[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Compounding Lab [@CompoundingLab](/creator/twitter/CompoundingLab) on x XXX followers Created: 2025-07-23 10:01:00 UTC $ADSK The stock has recently outperformed the S&P 500, driven by digital transformation tailwinds and expanded margins. While past multi-year returns have lagged the index due to valuation resets, Autodesk’s forward projections remain highly attractive for growth-oriented investors due to robust ongoing demand, innovation in AI/cloud, and disciplined capital deployment. Indeed, we are noticing significant improvement in ROIC from 2017 onwards. The upward trend in ROIC demonstrates Autodesk’s strengthened capital efficiency and robust execution as it scales its cloud platform, solidifying its competitive position. Earnings yield, however, remains low and is probably a reflection of high expectations regarding the company's future performance as highlighted below. Autodesk has delivered solid revenue and earnings growth historically, with prospects accelerating driven by robust demand for cloud-based design, AI-enhanced productivity, and a comprehensive product ecosystem. Analysts anticipate mid-teens earnings CAGR, outperforming the broader market and supporting premium valuation multiples. Key segments: 🔘AEC is the dominant revenue contributor, accounting for nearly half of Autodesk’s revenue. 🔘AutoCAD/AutoCAD LT Family and Manufacturing represent significant portions, underscoring Autodesk’s strong presence in digital design and industrial software. 🔘Media & Entertainment and Other represent smaller, but stable, sources of revenue. Our intrinsic (fair) value estimate for this software company is USD XXX per share, meaning that at current price @ XXX it’s fairly valued.  XXX engagements  **Related Topics** [rating agency](/topic/rating-agency) [$adsk](/topic/$adsk) [autodesk inc](/topic/autodesk-inc) [stocks technology](/topic/stocks-technology) [$spy](/topic/$spy) [Post Link](https://x.com/CompoundingLab/status/1947960128210411561)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-23 10:01:00 UTC

