[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.7K followers Created: 2025-07-28 14:59:00 UTC BBG: While once piling into low priced names or those with high short interest was a symbol of rebellion against the well-heeled Wall Street establishment, today "it’s just another day in markets... retail-driven speculative behavior no longer signals generational angst or post-pandemic distortion. It has instead become a settled feature of the current cycle. Short-dated options are part of the retail toolkit." In that regard the tool of choice is 0DTEs, options which expire within XX hours which made up a record XX% of total SPX options last quarter. Peter Atwater, an adjunct professor at the College of William & Mary who studies retail investors, said the current wave of activity reflects a shift in both market sentiment and investment mindset. Meme stocks trading, he says, has lost its sense of novelty — and that’s precisely the point. “We’ve normalized memeing,” he said. “There’s a yawn to it now.” In Atwater’s view, the most aggressive traders have already moved on to riskier frontiers – digital tokens, leveraged ETFs, prediction markets — while meme stocks have become more of a cultural rerun. “It’s like 30-year-olds dancing to music 20-year-olds used to party to,” he said. “This generation is far savvier about options and market structure,” said Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets. “While my generation was perhaps taught to ‘buy a house’ this one knows to ‘buy the dip.’” “I don’t think it’s the beginning of a new trend, but it is very interesting to watch because it speaks that the retail investor really wants to be involved in this market,” said Jay Woods, chief global strategist at Freedom Capital Markets. “This is bullish. This is not bearish. This is not significant of a top.”  XXXXX engagements  **Related Topics** [signals](/topic/signals) [wall street](/topic/wall-street) [Post Link](https://x.com/neilksethi/status/1949847061802967158)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-28 14:59:00 UTC

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-28 14:59:00 UTC

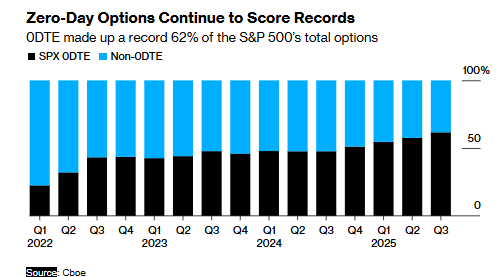

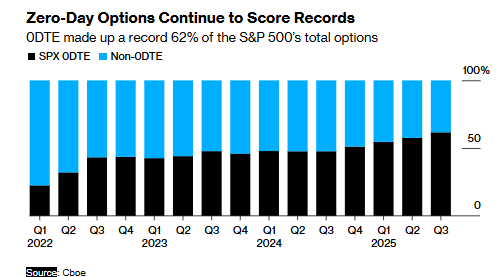

BBG: While once piling into low priced names or those with high short interest was a symbol of rebellion against the well-heeled Wall Street establishment, today "it’s just another day in markets... retail-driven speculative behavior no longer signals generational angst or post-pandemic distortion. It has instead become a settled feature of the current cycle. Short-dated options are part of the retail toolkit."

In that regard the tool of choice is 0DTEs, options which expire within XX hours which made up a record XX% of total SPX options last quarter.

Peter Atwater, an adjunct professor at the College of William & Mary who studies retail investors, said the current wave of activity reflects a shift in both market sentiment and investment mindset. Meme stocks trading, he says, has lost its sense of novelty — and that’s precisely the point. “We’ve normalized memeing,” he said. “There’s a yawn to it now.”

In Atwater’s view, the most aggressive traders have already moved on to riskier frontiers – digital tokens, leveraged ETFs, prediction markets — while meme stocks have become more of a cultural rerun. “It’s like 30-year-olds dancing to music 20-year-olds used to party to,” he said.

“This generation is far savvier about options and market structure,” said Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets. “While my generation was perhaps taught to ‘buy a house’ this one knows to ‘buy the dip.’”

“I don’t think it’s the beginning of a new trend, but it is very interesting to watch because it speaks that the retail investor really wants to be involved in this market,” said Jay Woods, chief global strategist at Freedom Capital Markets. “This is bullish. This is not bearish. This is not significant of a top.”

XXXXX engagements

Related Topics signals wall street