[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Unichain Daily [@unichaindaily](/creator/twitter/unichaindaily) on x XXX followers Created: 2025-07-22 18:29:36 UTC Behind every thriving DeFi market, the data reveals the true story. ✨ Let's dig into the numbers fueling Compound V3's surge on Unichain and see why these metrics matter. Compound V3: Powering DeFi on Unichain - By the Numbers 👇 ▫️Let's break down Compound V3's current momentum with key stats: • Total Value Locked: $872.5M • 24h DEX Volume: $568.6M • Stablecoins Market Cap: $451.3M • Active Users: XXXXX • 24h Chain Fees: $XXXXXX • 24h Protocol Revenue: $XXXXXXX ▫️Protocol Health & Risk Metrics • Health Factor: XXXX — healthy buffer for borrowers and lenders • Liquidation Threshold: XX% - keeping the ecosystem stable • Reserve Factor: XX% — optimized for sustainability • Borrow APY: XXX% — competitive borrowing landscape ▫️Interest Rate Snapshot • Supply APY (24h): XXX% • Borrow Rate (24h): XXX% • Current Borrow APY: XXX% Robust demand and balanced returns for both lenders and borrowers. ▫️Asset Breakdown • USDC: Supply: XXX% | Borrow: XXX% | $45M supplied | $18M borrowed • WETH: Supply: XXX% | Borrow: XXX% | $25M supplied | $12M borrowed • WBTC: Supply: XXX% | Borrow: XXX% | $15M supplied | $7.5M borrowed • LINK: Supply: XXX% | Borrow: XXX% | $8M supplied | $3.2M borrowed ▫️Key Takeaway: Compound V3 is thriving on Unichain, securing nearly $900M in TVL, delivering healthy yields and showing strong user and fee activity. Risk buffer remain optimal, and protocols are drawing in both blue-chip and defi native assets ▪️Which asset are you supplying or borrowing? See something surprising in the data? Let's talk Compound V3 strategies in the comments. For live stats, metrics, and DeFi deep-dives, and everything Unichain, follow @unichaindaily  XXX engagements  **Related Topics** [market cap](/topic/market-cap) [$4513m](/topic/$4513m) [stablecoins](/topic/stablecoins) [$5686m](/topic/$5686m) [$8725m](/topic/$8725m) [momentum](/topic/momentum) [metrics](/topic/metrics) [surge](/topic/surge) [Post Link](https://x.com/unichaindaily/status/1947725731611439212)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Unichain Daily @unichaindaily on x XXX followers

Created: 2025-07-22 18:29:36 UTC

Unichain Daily @unichaindaily on x XXX followers

Created: 2025-07-22 18:29:36 UTC

Behind every thriving DeFi market, the data reveals the true story. ✨

Let's dig into the numbers fueling Compound V3's surge on Unichain and see why these metrics matter.

