[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Pee😎 [@SirpeeOG](/creator/twitter/SirpeeOG) on x XXX followers Created: 2025-07-24 06:23:58 UTC Visualizing Cross-Chain Capital Flow in DeFi @0xSoulProtocol Lending Map This powerful visualization offers a deep dive into soul protocol decentralized lending ecosystem, mapping how capital flows seamlessly across multiple chains and protocols. At the core lies a Borrow Limit of XXXXX% and a Net APY of 5.23%, showcasing the health and efficiency of this lending strategy. Here's what this visual tells us: 💠 Supply Side Highlights ☑️ Assets are supplied across chains like Ethereum, BNB Chain, Polygon, Arbitrum, and Avalanche. ☑️ Strong yields on BNB Chain: +9.903% APY on USDC, indicating attractive passive income opportunities. ☑️ Multiple assets including BTC, ETH, and stablecoins are powering the supply pool. 💸 Borrowing Side Insights ☑️ Borrowed on Polygon with USDC and ETH at -XXXXX% and -XXXXX% respectively reflecting borrowing cost vs potential yield or leverage strategies. ☑️ Strategic borrowing suggests capital is being rotated into higher-yield environments ☑️ Multichain Interoperability This image confirms soul protocol crosschain DeFi optimization, where lending and borrowing happens modularly and strategically across ecosystems like: Ethereum BNB Chain Polygon Avalanche Arbitrum MultiversX  XXXXX engagements  **Related Topics** [$so](/topic/$so) [apy](/topic/apy) [seamlessly](/topic/seamlessly) [decentralized](/topic/decentralized) [protocol](/topic/protocol) [southern co](/topic/southern-co) [stocks utilities](/topic/stocks-utilities) [Post Link](https://x.com/SirpeeOG/status/1948267898666901920)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Pee😎 @SirpeeOG on x XXX followers

