[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.7K followers Created: 2025-07-28 13:25:01 UTC Mike Wilson, Morgan Stanley’s chief stock-market strategist, says he now is leaning more toward his bull case of 7200 in XX mths for the S&P XXX based on earnings per share of $XXX and a forward share price to earnings multiple of XXXX. Wilson says this view is grounded on a more resilient earnings and cash flow backdrop than previously expected, an improvement driven in part by AI adoption, dollar weakness, cash tax savings from the Trump administration’s One Big Beautiful Bill Act and pent up demand for many sectors in the market. With private sector wage growth in decline and AI adoption accelerating this positive operating leverage should see profit margins expand. All told, earnings revision breadth has improved considerably in recent months, he says. The high probability of more Federal Reserve rate cuts in the first quarter of 2026 makes Wilson more comfortable with historically high multiples. “On that score, our regime analysis shows that when EPS growth is above the long-term median and the fed-funds rate is down on a year-over-year basis (our house views by mid-2026), the market multiple expands XX% of the time,” Wilson says. With regard to tariffs, he acknowledges they may be a problem for consumer goods companies, of which he suggests investors should be underweight. But overall the “rate of change on policy uncertainty peaked back in April as stocks troughed.” Wilson’s favored sector is industrials, even though he notes it’s already the best performing in the S&P XXX year-to-date and over the last month. “Relative earnings revisions remain durable, capacity utilization is stabilizing, and aggregate C&I [commercial and industrial] loans have surpassed $XXX trillion (the highest level since 2020),” he writes. Despite Wilson’s positivity going into 2026, he accepts that near-term the setup is not without risks, including stubbornly high longer-term Treasury yields, tariff-related inflation and seasonal stock market headwinds. “Thus, we do expect some consolidation tactically, but would reiterate that we expect pullbacks to be shallow, and we’re buyers of dips,” he says.  XXXXXX engagements  **Related Topics** [adoption](/topic/adoption) [coins ai](/topic/coins-ai) [cash flow](/topic/cash-flow) [quarterly earnings](/topic/quarterly-earnings) [rating agency](/topic/rating-agency) [stockmarket](/topic/stockmarket) [$spy](/topic/$spy) [Post Link](https://x.com/neilksethi/status/1949823408356594014)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-28 13:25:01 UTC

Neil Sethi @neilksethi on x 12.7K followers

Created: 2025-07-28 13:25:01 UTC

Mike Wilson, Morgan Stanley’s chief stock-market strategist, says he now is leaning more toward his bull case of 7200 in XX mths for the S&P XXX based on earnings per share of $XXX and a forward share price to earnings multiple of XXXX.

Wilson says this view is grounded on a more resilient earnings and cash flow backdrop than previously expected, an improvement driven in part by AI adoption, dollar weakness, cash tax savings from the Trump administration’s One Big Beautiful Bill Act and pent up demand for many sectors in the market.

