[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Brett Gibbs [@OilandGibbs](/creator/twitter/OilandGibbs) on x 2196 followers Created: 2025-07-23 15:02:07 UTC For those who have reached out about this. H. R. X changed the termination date of Section 6426(k) from 12/31/24 TO 9/30/25. Section 6426(k) is: - SAF excise tax credit - Not restricted to US producers - Qualifies for direct payment - Minimum credit of $1.25/gal if you're XX% of the lifecycle emissions rate of conventional jet fuel. (You get X cent per % thereafter) So, our read, is if you're a foreign SAF producer you capitalize on that as much as possible from mid-June to September as they originally didn't qualify for any in 2025. Now, @biofuelslaw, the question becomes for those who sold SAF gallons in the US, can you retroactively collect 6426(k) credits back to Jan 1? How/when does that direct payment hit if so? Links H. R. X - Section 6426(k) -  XXXXX engagements  **Related Topics** [cent](/topic/cent) [$125gal](/topic/$125gal) [tax bracket](/topic/tax-bracket) [Post Link](https://x.com/OilandGibbs/status/1948035906998358168)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Brett Gibbs @OilandGibbs on x 2196 followers

Created: 2025-07-23 15:02:07 UTC

Brett Gibbs @OilandGibbs on x 2196 followers

Created: 2025-07-23 15:02:07 UTC

For those who have reached out about this.

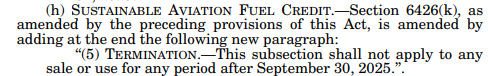

H. R. X changed the termination date of Section 6426(k) from 12/31/24 TO 9/30/25.

Section 6426(k) is:

- SAF excise tax credit

- Not restricted to US producers

- Qualifies for direct payment

- Minimum credit of $1.25/gal if you're XX% of the lifecycle emissions rate of conventional jet fuel. (You get X cent per % thereafter)

So, our read, is if you're a foreign SAF producer you capitalize on that as much as possible from mid-June to September as they originally didn't qualify for any in 2025.

Now, @biofuelslaw, the question becomes for those who sold SAF gallons in the US, can you retroactively collect 6426(k) credits back to Jan 1? How/when does that direct payment hit if so?

Links H. R. X - Section 6426(k) -

XXXXX engagements

Related Topics cent $125gal tax bracket