[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-21 17:40:00 UTC As noted two weeks ago “we’re now into the meat of the April/May volatility on the 3-mth realized volatility lookback,” which you can see by the sharp drop in the chart of realized volatility, and we’ll continue to drop some big numbers including 2.5, 2.4, 2.0, & XXX% lookback days. That should see the 3-mth lookback realized volatility continue to “to drop like a rock”. The 1-mth lookback though continues to remain much less favorable (although it did drop a bit last week) and will likely not provide much buying power (but would provide selling on a jump in volatility). While we do get two days of X% moves, the other three days are XXX% or less. Regardless, as noted two weeks ago, given the drop we’re going to be seeing in realized volatility at the 3-mth lookback this week, we should be a continued increase in vol control buying absent notably higher volatility.  XXXXX engagements  **Related Topics** [$6753t](/topic/$6753t) [volatility](/topic/volatility) [Post Link](https://x.com/neilksethi/status/1947350862789284001)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 17:40:00 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 17:40:00 UTC

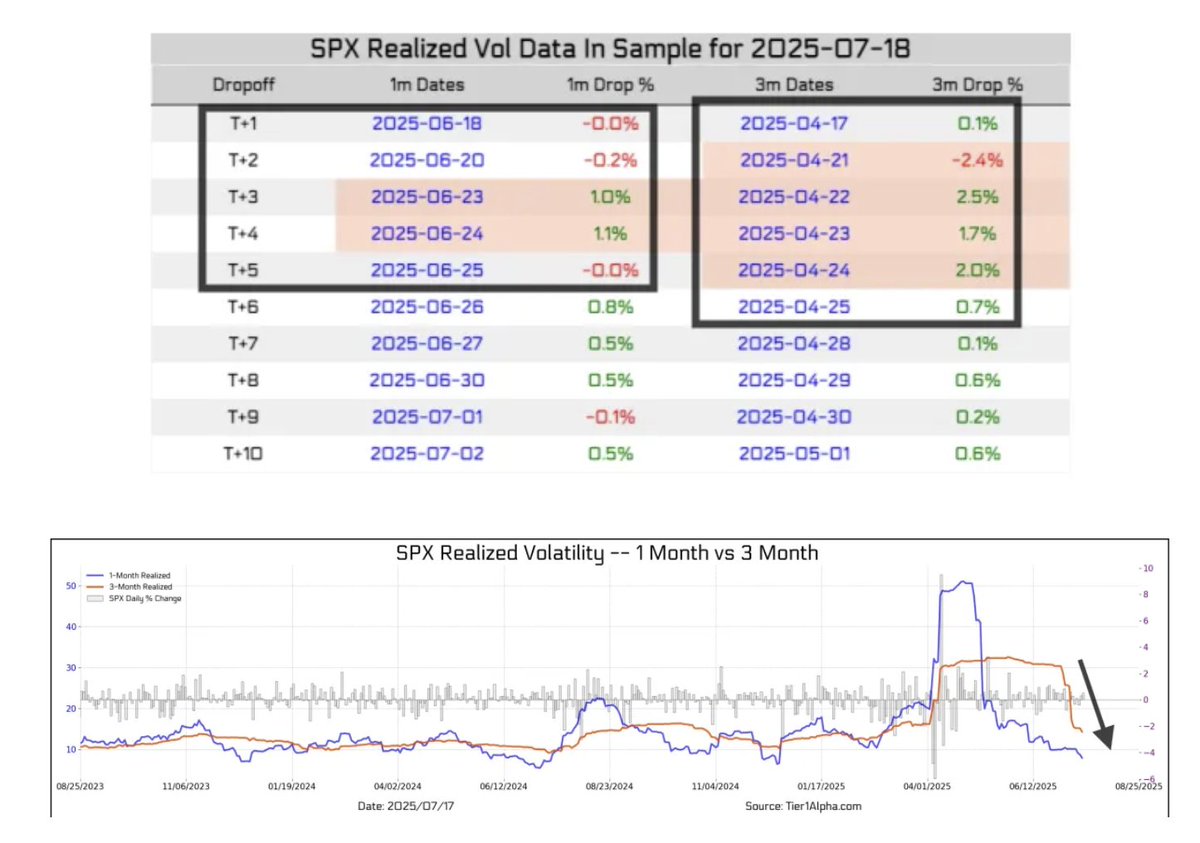

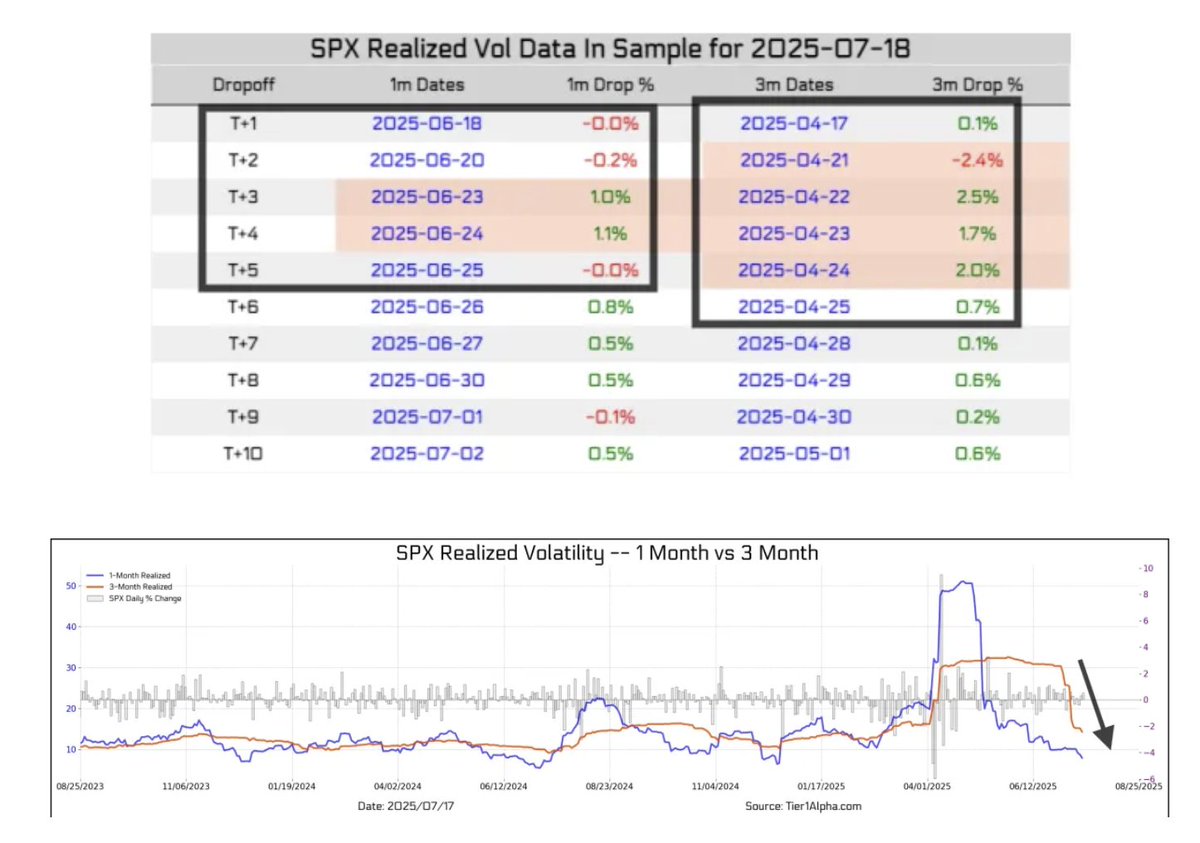

As noted two weeks ago “we’re now into the meat of the April/May volatility on the 3-mth realized volatility lookback,” which you can see by the sharp drop in the chart of realized volatility, and we’ll continue to drop some big numbers including 2.5, 2.4, 2.0, & XXX% lookback days. That should see the 3-mth lookback realized volatility continue to “to drop like a rock”.

The 1-mth lookback though continues to remain much less favorable (although it did drop a bit last week) and will likely not provide much buying power (but would provide selling on a jump in volatility). While we do get two days of X% moves, the other three days are XXX% or less.

Regardless, as noted two weeks ago, given the drop we’re going to be seeing in realized volatility at the 3-mth lookback this week, we should be a continued increase in vol control buying absent notably higher volatility.

XXXXX engagements

Related Topics $6753t volatility