects full GAAP profitability by 2026/27 —are being priced as afterthoughts. Add to that: Clover’s Counterpart Health, a SaaS subsidiary with high gross margins, has yet to report revenue—offering hidden upside in both earnings and FCF. And with ~$40M in ACO-related costs now removed, free cash flow is expected to grow by $50M+ conservatively. Yet Wall Street ignores this. Why? Because it’s not flashy. Because a politician didn’t tweet about it. Here, we follow first principles—not popularity. We apply the value investing discipline of Ben Graham and the long-term clarity of Warren Buffett to the Fourth Industrial Revolution. Those who understand these numbers are holding the GPS in a market full of headless momentum. You either study the map—or follow the crowd over the cliff. This is what intelligent investing looks like.  XXXXX engagements  **Related Topics** [investment](/topic/investment) [metrics](/topic/metrics) [coins analytics](/topic/coins-analytics) [market cap](/topic/market-cap) [$1004b](/topic/$1004b) [coins ai](/topic/coins-ai) [$hum](/topic/$hum) [$cvs](/topic/$cvs) [Post Link](https://x.com/_AlbertAlan/status/1942418576889242110)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Albert Alan @_AlbertAlan on x 2917 followers

Created: 2025-07-08 03:00:51 UTC

Albert Alan @_AlbertAlan on x 2917 followers

Created: 2025-07-08 03:00:51 UTC

Dear $CLOV, $ELV, $CNC, $ALHC, $UNH, $MOH, $CVS, $OSCR and $HUM Investors,

Tempus AI $TEM is trading at a $10.04B market cap with an average Price-to-Sales of 14.42—an astronomical valuation by any traditional measure.

Yet if you dig into the fundamentals, the picture changes drastically.

