[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Data Driven Investing [@DataDInvesting](/creator/twitter/DataDInvesting) on x 42.9K followers Created: 2025-07-07 13:43:31 UTC $SoFi is fixing their biggest operational mistake of the past few years. Credit cards were supposed to be a growth driver in 2023 but they got the underwriting wrong. Defaults spiked all the way up to XXXX% in Q1 2023 and the credit card business has cost them hundreds of millions of dollars of cumulative losses over the past several years. 2024 was a year where credit card balances stayed basically flat and charge-offs began to trend downward. Q1 2025 was the first quarter in over a year where credit card balances saw a meaningful increase, and it was accompanied by even lower defaults. If they have truly solved their underwriting issues, over the next couple years, this should go from a business that was losing them $100M/yr to one that is making them well in excess of $100M/yr.  XXXXXX engagements  **Related Topics** [losses](/topic/losses) [mergers and acquisitions](/topic/mergers-and-acquisitions) [credit cards](/topic/credit-cards) [$sofi](/topic/$sofi) [investment](/topic/investment) [sofi technologies](/topic/sofi-technologies) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/DataDInvesting/status/1942217921230770303)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Data Driven Investing @DataDInvesting on x 42.9K followers

Created: 2025-07-07 13:43:31 UTC

Data Driven Investing @DataDInvesting on x 42.9K followers

Created: 2025-07-07 13:43:31 UTC

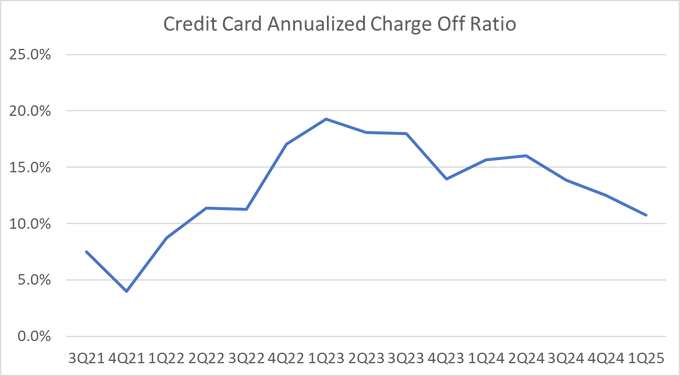

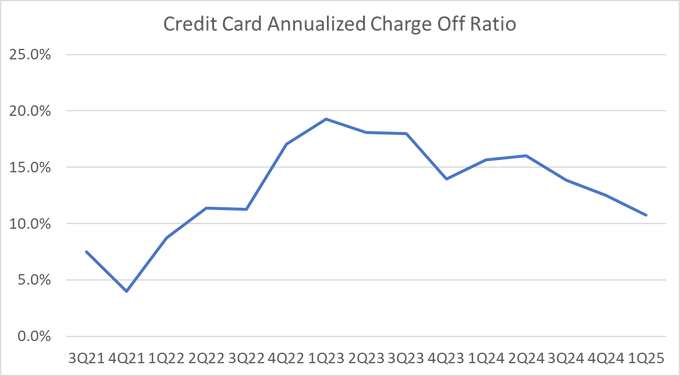

$SoFi is fixing their biggest operational mistake of the past few years. Credit cards were supposed to be a growth driver in 2023 but they got the underwriting wrong. Defaults spiked all the way up to XXXX% in Q1 2023 and the credit card business has cost them hundreds of millions of dollars of cumulative losses over the past several years.

2024 was a year where credit card balances stayed basically flat and charge-offs began to trend downward. Q1 2025 was the first quarter in over a year where credit card balances saw a meaningful increase, and it was accompanied by even lower defaults.

If they have truly solved their underwriting issues, over the next couple years, this should go from a business that was losing them $100M/yr to one that is making them well in excess of $100M/yr.

XXXXXX engagements

Related Topics losses mergers and acquisitions credit cards $sofi investment sofi technologies stocks financial services