[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

𝐃 𝐲 𝐍𝐚𝐭𝐢𝟎𝐍 🐦🔥 [@Dy_Nati0N_](/creator/twitter/Dy_Nati0N_) on x 1631 followers

Created: 2025-07-24 08:18:43 UTC

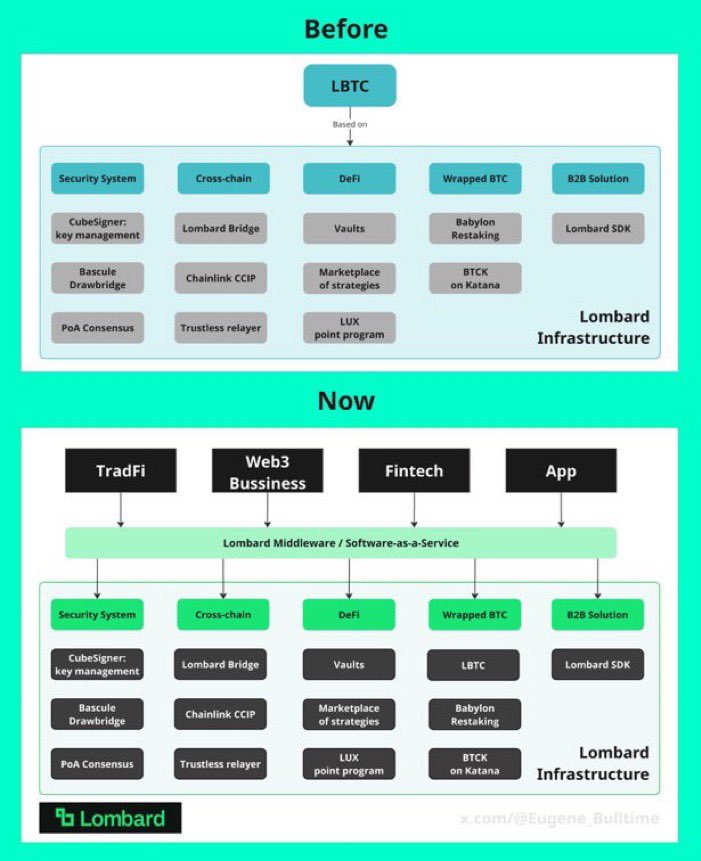

@Lombard_Finance: From Protocol to Platform

The image illustrates Lombard’s transformation from a focused Bitcoin protocol into a comprehensive BTCFi infrastructure stack powering use cases across TradFi, Web3, Fintech, and consumer apps.

Before: Protocol-Centric BTCFi

Lombard originally revolved around LBTC Liquid Bitcoin; a tokenized version of BTC usable across chains. This core product was supported by five key infrastructure pillars:

X. Security System

✤ CubeSigner: A hardware-secured, non-custodial key management tool to prevent key leaks or misuse.

✤ Bascule Drawbridge: A verification layer that independently validates Bitcoin state to prevent fraud in bridging.

✤ PoA Consensus: A lightweight, permissioned system ensuring efficient consensus over security-critical decisions.

X. Cross-Chain Infrastructure

✥ Lombard Bridge: A secure bridge enabling BTC to move across ecosystems.

✥ Chainlink CCIP: Decentralized messaging to authorize mint/burn actions across chains.

✥ Trustless Relayer: Ensures cross-chain communications remain transparent and verifiable.

X. DeFi Layer

▫️Vaults: Smart contract-based strategies to earn passive yield with BTC.

▫️Marketplace of Strategies: A curated set of BTC-yield strategies users can opt into.

▫️LUX Point Program: A reward layer incentivizing on-chain BTC activity.

X. Wrapped BTC Support

✦ Babylon Restaking: Allows BTC holders to restake and earn while securing networks.

✦ BTCK on Katana: A wrapped BTC asset deployed on Katana for composability and trading.

X. B2B Solutions

✒︎ Lombard SDK: A development kit allowing third parties to integrate LBTC and associated tools into their own systems.

This setup helped bootstrap BTCFi, but it was limited to protocol participants.

Now: Modular Middleware for the Ecosystem

Lombard has expanded its scope. Instead of being just a protocol, it now functions as Middleware or Software-as-a-Service (SaaS) infrastructure. The same powerful tools are available for:

☛ TradFi Institutions

☛ Web3 Businesses

☛ Fintech Startups

☛ App Developers

These verticals can now integrate:

❥ Security Systems (CubeSigner, Bascule, PoA) for on-chain key and asset control.

❥ Cross-Chain Tools to connect assets and logic across networks.

❥ DeFi Components like vaults, strategy engines, and reward layers.

❥ Wrapped BTC Solutions that support staking and composable BTC assets.

❥ SDKs and APIs for easy integration of BTCFi primitives.

In summary:

Lombard has evolved from a standalone DeFi protocol into a plug-and-play infrastructure layer that powers BTCFi across sectors. The tools remain the same, but the reach, flexibility, and impact are now much broader.

This is how Bitcoin becomes usable, programmable, and scalable across Web3 and beyond.

