[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Indian Investor [@Anvith_](/creator/twitter/Anvith_) on x 19.4K followers Created: 2025-07-25 01:44:27 UTC India’s IPO Pipeline is Heating Up in 2025 Over ₹28,000 Cr worth of fresh equity listings are lined up across consumer brands, fintech, microfinance, solar, and tech. Let’s break it down 👇 💎 Biggest IPOs in the Queue ▪️ SK Finance – ₹2,200 Cr ➡️ NBFC with strong rural lending book and Rajasthan roots ▪️ boAt – ₹2,000 Cr ➡️ India’s audio wearables unicorn; now eyeing profitability and global push ▪️ Innovativeview India – ₹2,000 Cr ➡️ Smart security & surveillance solutions provider; plays on smart infra ▪️ Jain Resource Recycling – ₹2,000 Cr ➡️ Metal recycling player riding on sustainability & circular economy ▪️ Urban Company – ₹1,900 Cr ➡️ Tech-enabled home services marketplace; bets on premiumisation ⚙️ Industrial & Infra Edge ▪️ Karamtara Engineering – ₹1,750 Cr ➡️ Transmission tower & EPC firm; plays on power infra capex boom ▪️ Rayzon Solar – ₹1,500 Cr ➡️ Solar modules & EPC player from Gujarat; benefits from renewable tailwinds ▪️ Aditya Infotech – ₹1,300 Cr ➡️ Security surveillance & electronics distributor; key B2B enabler 💰 Financial Inclusion & Lending ▪️ Asirvad Micro Finance – ₹1,500 Cr ➡️ Subsidiary of Manappuram Finance; strong South India microfinance base ▪️ Belstar Microfinance – ₹1,300 Cr ➡️ Promoted by Muthoot Finance; solid MFI track record ▪️ Aye Finance – ₹1,450 Cr ➡️ MSME lender with tech-enabled underwriting model ▪️ EAAA India Alternatives – ₹1,500 Cr ➡️ Alternative investment platform eyeing wealth-tech space 🛍️ Consumer & Healthcare Plays ▪️ Lalithaa Jewellery Mart – ₹1,700 Cr ➡️ South-based retail gold giant; traditional + digital sales mix ▪️ Park Medi World – ₹1,260 Cr ➡️ Multispecialty hospital chain; affordable private care segment ▪️ Mouri Tech – ₹1,500 Cr ➡️ Enterprise tech services firm; ERP, cloud, and digital transformation focus #IPO2025 #IPO #Investing #Nifty  XXXXX engagements  **Related Topics** [momentum](/topic/momentum) [money](/topic/money) [finance](/topic/finance) [ipos](/topic/ipos) [fintech](/topic/fintech) [listings](/topic/listings) [ipo](/topic/ipo) [investment](/topic/investment) [Post Link](https://x.com/Anvith_/status/1948559941079630171)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Indian Investor @Anvith_ on x 19.4K followers