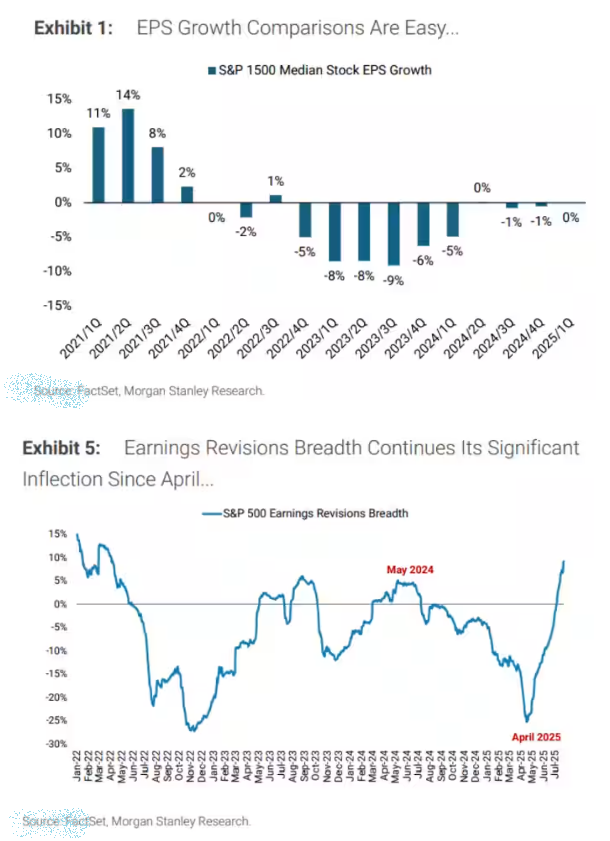

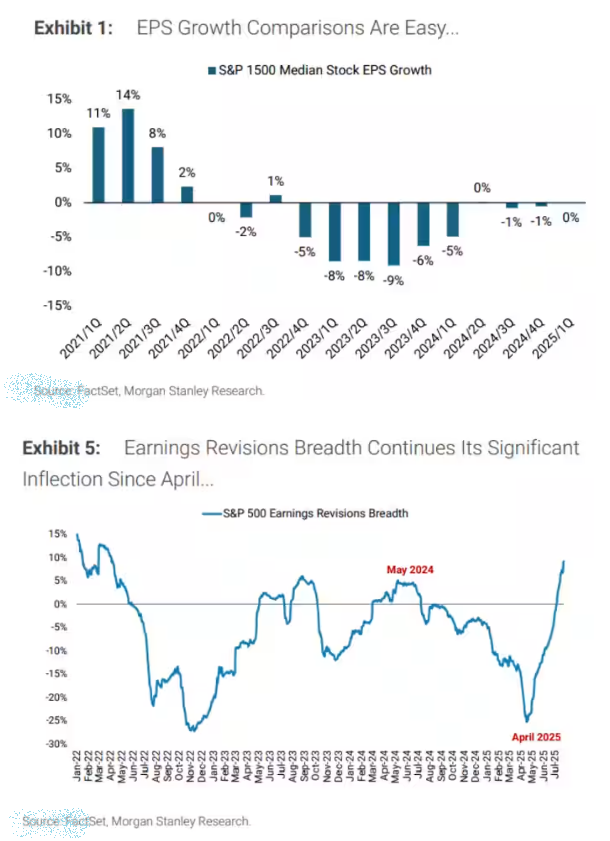

With private sector wage growth in decline and AI adoption accelerating this positive operating leverage should see profit margins expand. All told, earnings revision breadth has improved considerably in recent months, he says.

The high probability of more Federal Reserve rate cuts in the first quarter of 2026 makes Wilson more comfortable with historically high multiples. “On that score, our regime analysis shows that when EPS growth is above the long-term median and the fed-funds rate is down on a year-over-year basis (our house views by mid-2026), the market multiple expands XX% of the time,” Wilson says.

With regard to tariffs, he acknowledges they may be a problem for consumer goods companies, of which he suggests investors should be underweight. But overall the “rate of change on policy uncertainty peaked back in April as stocks troughed.”

Wilson’s favored sector is industrials, even though he notes it’s already the best performing in the S&P XXX year-to-date and over the last month. “Relative earnings revisions remain durable, capacity utilization is stabilizing, and aggregate C&I [commercial and industrial] loans have surpassed $XXX trillion (the highest level since 2020),” he writes.

Despite Wilson’s positivity going into 2026, he accepts that near-term the setup is not without risks, including stubbornly high longer-term Treasury yields, tariff-related inflation and seasonal stock market headwinds. “Thus, we do expect some consolidation tactically, but would reiterate that we expect pullbacks to be shallow, and we’re buyers of dips,” he says.

XXXXXX engagements

Related Topics adoption coins ai cash flow quarterly earnings rating agency stockmarket $spy