[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Nyx [@NyxHarrow](/creator/twitter/NyxHarrow) on x 11.4K followers Created: 2025-07-24 09:53:14 UTC No headlines. No hype. But Wall Street is quietly going long on Ethereum—and the numbers don’t lie. On July 16, 2025, US-listed Ethereum ETFs recorded $726M in net inflows *in a single day*, smashing all previous records. Between July XX and 18, the total reached nearly $2.2B—the strongest 5-day streak since launch. And who’s leading the pack? BlackRock’s iShares Ethereum Trust (ETHA) now holds over 2M ETH—nearly **2% of global supply**, worth ~$7.73B. The narrative has shifted: → ETH is no longer just a Web3 dream. → It’s an institutional-grade asset, accessible through regulated, fiat-onboarded vehicles But here’s the question: What does it mean when a decentralized asset is increasingly held by centralized giants? Are we witnessing the financialization of Ethereum—or the start of a new monetary layer for TradFi? Would love to hear your take 👇 #Ethereum #Crypto #Web3 #ETH #BlackRock @KaitoAI  XX engagements  **Related Topics** [$22bthe](/topic/$22bthe) [$726m](/topic/$726m) [wall street](/topic/wall-street) [nyx](/topic/nyx) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [ishares ethereum](/topic/ishares-ethereum) [stocks etf](/topic/stocks-etf) [Post Link](https://x.com/NyxHarrow/status/1948320562037535063)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Nyx @NyxHarrow on x 11.4K followers

Created: 2025-07-24 09:53:14 UTC

Nyx @NyxHarrow on x 11.4K followers

Created: 2025-07-24 09:53:14 UTC

No headlines. No hype.

But Wall Street is quietly going long on Ethereum—and the numbers don’t lie.

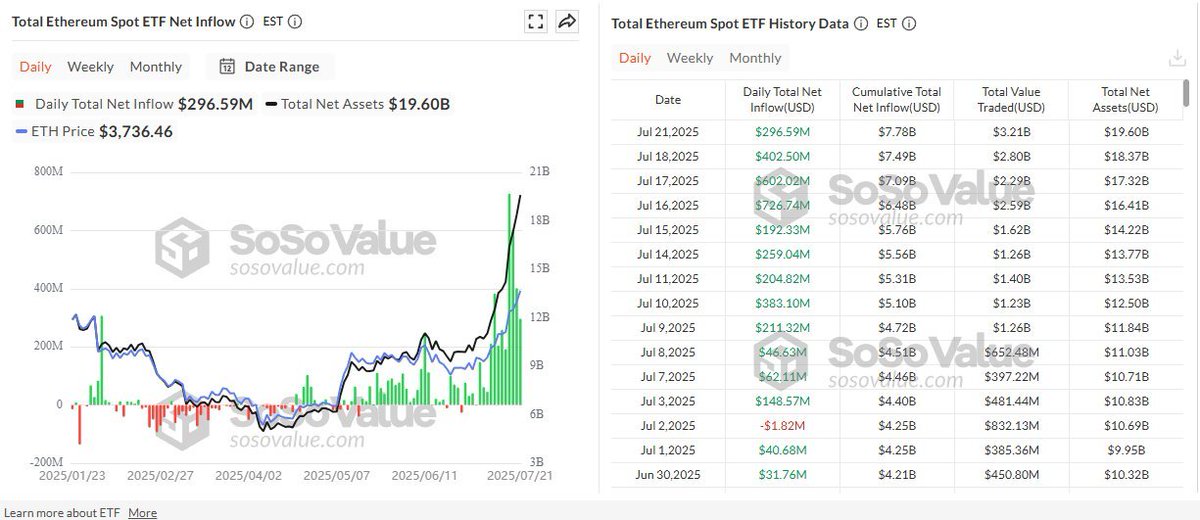

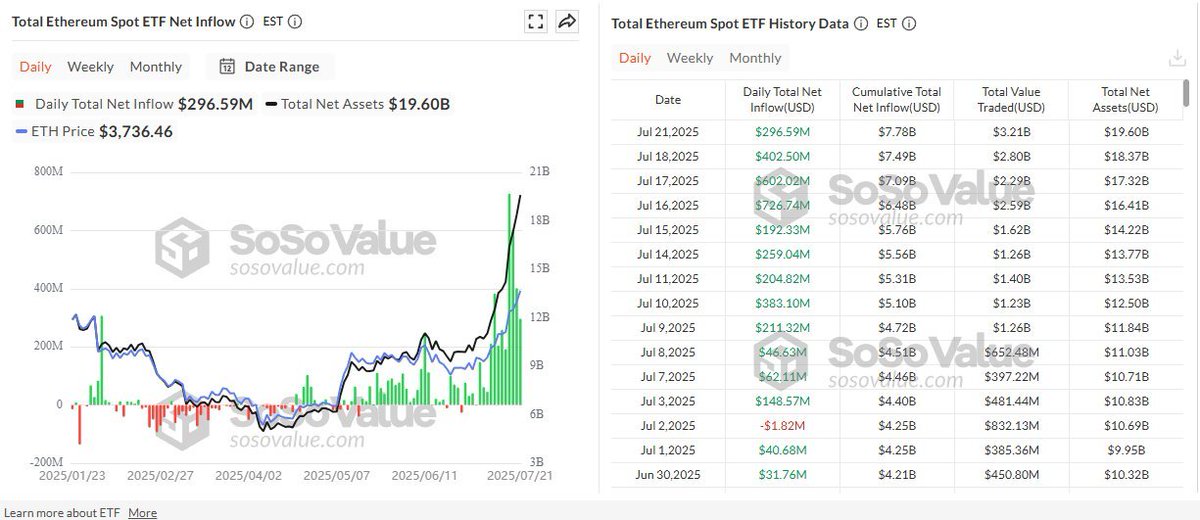

On July 16, 2025, US-listed Ethereum ETFs recorded $726M in net inflows in a single day, smashing all previous records. Between July XX and 18, the total reached nearly $2.2B—the strongest 5-day streak since launch.

And who’s leading the pack?

BlackRock’s iShares Ethereum Trust (ETHA) now holds over 2M ETH—nearly 2% of global supply, worth ~$7.73B.

The narrative has shifted: → ETH is no longer just a Web3 dream. → It’s an institutional-grade asset, accessible through regulated, fiat-onboarded vehicles

But here’s the question: What does it mean when a decentralized asset is increasingly held by centralized giants?

Are we witnessing the financialization of Ethereum—or the start of a new monetary layer for TradFi?

Would love to hear your take 👇

#Ethereum #Crypto #Web3 #ETH #BlackRock @KaitoAI

XX engagements

Related Topics $22bthe $726m wall street nyx ethereum coins layer 1 ishares ethereum stocks etf