Created: 2025-07-25 01:44:27 UTC

The Indian Investor @Anvith_ on x 19.4K followers

Created: 2025-07-25 01:44:27 UTC

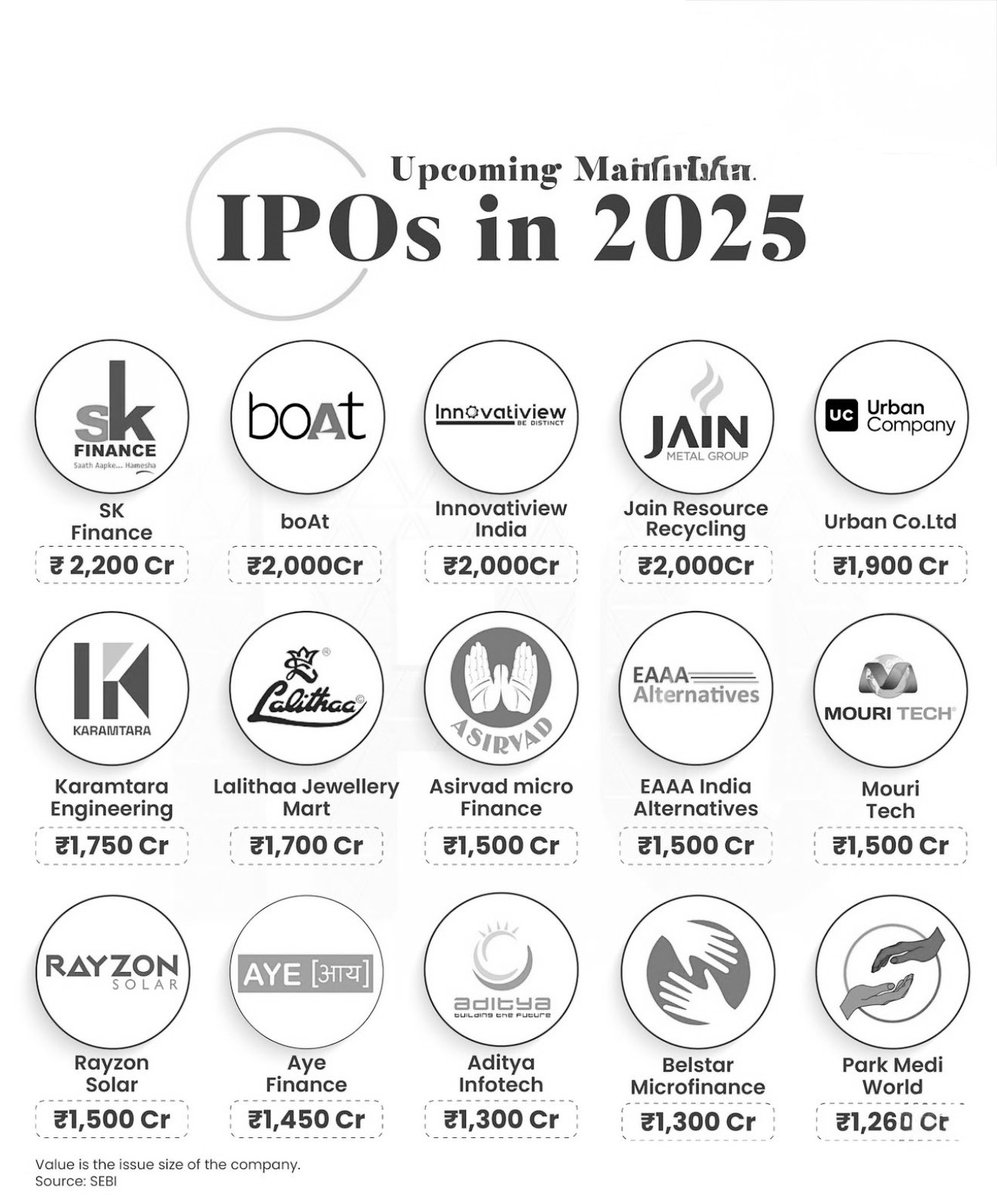

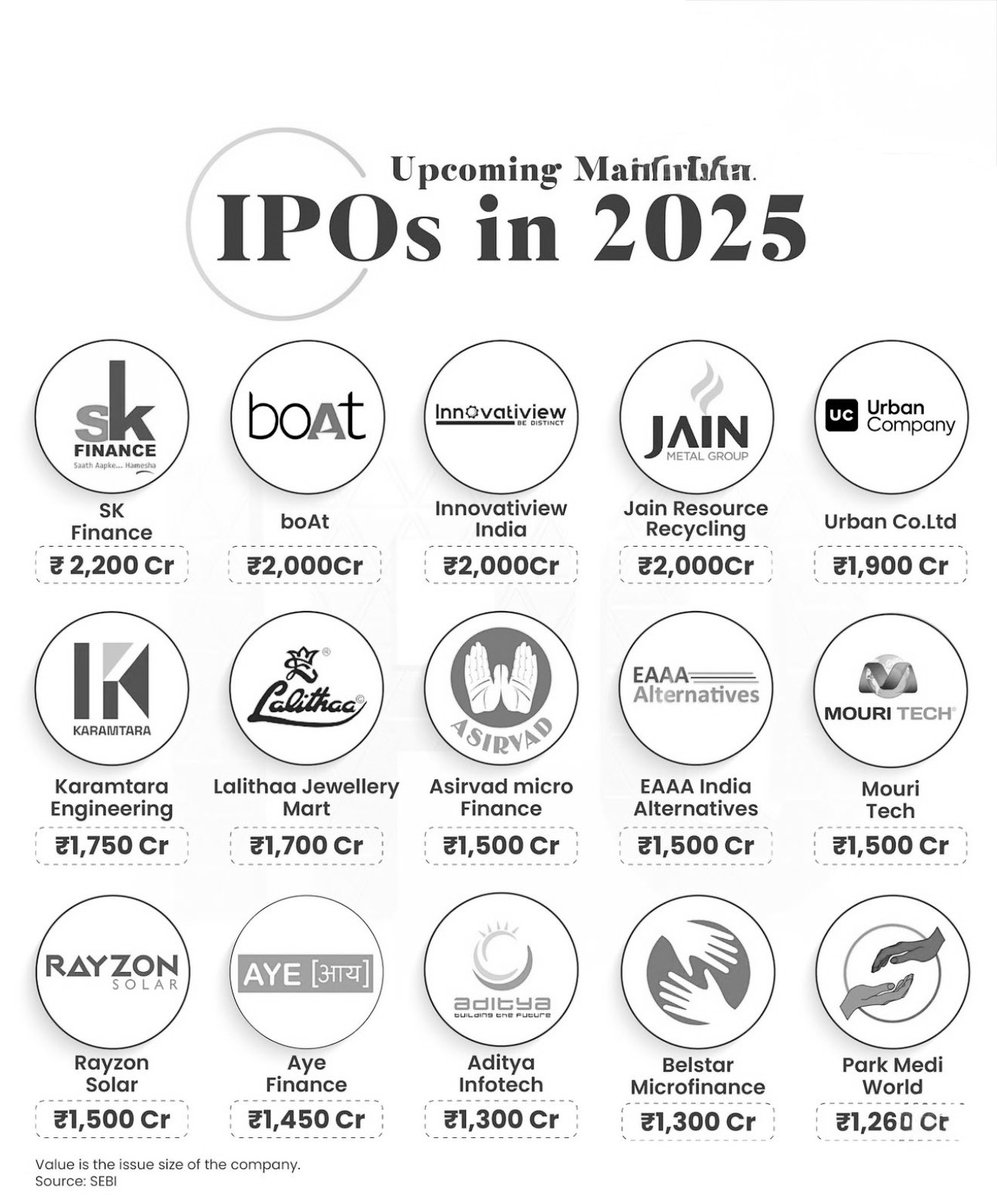

India’s IPO Pipeline is Heating Up in 2025

Over ₹28,000 Cr worth of fresh equity listings are lined up across consumer brands, fintech, microfinance, solar, and tech.

Let’s break it down 👇

💎 Biggest IPOs in the Queue

▪️ SK Finance – ₹2,200 Cr ➡️ NBFC with strong rural lending book and Rajasthan roots

▪️ boAt – ₹2,000 Cr ➡️ India’s audio wearables unicorn; now eyeing profitability and global push

▪️ Innovativeview India – ₹2,000 Cr ➡️ Smart security & surveillance solutions provider; plays on smart infra

▪️ Jain Resource Recycling – ₹2,000 Cr ➡️ Metal recycling player riding on sustainability & circular economy

▪️ Urban Company – ₹1,900 Cr ➡️ Tech-enabled home services marketplace; bets on premiumisation

⚙️ Industrial & Infra Edge

▪️ Karamtara Engineering – ₹1,750 Cr ➡️ Transmission tower & EPC firm; plays on power infra capex boom

