[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Oliver Venture [@_OliverVenture](/creator/twitter/_OliverVenture) on x 1325 followers Created: 2025-07-27 22:34:38 UTC The market loves a simple story, but the best investments are often the most misunderstood. The biggest alpha generation happens in the gap between perception and reality. What we're trying to find: disruptive companies where the market is looking backward while the business is transforming forward. Trap Navigators. Here's the framework for finding them. ---------- 🛤️ Two Paths: Our search sorts the market into two buckets: Profile A: The Trap Navigator: A company caught between the market's lazy bear perception and the business's hidden, positive reality. The market is so focused on Act I, they haven't noticed Act II is right under their nose. Profile B: The Quiet Compounder: A world-class business the market actually understands. The primary debate is valuation, not fundamentals. Nothing wrong with these companies (in fact ideal for most portfolios!), but not what we're looking for. ---------- 📊 Case Study: Palantir $PLTR circa 2023. The Trap: The market saw an "unprofitable government consultant" with a black-box product. The Secret: Palantir was becoming a scalable AI platform, with its US commercial business growing at an explosive and importantly, under-the-radar rate. Leading to...an inflection point. This was their Feb 2024 earnings report: GAAP profitability was proven (lazy bear thesis nuked) and "unprecedented" AI demand was revealed (secret revealed). The trap had been sprung. We all know what happened next. 📈 ---------- 🔍 Deconstructing The Narrative For a Profile A company, we deconstruct the market narrative. The "Lazy Bear" Thesis: Articulate the simple, backward-looking bear case. (Example: "This is a legacy hardware company in terminal decline.") The Forward-Looking "Secret" Thesis: Identify the data-backed (!) reality of what the business is becoming. (Example: "Software is now XX% of revenue and growing at XX% annually.") ---------- 🧪 The Litmus Test To survive, a Profile A candidate needs to pass a litmus test on the nature of its lazy bear thesis. Is the thesis based on disagreement about the FUTURE (example: the market doubts a new product's success)? ✅ Survives. OR Is it based on definitive evidence of PRESENT failure (example: financials are declining, customers are churning)? ❌ Disqualified (Fatal Trap) ---------- ⚠️ The Fatal Trap Checklist Once a company passes the litmus test, we then vet it against a checklist of fatal flaws. A single fail and the stock is disqualified (fatal trap). ⚡️Commoditized Feature Flaw: Is the company's core product an easily replicated feature? ⚡️Red Ocean Flaw: Does it operate in a hyper-competitive market with no defensible niche? ⚡️Hyperscaler's Shadow Flaw: Absolutely critical for any software company. Does it compete with a native service from its own infrastructure provider (AWS, Azure, GCP)? Are we talking about a C-suite level business solution or just an enabling technology component? ⚡️Broken Thesis Flaw: Has the company's own historical performance consistently disproven its foundational thesis? ⚡️Un-investable Macro Flaw: Is the company's success primarily dependent on a volatile factor beyond management's control (like commodity prices or geopolitics)? One fail, we bail. ---------- 🎯 Looking for the Turnaround Once we have a candidate, we then start looking for the evidence of the turnaround—signals that don't necessarily show up in the financials. Clues we can look for: A "Hidden AWS": Signs of a budding, high-growth business unit the market undervalues. "Lighthouse" Customer Wins: Recent indications of adoption by tier-1 customers that de-risk the future. A "Gravity Shift" in Talent: Acquiring key hires from market leaders (follow the talent). "Language of a Solved Problem": Company executives shift the narrative from defense to offense on earnings calls/investor conferences/etc. Of course, we also have to do our homework to codify our conviction as well as a sanity check on the valuation vs peers to assess risk/reward, but the basic concept for the framework is established—finding stocks that are stuck in a temporary confidence trap. The market is fixated on a persistent, but ultimately fragile, bear case, but we understand (with evidence) a secret—a new growth vector or transition, in companies with a specific, asymmetric risk/reward profile. This framework isn't just about finding misunderstood stocks, fallen angels, deep value, or venture bets. It's a system to reduce our own biases and find great companies trapped by incomplete stories navigating their way to narrative-shattering re-evaluations. ✅Follow for stock analysis using this framework. ✅Follow for the most logical venture bets in biotech And finally, what's the most misunderstood stock on your watchlist right now? $HIMS $AFRM $SYM $COUR $TOST $IREN $PGY $CLBT $ABCL $IOT Disclosure: see pinned post for current positions  XXX engagements  **Related Topics** [alternative investments](/topic/alternative-investments) [Post Link](https://x.com/_OliverVenture/status/1949599336746401977)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Oliver Venture @_OliverVenture on x 1325 followers

Created: 2025-07-27 22:34:38 UTC

Oliver Venture @_OliverVenture on x 1325 followers

Created: 2025-07-27 22:34:38 UTC

The market loves a simple story, but the best investments are often the most misunderstood. The biggest alpha generation happens in the gap between perception and reality. What we're trying to find: disruptive companies where the market is looking backward while the business is transforming forward.

