[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-23 11:30:01 UTC JPM: Q2 consensus forecasts have been cut substantially (top chart) for the S&P XXX with the implied yoy growth rate at +3.5% y/y, down from +11% y/y at the start of the year. The unassuming hurdle rate suggests beats at headline level for Q2, but this is in the backdrop of strong recent equity rally, so there could be disappointments if earnings do not deliver or if the guidances are mixed [which we have seen]. Further out, earnings are expected to climb more steeply in 2H, delivering XX% growth rate in Q4 vs Q2 – middle chart. That is quite optimistic, as the historical median growth rate over those time frames was only 2.7%, and fundamentally this is especially so in light of activity slowing, as well as softer pricing – see bottom chart. Top-line growth is decelerating.  XXXXX engagements  **Related Topics** [neil](/topic/neil) [rating agency](/topic/rating-agency) [jpm](/topic/jpm) [$spy](/topic/$spy) [Post Link](https://x.com/neilksethi/status/1947982528272347376)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-23 11:30:01 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-23 11:30:01 UTC

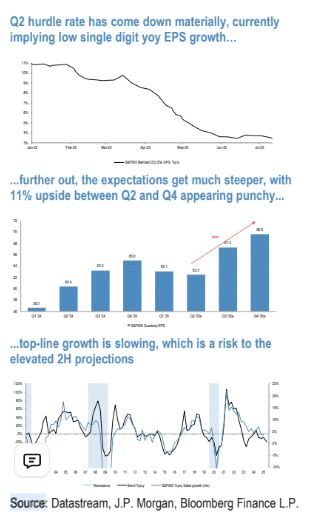

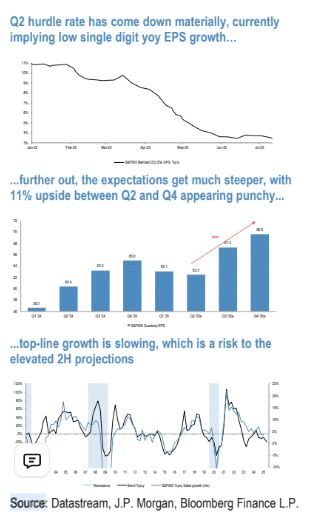

JPM: Q2 consensus forecasts have been cut substantially (top chart) for the S&P XXX with the implied yoy growth rate at +3.5% y/y, down from +11% y/y at the start of the year. The unassuming hurdle rate suggests beats at headline level for Q2, but this is in the backdrop of strong recent equity rally, so there could be disappointments if earnings do not deliver or if the guidances are mixed [which we have seen].

Further out, earnings are expected to climb more steeply in 2H, delivering XX% growth rate in Q4 vs Q2 – middle chart. That is quite optimistic, as the historical median growth rate over those time frames was only 2.7%, and fundamentally this is especially so in light of activity slowing, as well as softer pricing – see bottom chart. Top-line growth is decelerating.

XXXXX engagements

Related Topics neil rating agency jpm $spy