▪️ Rayzon Solar – ₹1,500 Cr ➡️ Solar modules & EPC player from Gujarat; benefits from renewable tailwinds

▪️ Aditya Infotech – ₹1,300 Cr ➡️ Security surveillance & electronics distributor; key B2B enabler

💰 Financial Inclusion & Lending

▪️ Asirvad Micro Finance – ₹1,500 Cr ➡️ Subsidiary of Manappuram Finance; strong South India microfinance base

▪️ Belstar Microfinance – ₹1,300 Cr ➡️ Promoted by Muthoot Finance; solid MFI track record

▪️ Aye Finance – ₹1,450 Cr ➡️ MSME lender with tech-enabled underwriting model

▪️ EAAA India Alternatives – ₹1,500 Cr ➡️ Alternative investment platform eyeing wealth-tech space

🛍️ Consumer & Healthcare Plays

▪️ Lalithaa Jewellery Mart – ₹1,700 Cr ➡️ South-based retail gold giant; traditional + digital sales mix

▪️ Park Medi World – ₹1,260 Cr ➡️ Multispecialty hospital chain; affordable private care segment

▪️ Mouri Tech – ₹1,500 Cr ➡️ Enterprise tech services firm; ERP, cloud, and digital transformation focus

#IPO2025 #IPO #Investing #Nifty

XXXXX engagements

Related Topics momentum money finance ipos fintech listings ipo investment