Trap Navigators.

Here's the framework for finding them.

🛤️ Two Paths:

Our search sorts the market into two buckets:

Profile A: The Trap Navigator: A company caught between the market's lazy bear perception and the business's hidden, positive reality. The market is so focused on Act I, they haven't noticed Act II is right under their nose.

Profile B: The Quiet Compounder: A world-class business the market actually understands. The primary debate is valuation, not fundamentals. Nothing wrong with these companies (in fact ideal for most portfolios!), but not what we're looking for.

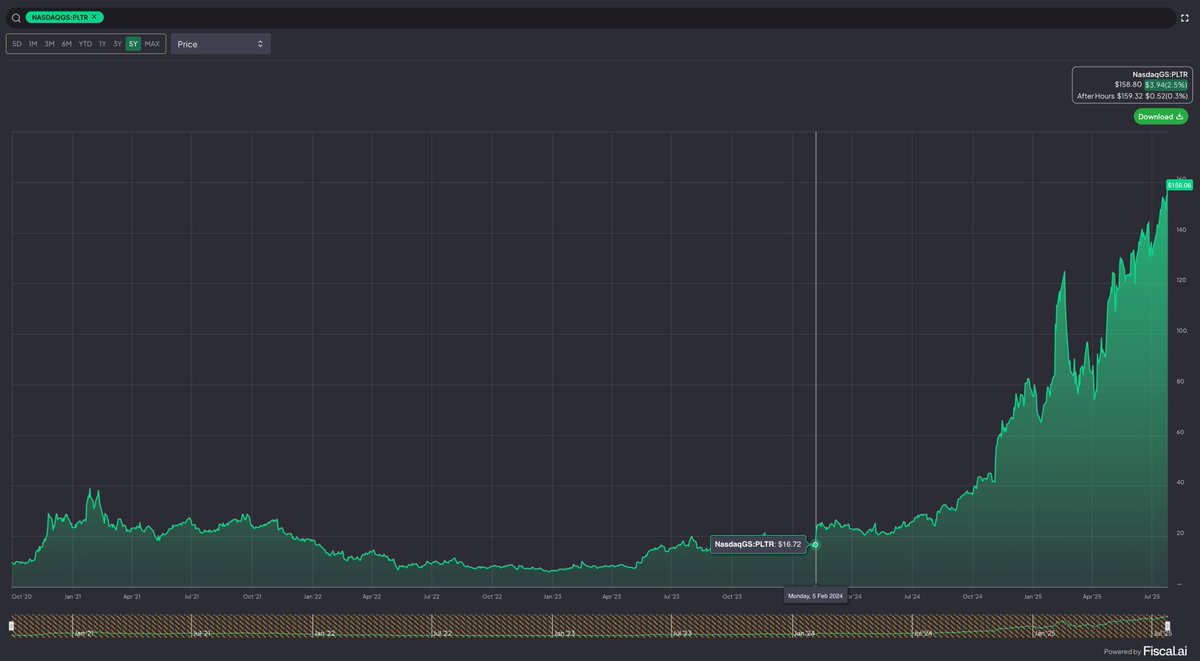

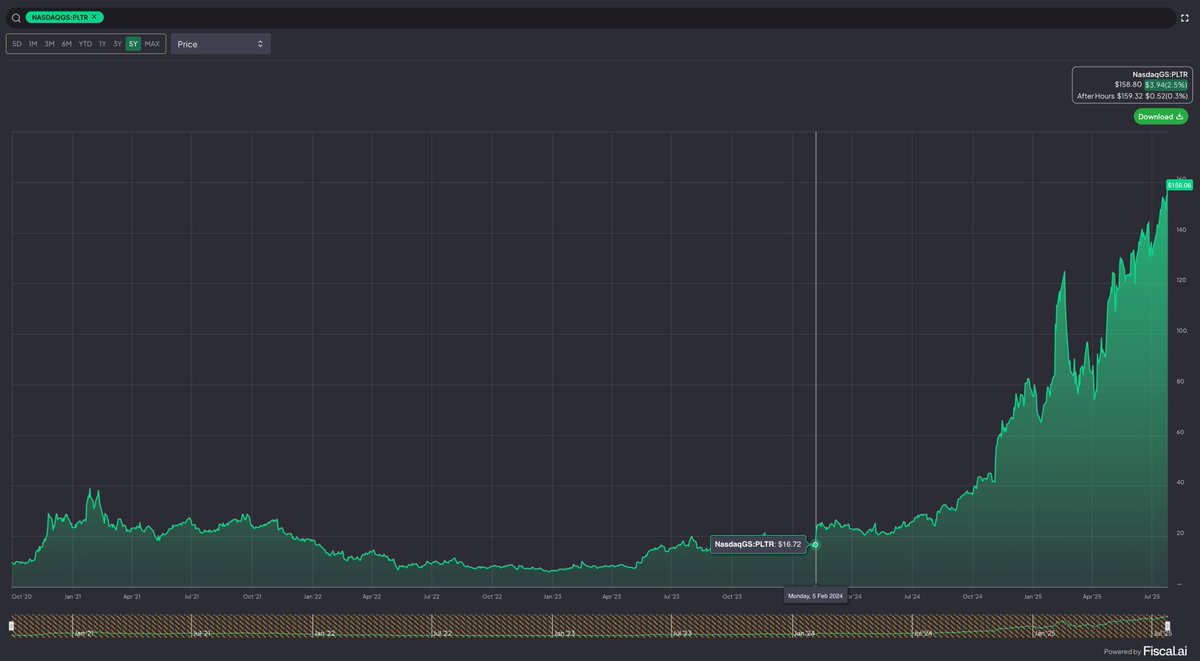

📊 Case Study: Palantir $PLTR circa 2023.

The Trap: The market saw an "unprofitable government consultant" with a black-box product.

The Secret: Palantir was becoming a scalable AI platform, with its US commercial business growing at an explosive and importantly, under-the-radar rate.

Leading to...an inflection point.

This was their Feb 2024 earnings report: GAAP profitability was proven (lazy bear thesis nuked) and "unprecedented" AI demand was revealed (secret revealed). The trap had been sprung. We all know what happened next. 📈

🔍 Deconstructing The Narrative

For a Profile A company, we deconstruct the market narrative.

The "Lazy Bear" Thesis: Articulate the simple, backward-looking bear case. (Example: "This is a legacy hardware company in terminal decline.")

The Forward-Looking "Secret" Thesis: Identify the data-backed (!) reality of what the business is becoming. (Example: "Software is now XX% of revenue and growing at XX% annually.")

🧪 The Litmus Test

To survive, a Profile A candidate needs to pass a litmus test on the nature of its lazy bear thesis.

Is the thesis based on disagreement about the FUTURE (example: the market doubts a new product's success)? ✅ Survives.

OR

Is it based on definitive evidence of PRESENT failure (example: financials are declining, customers are churning)? ❌ Disqualified (Fatal Trap)

⚠️ The Fatal Trap Checklist

Once a company passes the litmus test, we then vet it against a checklist of fatal flaws. A single fail and the stock is disqualified (fatal trap).

⚡️Commoditized Feature Flaw: Is the company's core product an easily replicated feature?

