[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-22 19:20:00 UTC MarketWatch: Blackrock remains bullish on bonds noting income in the bond market hasn’t looked this good in XX years. “Higher-for-longer policy rates have made this the best backdrop for earning income in bonds in two decades — without taking more interest-rate or credit risk,” the asset-management giant said in a note Monday. “Some XX% of global fixed-income assets now offer yields above X% as interest rates have settled above prepandemic levels.” In the chart, BlackRock showed the market share of fixed-income assets with a yield of X% or more. “We like short-term government bonds,” BlackRock added, explaining that the recently passed U.S. budget bill “highlighted a lack of fiscal discipline, while sticky inflation limits rate cuts, keeping us tactically cautious on long-term bonds.” As for credit markets, the firm said that “resilient growth has kept corporate balance sheets solid even with tariffs.” While being selective due to “fiscal sustainability risks,” BlackRock favors short- and medium-term government bonds, U.S. agency mortgage-backed securities, as well as “currency-hedged international bonds” and local-currency emerging-market debt, according to the note.  XXXXX engagements  **Related Topics** [credit default swaps](/topic/credit-default-swaps) [rates](/topic/rates) [blackrock](/topic/blackrock) [stocks financial services](/topic/stocks-financial-services) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [Post Link](https://x.com/neilksethi/status/1947738416679948728)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-22 19:20:00 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-22 19:20:00 UTC

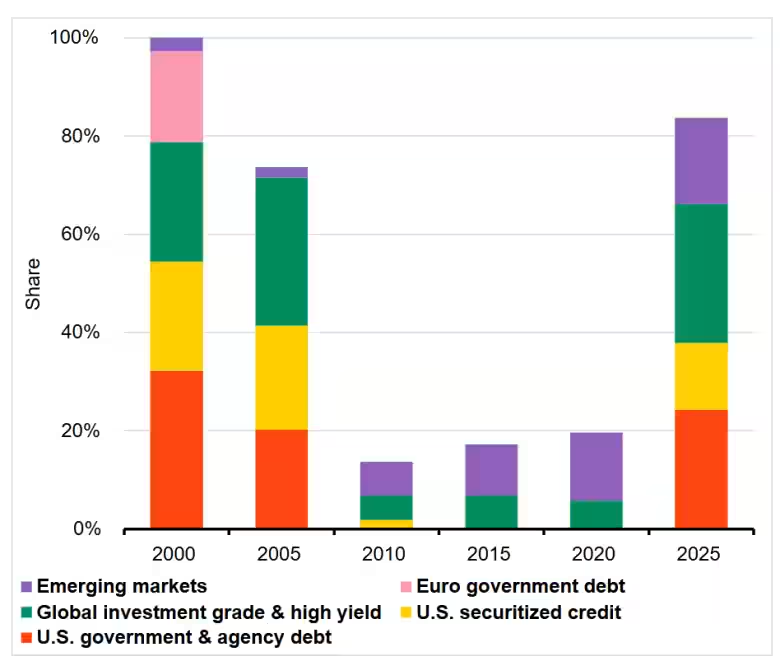

MarketWatch: Blackrock remains bullish on bonds noting income in the bond market hasn’t looked this good in XX years.

“Higher-for-longer policy rates have made this the best backdrop for earning income in bonds in two decades — without taking more interest-rate or credit risk,” the asset-management giant said in a note Monday. “Some XX% of global fixed-income assets now offer yields above X% as interest rates have settled above prepandemic levels.”

In the chart, BlackRock showed the market share of fixed-income assets with a yield of X% or more.

“We like short-term government bonds,” BlackRock added, explaining that the recently passed U.S. budget bill “highlighted a lack of fiscal discipline, while sticky inflation limits rate cuts, keeping us tactically cautious on long-term bonds.” As for credit markets, the firm said that “resilient growth has kept corporate balance sheets solid even with tariffs.”

While being selective due to “fiscal sustainability risks,” BlackRock favors short- and medium-term government bonds, U.S. agency mortgage-backed securities, as well as “currency-hedged international bonds” and local-currency emerging-market debt, according to the note.

XXXXX engagements

Related Topics credit default swaps rates blackrock stocks financial services stocks bitcoin treasuries