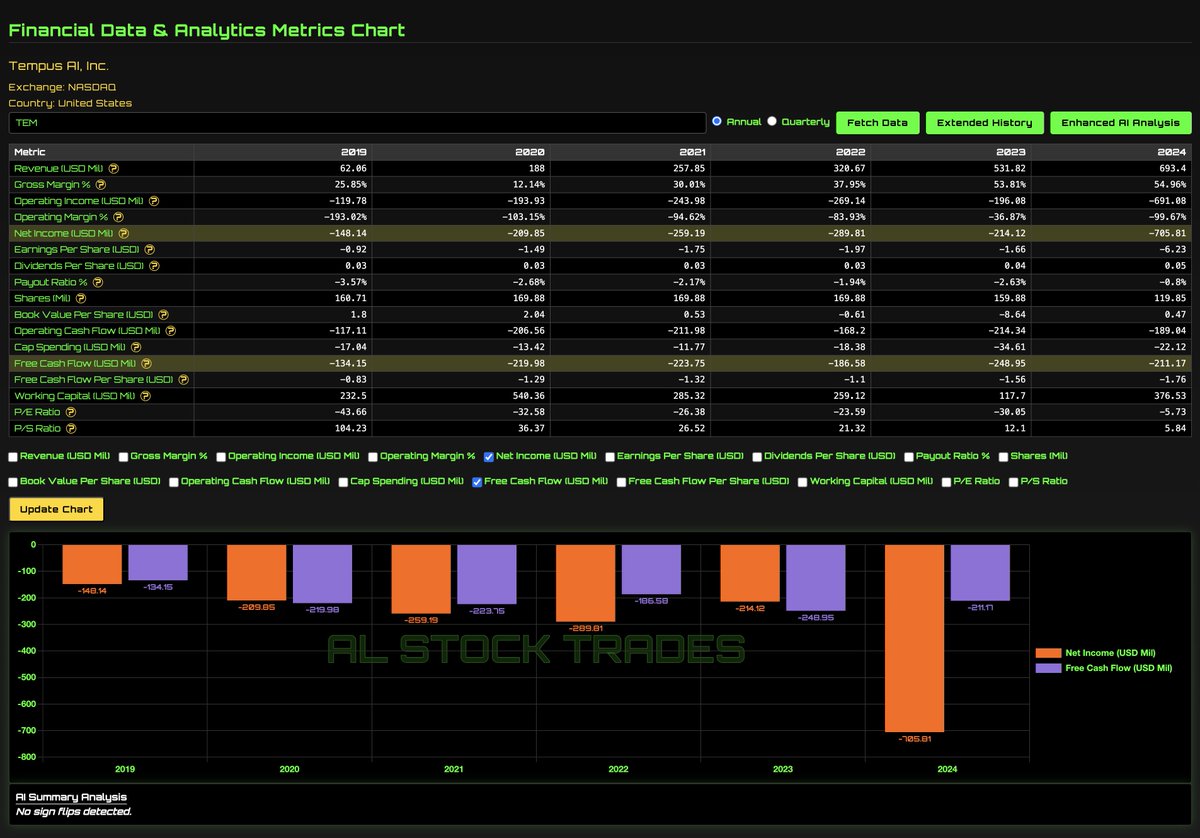

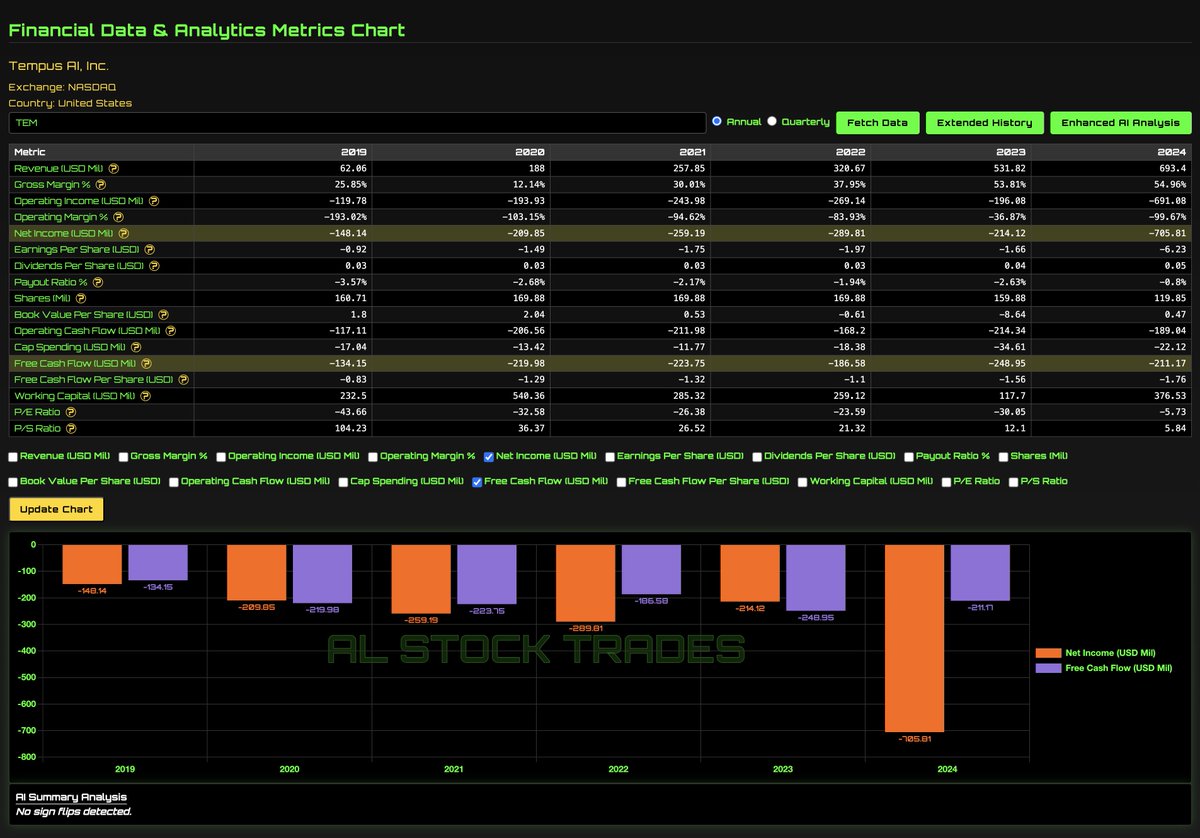

According to our proprietary Financial Data & Analytics Metrics Chart (see image), in 2024 alone, Tempus posted:

Net Loss: –$705.81M Free Cash Flow: –$211.17M That’s nearly three-quarters of a billion dollars lost on the bottom line and a quarter-billion in FCF gone—in a single year. While there were sporadic quarters of positive free cash flow, the long-term trend remains decisively negative.

So why the love from Wall Street?

Nancy Pelosi disclosed a position in TEM—suddenly, the market followed. Others jumped in, riding the momentum without asking why the business is valued as a high-growth darling when the fundamentals say otherwise.

This is where experience matters.

With over XX years on Wall Street, I’ve seen this movie before. Meanwhile, companies like Clover Health $CLOV—which reported:

- $33.29M in Free Cash Flow (2024) – $43.01M in Net Income (2024) And expects full GAAP profitability by 2026/27 —are being priced as afterthoughts.

Add to that:

Clover’s Counterpart Health, a SaaS subsidiary with high gross margins, has yet to report revenue—offering hidden upside in both earnings and FCF. And with ~$40M in ACO-related costs now removed, free cash flow is expected to grow by $50M+ conservatively. Yet Wall Street ignores this.

Why? Because it’s not flashy. Because a politician didn’t tweet about it.

Here, we follow first principles—not popularity.

We apply the value investing discipline of Ben Graham and the long-term clarity of Warren Buffett to the Fourth Industrial Revolution.

Those who understand these numbers are holding the GPS in a market full of headless momentum. You either study the map—or follow the crowd over the cliff.

This is what intelligent investing looks like.

XXXXX engagements

Related Topics investment metrics coins analytics market cap $1004b coins ai $hum $cvs