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-23 10:01:00 UTC

$ADSK

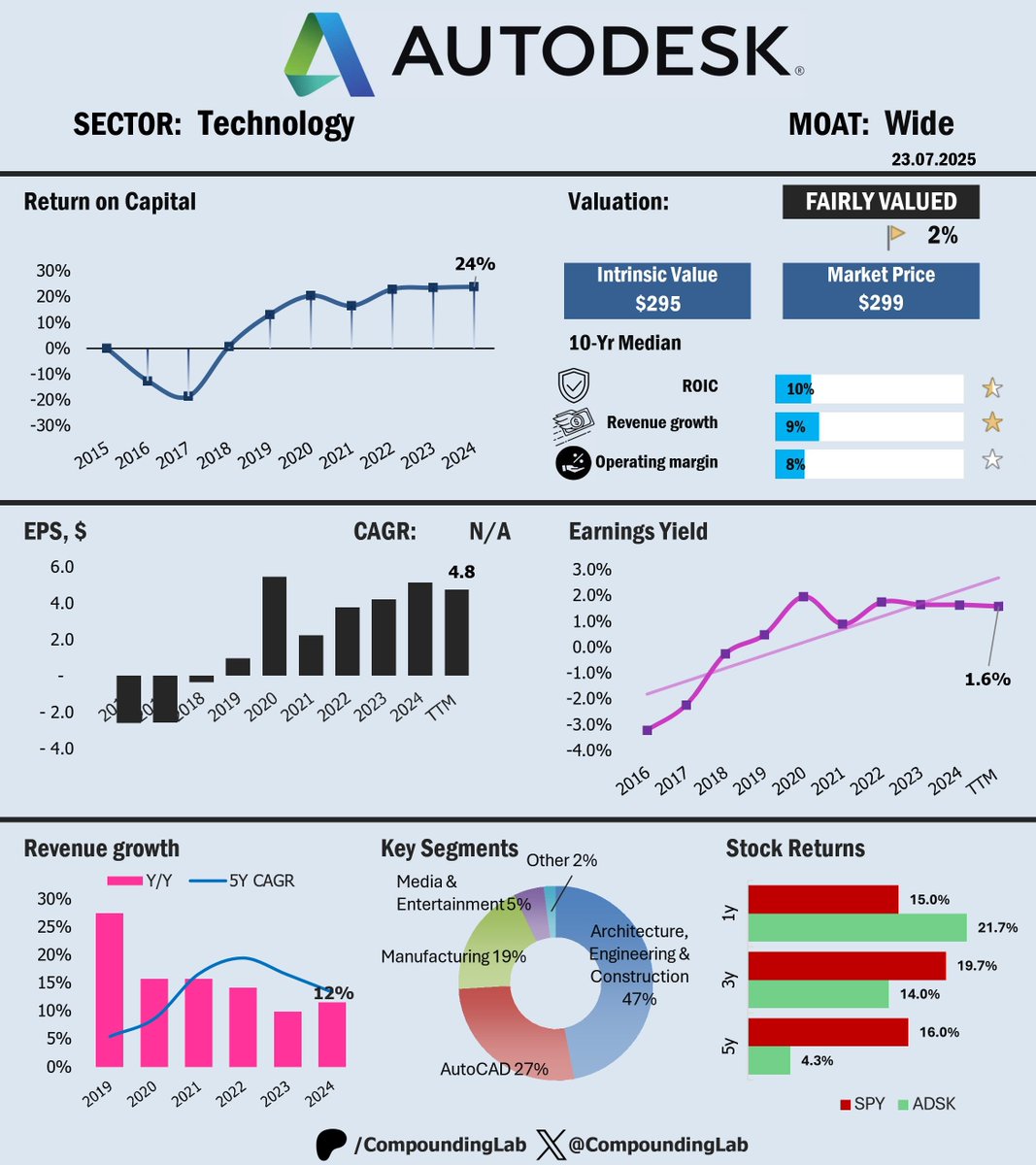

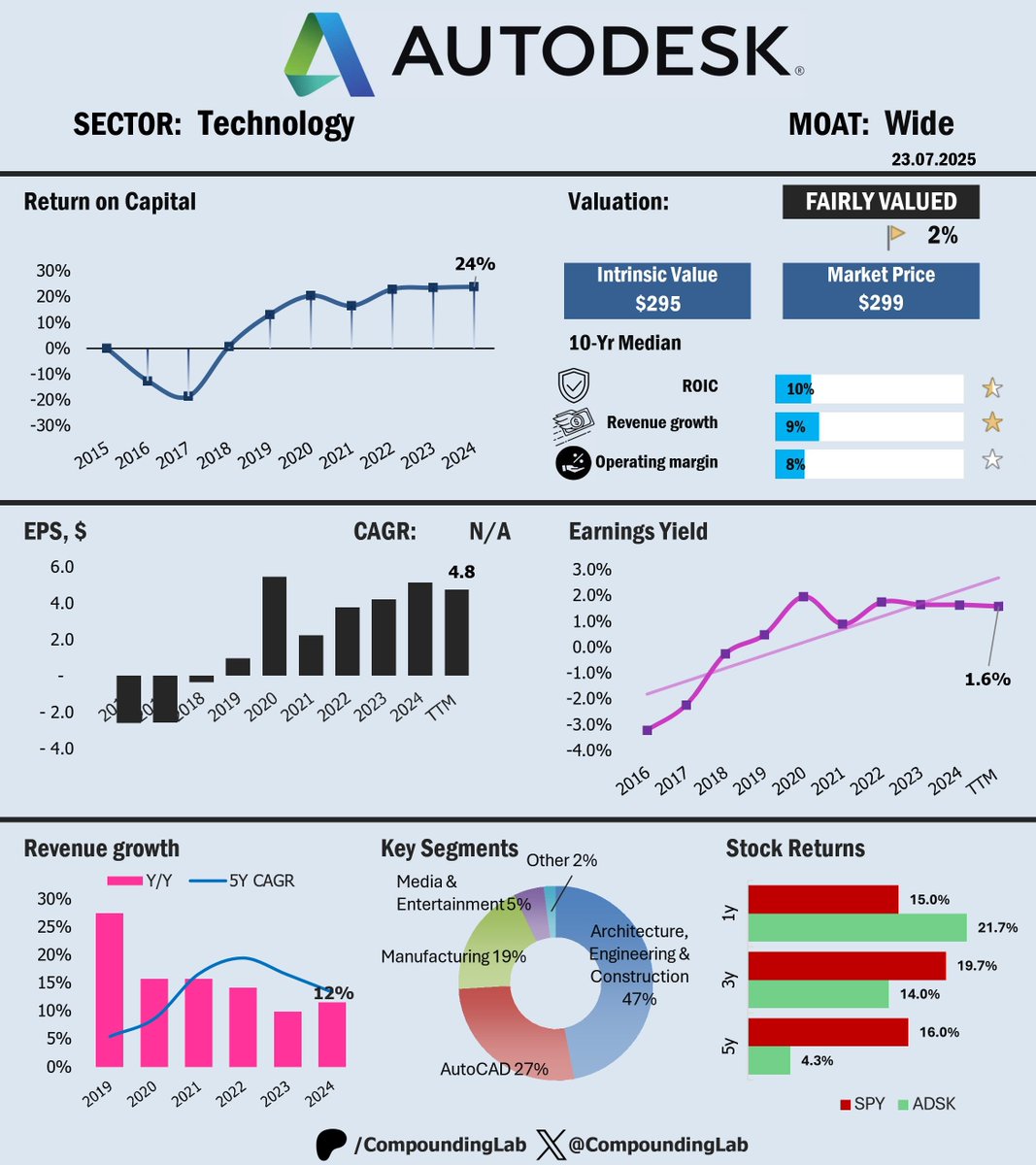

The stock has recently outperformed the S&P 500, driven by digital transformation tailwinds and expanded margins. While past multi-year returns have lagged the index due to valuation resets, Autodesk’s forward projections remain highly attractive for growth-oriented investors due to robust ongoing demand, innovation in AI/cloud, and disciplined capital deployment.

Indeed, we are noticing significant improvement in ROIC from 2017 onwards. The upward trend in ROIC demonstrates Autodesk’s strengthened capital efficiency and robust execution as it scales its cloud platform, solidifying its competitive position.

Earnings yield, however, remains low and is probably a reflection of high expectations regarding the company's future performance as highlighted below.

Autodesk has delivered solid revenue and earnings growth historically, with prospects accelerating driven by robust demand for cloud-based design, AI-enhanced productivity, and a comprehensive product ecosystem. Analysts anticipate mid-teens earnings CAGR, outperforming the broader market and supporting premium valuation multiples.

Key segments: 🔘AEC is the dominant revenue contributor, accounting for nearly half of Autodesk’s revenue. 🔘AutoCAD/AutoCAD LT Family and Manufacturing represent significant portions, underscoring Autodesk’s strong presence in digital design and industrial software. 🔘Media & Entertainment and Other represent smaller, but stable, sources of revenue.

Our intrinsic (fair) value estimate for this software company is USD XXX per share, meaning that at current price @ XXX it’s fairly valued.

XXX engagements

Related Topics rating agency $adsk autodesk inc stocks technology $spy