Created: 2025-07-24 06:23:58 UTC

Pee😎 @SirpeeOG on x XXX followers

Created: 2025-07-24 06:23:58 UTC

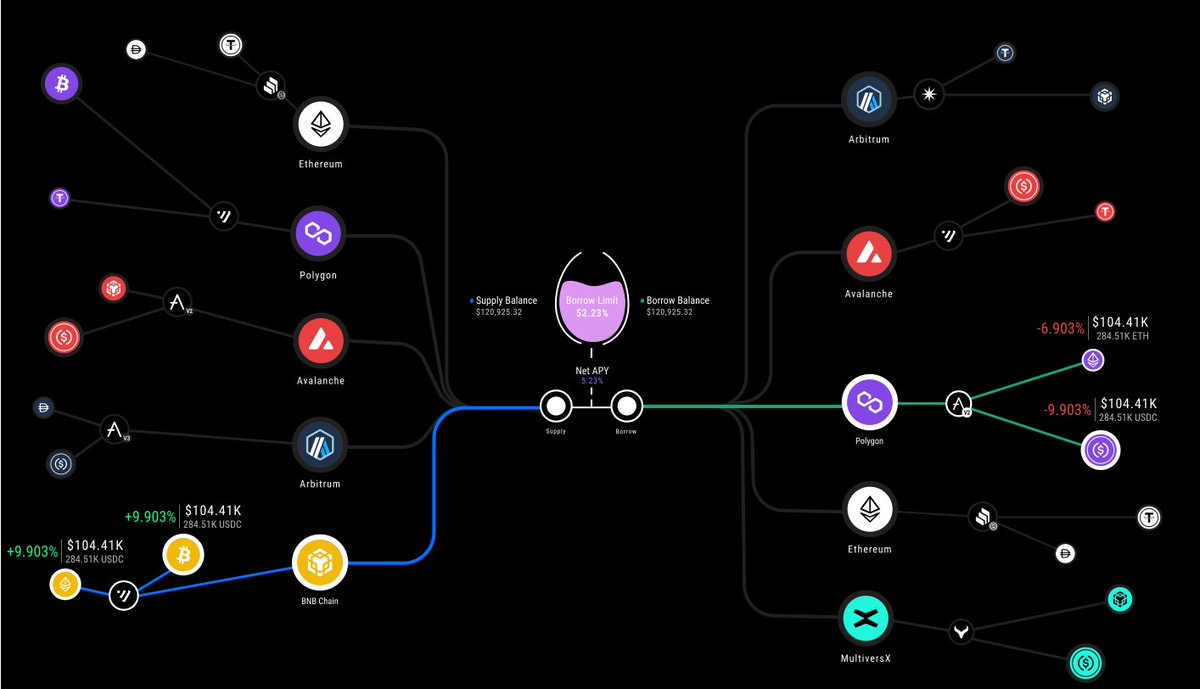

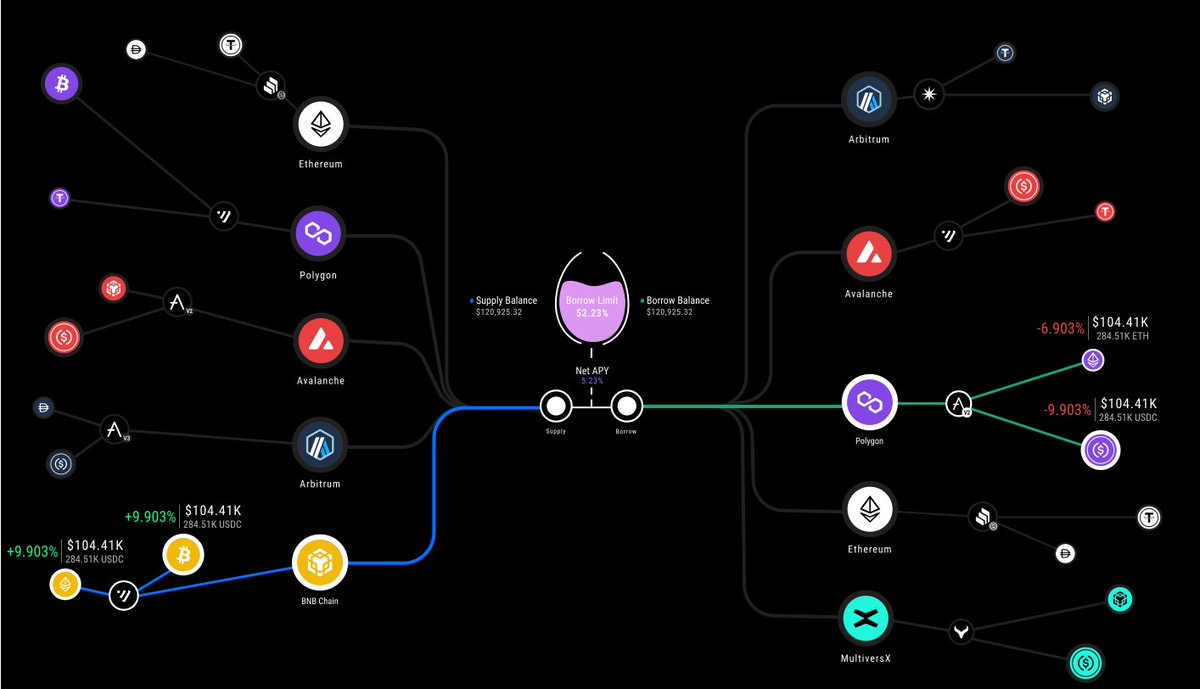

Visualizing Cross-Chain Capital Flow in DeFi @0xSoulProtocol Lending Map

This powerful visualization offers a deep dive into soul protocol decentralized lending ecosystem, mapping how capital flows seamlessly across multiple chains and protocols.

At the core lies a Borrow Limit of XXXXX% and a Net APY of 5.23%, showcasing the health and efficiency of this lending strategy. Here's what this visual tells us:

💠 Supply Side Highlights

☑️ Assets are supplied across chains like Ethereum, BNB Chain, Polygon, Arbitrum, and Avalanche.

☑️ Strong yields on BNB Chain: +9.903% APY on USDC, indicating attractive passive income opportunities.

☑️ Multiple assets including BTC, ETH, and stablecoins are powering the supply pool.

💸 Borrowing Side Insights

☑️ Borrowed on Polygon with USDC and ETH at -XXXXX% and -XXXXX% respectively reflecting borrowing cost vs potential yield or leverage strategies.

☑️ Strategic borrowing suggests capital is being rotated into higher-yield environments

☑️ Multichain Interoperability This image confirms soul protocol crosschain DeFi optimization, where lending and borrowing happens modularly and strategically across ecosystems like:

Ethereum

BNB Chain

Polygon

Avalanche

Arbitrum

MultiversX

XXXXX engagements

Related Topics $so apy seamlessly decentralized protocol southern co stocks utilities