[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-23 16:42:47 UTC 🇺🇸 Walmart Inc (Valuation - Very Expensive) Walmart Inc has the worst Fundamentals score in Global Consumer Staples Distribution & Retail. The fundamentals score is -X. Walmart Inc has a total score of +4 and there are X alerts. Walmart's valuation ratios indicate that the company is very expensive compared to its peers. The forward P/E ratio of XXXXX is significantly higher than the peer average of 17.93, suggesting that investors are paying a premium for future earnings. The trailing P/E ratio of XXXXX is also well above the peer average of 20.84, indicating that the stock is highly valued based on historical earnings. The enterprise value to EBITDA ratio of XXXXX is substantially higher than the peer average of 12.15, suggesting that the market is pricing Walmart at a premium relative to its earnings potential. The price-to-sales ratio of XXXX is also higher than the peer average of 0.38, reinforcing the notion that Walmart is trading at a very expensive valuation. Overall, these metrics suggest that Walmart may be overvalued, and investors should exercise caution. #DarwinKnows #Walmart #WMT $WMT #FreeTrialAvailable #AskDarwin #StockToWatch  XXX engagements  **Related Topics** [staples](/topic/staples) [$wmt](/topic/$wmt) [stocks consumer defensive](/topic/stocks-consumer-defensive) [Post Link](https://x.com/Darwin_Knows/status/1948061239927853564)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-23 16:42:47 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-23 16:42:47 UTC

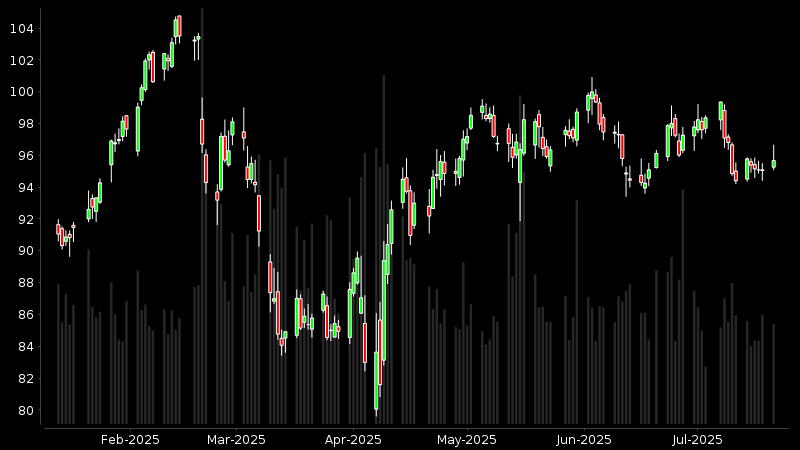

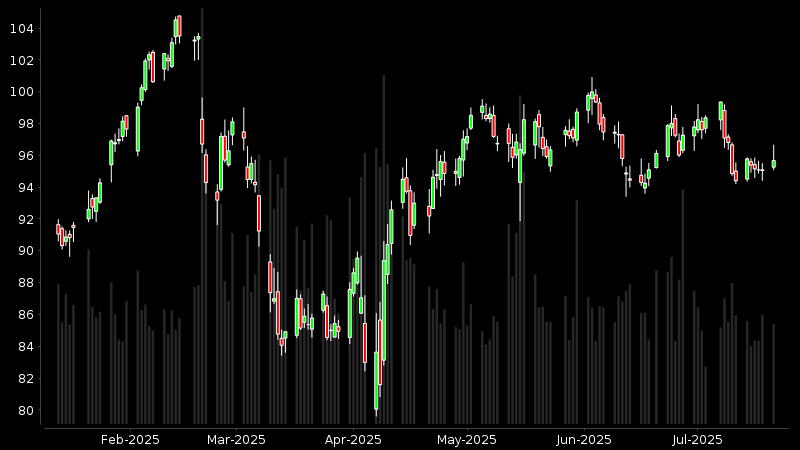

🇺🇸 Walmart Inc (Valuation - Very Expensive)

Walmart Inc has the worst Fundamentals score in Global Consumer Staples Distribution & Retail. The fundamentals score is -X. Walmart Inc has a total score of +4 and there are X alerts.

Walmart's valuation ratios indicate that the company is very expensive compared to its peers. The forward P/E ratio of XXXXX is significantly higher than the peer average of 17.93, suggesting that investors are paying a premium for future earnings. The trailing P/E ratio of XXXXX is also well above the peer average of 20.84, indicating that the stock is highly valued based on historical earnings. The enterprise value to EBITDA ratio of XXXXX is substantially higher than the peer average of 12.15, suggesting that the market is pricing Walmart at a premium relative to its earnings potential. The price-to-sales ratio of XXXX is also higher than the peer average of 0.38, reinforcing the notion that Walmart is trading at a very expensive valuation. Overall, these metrics suggest that Walmart may be overvalued, and investors should exercise caution.

#DarwinKnows #Walmart #WMT $WMT

#FreeTrialAvailable #AskDarwin #StockToWatch

XXX engagements

Related Topics staples $wmt stocks consumer defensive