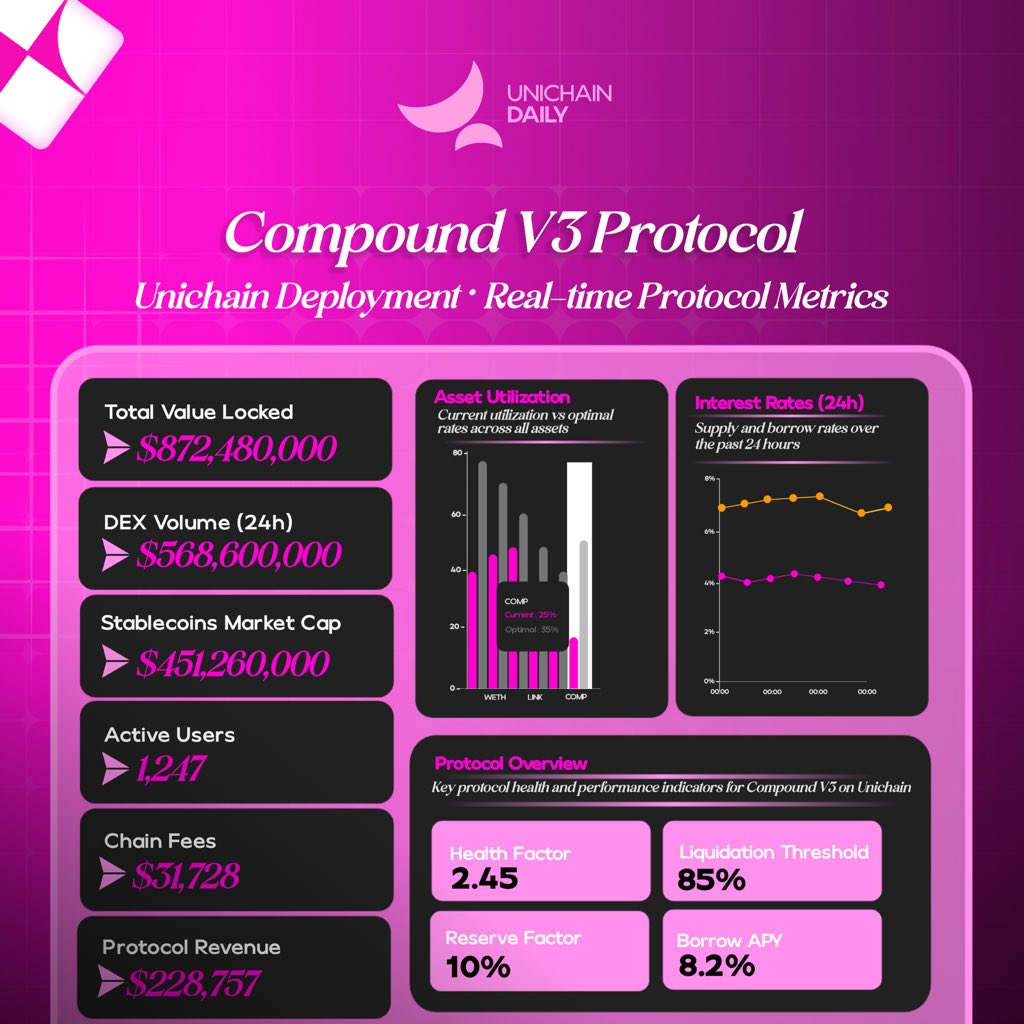

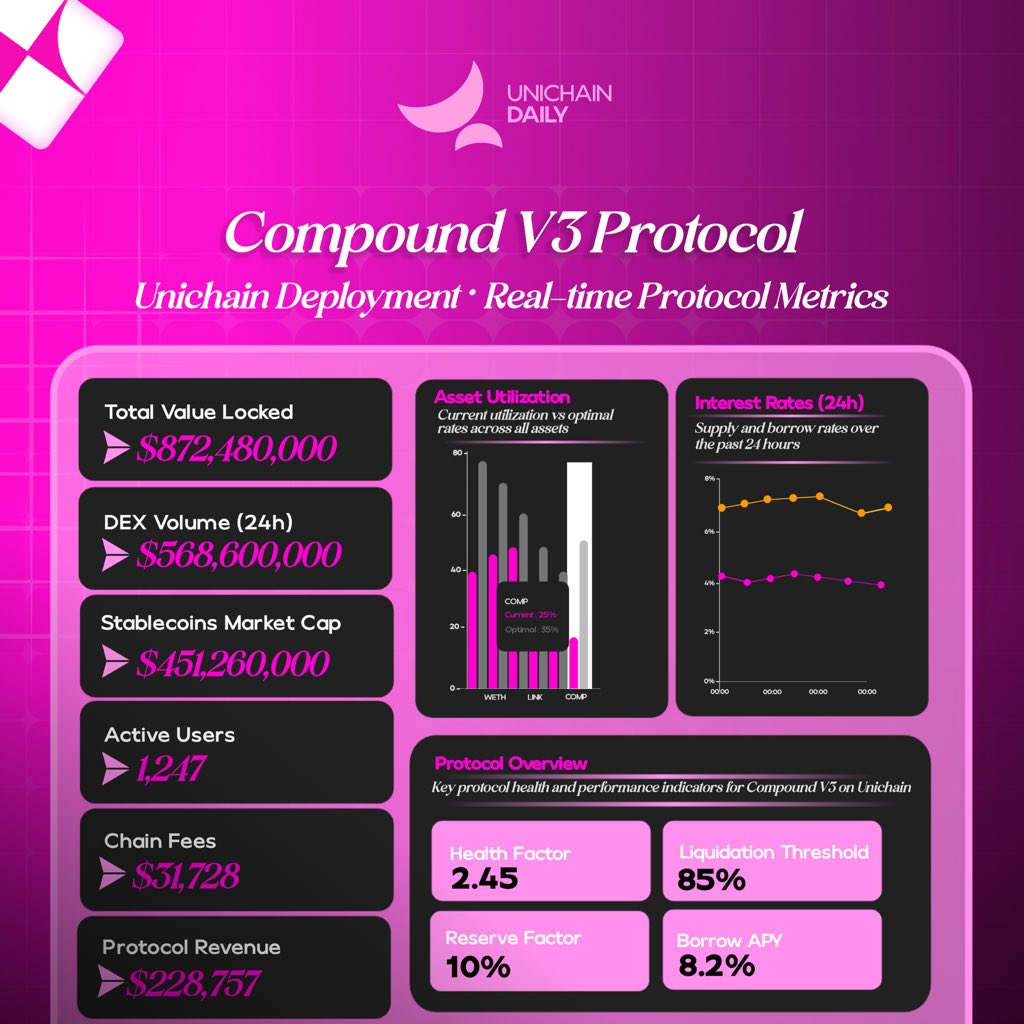

Compound V3: Powering DeFi on Unichain - By the Numbers 👇

▫️Let's break down Compound V3's current momentum with key stats:

• Total Value Locked: $872.5M • 24h DEX Volume: $568.6M • Stablecoins Market Cap: $451.3M • Active Users: XXXXX • 24h Chain Fees: $XXXXXX • 24h Protocol Revenue: $XXXXXXX

▫️Protocol Health & Risk Metrics

• Health Factor: XXXX — healthy buffer for borrowers and lenders • Liquidation Threshold: XX% - keeping the ecosystem stable • Reserve Factor: XX% — optimized for sustainability • Borrow APY: XXX% — competitive borrowing landscape

▫️Interest Rate Snapshot

• Supply APY (24h): XXX% • Borrow Rate (24h): XXX% • Current Borrow APY: XXX% Robust demand and balanced returns for both lenders and borrowers.

▫️Asset Breakdown

• USDC: Supply: XXX% | Borrow: XXX% | $45M supplied | $18M borrowed • WETH: Supply: XXX% | Borrow: XXX% | $25M supplied | $12M borrowed • WBTC: Supply: XXX% | Borrow: XXX% | $15M supplied | $7.5M borrowed • LINK: Supply: XXX% | Borrow: XXX% | $8M supplied | $3.2M borrowed

▫️Key Takeaway:

Compound V3 is thriving on Unichain, securing nearly $900M in TVL, delivering healthy yields and showing strong user and fee activity.

Risk buffer remain optimal, and protocols are drawing in both blue-chip and defi native assets

▪️Which asset are you supplying or borrowing? See something surprising in the data? Let's talk Compound V3 strategies in the comments.

For live stats, metrics, and DeFi deep-dives, and everything Unichain, follow @unichaindaily

XXX engagements

Related Topics market cap $4513m stablecoins $5686m $8725m momentum metrics surge