⚡️Red Ocean Flaw: Does it operate in a hyper-competitive market with no defensible niche?

⚡️Hyperscaler's Shadow Flaw: Absolutely critical for any software company. Does it compete with a native service from its own infrastructure provider (AWS, Azure, GCP)? Are we talking about a C-suite level business solution or just an enabling technology component?

⚡️Broken Thesis Flaw: Has the company's own historical performance consistently disproven its foundational thesis?

⚡️Un-investable Macro Flaw: Is the company's success primarily dependent on a volatile factor beyond management's control (like commodity prices or geopolitics)?

One fail, we bail.

🎯 Looking for the Turnaround

Once we have a candidate, we then start looking for the evidence of the turnaround—signals that don't necessarily show up in the financials. Clues we can look for:

A "Hidden AWS": Signs of a budding, high-growth business unit the market undervalues.

"Lighthouse" Customer Wins: Recent indications of adoption by tier-1 customers that de-risk the future.

A "Gravity Shift" in Talent: Acquiring key hires from market leaders (follow the talent).

"Language of a Solved Problem": Company executives shift the narrative from defense to offense on earnings calls/investor conferences/etc.

Of course, we also have to do our homework to codify our conviction as well as a sanity check on the valuation vs peers to assess risk/reward, but the basic concept for the framework is established—finding stocks that are stuck in a temporary confidence trap. The market is fixated on a persistent, but ultimately fragile, bear case, but we understand (with evidence) a secret—a new growth vector or transition, in companies with a specific, asymmetric risk/reward profile.

This framework isn't just about finding misunderstood stocks, fallen angels, deep value, or venture bets. It's a system to reduce our own biases and find great companies trapped by incomplete stories navigating their way to narrative-shattering re-evaluations.

✅Follow for stock analysis using this framework. ✅Follow for the most logical venture bets in biotech

And finally, what's the most misunderstood stock on your watchlist right now?

$HIMS $AFRM $SYM $COUR $TOST $IREN $PGY $CLBT $ABCL $IOT

Disclosure: see pinned post for current positions

XXX engagements

Related Topics alternative investments