[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Bourbon Capital [@BourbonCap](/creator/twitter/BourbonCap) on x 50.2K followers Created: 2025-03-15 17:42:39 UTC Target Companies: The Portfolio Stars His current top holdings (Q4 2024) Fair Isaac Corp $FICO: The credit score king—monopoly vibes, pricing power, low costs. S&P Global $SPGI: Financial data giant, near-duopoly with Moody’s. A 25-bagger since 2008. Mastercard $MA: Payments juggernaut—capital-light, global scale, sticky ecosystem. Moody’s $MCO: Ratings duopoly with S&P. Bought in 2008-09 crash, held for over a decade. Visa $V: Another payments titan—predictable, scalable, dominant. Intuit $INTU: Accounting software leader (QuickBooks). Scalable, recurring revenue. $ASML: Lithography monopoly for semiconductors—tech exposure with a moat. $MSCI: Index and analytics provider. New buy in 2024, aligns with his love for financial data moats. Equifax $EFX: Credit bureau—another recent addition, oligopoly play.  XXXXXX engagements  **Related Topics** [$mco](/topic/$mco) [rating agency](/topic/rating-agency) [credit scores](/topic/credit-scores) [default risk](/topic/default-risk) [$fico](/topic/$fico) [fair isaac corp](/topic/fair-isaac-corp) [stocks technology](/topic/stocks-technology) [$spgi](/topic/$spgi) [Post Link](https://x.com/BourbonCap/status/1900965884706935054)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Bourbon Capital @BourbonCap on x 50.2K followers

Created: 2025-03-15 17:42:39 UTC

Bourbon Capital @BourbonCap on x 50.2K followers

Created: 2025-03-15 17:42:39 UTC

Target Companies: The Portfolio Stars

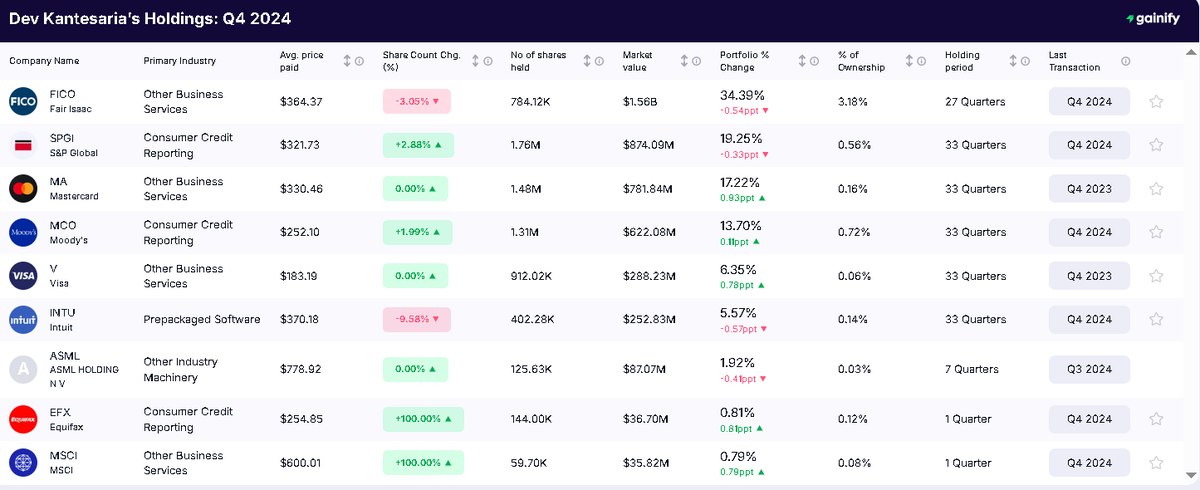

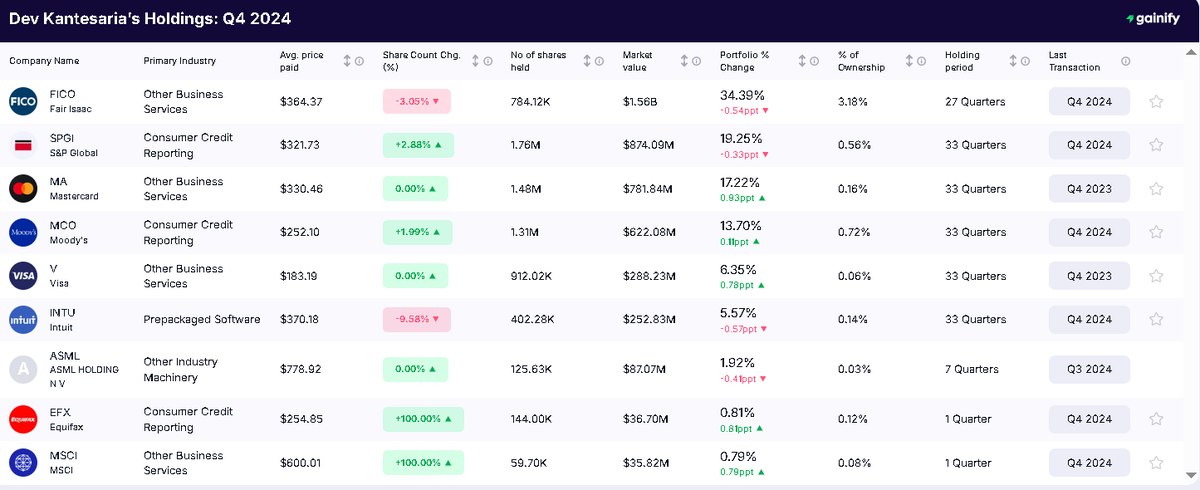

His current top holdings (Q4 2024)

Fair Isaac Corp $FICO: The credit score king—monopoly vibes, pricing power, low costs.

S&P Global $SPGI: Financial data giant, near-duopoly with Moody’s. A 25-bagger since 2008.

Mastercard $MA: Payments juggernaut—capital-light, global scale, sticky ecosystem.

Moody’s $MCO: Ratings duopoly with S&P. Bought in 2008-09 crash, held for over a decade.

Visa $V: Another payments titan—predictable, scalable, dominant.

Intuit $INTU: Accounting software leader (QuickBooks). Scalable, recurring revenue.

$ASML: Lithography monopoly for semiconductors—tech exposure with a moat.

$MSCI: Index and analytics provider. New buy in 2024, aligns with his love for financial data moats.

Equifax $EFX: Credit bureau—another recent addition, oligopoly play.

XXXXXX engagements

Related Topics $mco rating agency credit scores default risk $fico fair isaac corp stocks technology $spgi