XXX engagements

**Related Topics**

[tokenized](/topic/tokenized)

[lbtc](/topic/lbtc)

[fintech](/topic/fintech)

[web3](/topic/web3)

[stack](/topic/stack)

[coins btcfi](/topic/coins-btcfi)

[protocol](/topic/protocol)

[lombardfinance](/topic/lombardfinance)

[Post Link](https://x.com/Dy_Nati0N_/status/1948296776244498841)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

𝐃 𝐲 𝐍𝐚𝐭𝐢𝟎𝐍 🐦🔥 @Dy_Nati0N_ on x 1631 followers

Created: 2025-07-24 08:18:43 UTC

𝐃 𝐲 𝐍𝐚𝐭𝐢𝟎𝐍 🐦🔥 @Dy_Nati0N_ on x 1631 followers

Created: 2025-07-24 08:18:43 UTC

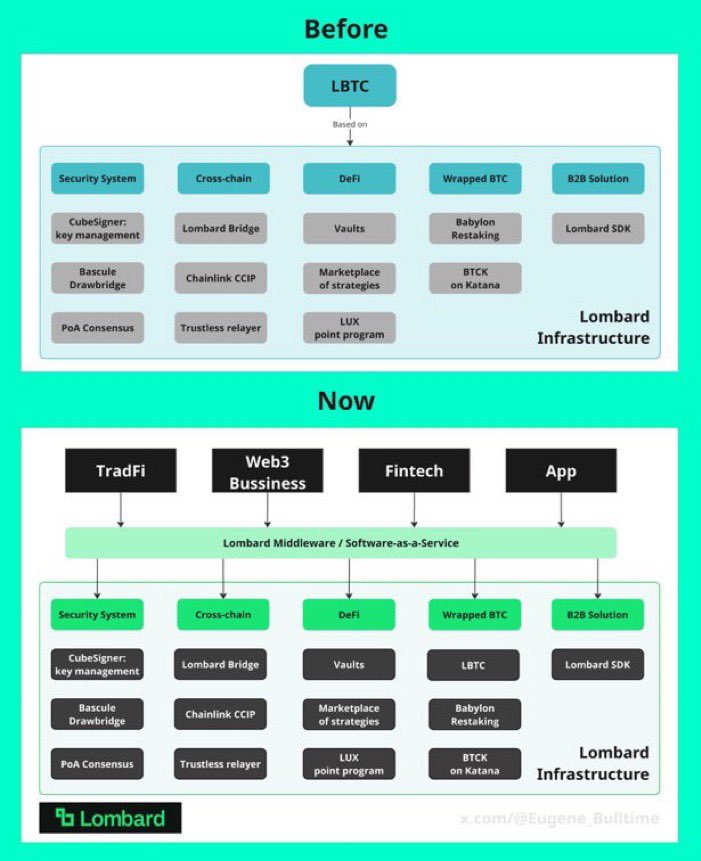

@Lombard_Finance: From Protocol to Platform

The image illustrates Lombard’s transformation from a focused Bitcoin protocol into a comprehensive BTCFi infrastructure stack powering use cases across TradFi, Web3, Fintech, and consumer apps.

Before: Protocol-Centric BTCFi

Lombard originally revolved around LBTC Liquid Bitcoin; a tokenized version of BTC usable across chains. This core product was supported by five key infrastructure pillars: X. Security System ✤ CubeSigner: A hardware-secured, non-custodial key management tool to prevent key leaks or misuse.

✤ Bascule Drawbridge: A verification layer that independently validates Bitcoin state to prevent fraud in bridging.

✤ PoA Consensus: A lightweight, permissioned system ensuring efficient consensus over security-critical decisions.

X. Cross-Chain Infrastructure ✥ Lombard Bridge: A secure bridge enabling BTC to move across ecosystems.

✥ Chainlink CCIP: Decentralized messaging to authorize mint/burn actions across chains.

✥ Trustless Relayer: Ensures cross-chain communications remain transparent and verifiable.

X. DeFi Layer ▫️Vaults: Smart contract-based strategies to earn passive yield with BTC.

▫️Marketplace of Strategies: A curated set of BTC-yield strategies users can opt into.

▫️LUX Point Program: A reward layer incentivizing on-chain BTC activity.

X. Wrapped BTC Support ✦ Babylon Restaking: Allows BTC holders to restake and earn while securing networks.

✦ BTCK on Katana: A wrapped BTC asset deployed on Katana for composability and trading.

X. B2B Solutions ✒︎ Lombard SDK: A development kit allowing third parties to integrate LBTC and associated tools into their own systems.

This setup helped bootstrap BTCFi, but it was limited to protocol participants.

Now: Modular Middleware for the Ecosystem

Lombard has expanded its scope. Instead of being just a protocol, it now functions as Middleware or Software-as-a-Service (SaaS) infrastructure. The same powerful tools are available for: ☛ TradFi Institutions ☛ Web3 Businesses ☛ Fintech Startups ☛ App Developers

These verticals can now integrate: ❥ Security Systems (CubeSigner, Bascule, PoA) for on-chain key and asset control.

❥ Cross-Chain Tools to connect assets and logic across networks.

❥ DeFi Components like vaults, strategy engines, and reward layers.

❥ Wrapped BTC Solutions that support staking and composable BTC assets.

❥ SDKs and APIs for easy integration of BTCFi primitives.

In summary: Lombard has evolved from a standalone DeFi protocol into a plug-and-play infrastructure layer that powers BTCFi across sectors. The tools remain the same, but the reach, flexibility, and impact are now much broader.

This is how Bitcoin becomes usable, programmable, and scalable across Web3 and beyond.

XXX engagements

Related Topics tokenized lbtc fintech web3 stack coins btcfi protocol lombardfinance