[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-21 13:40:00 UTC “We’re seeing an inflation market pricing a premium around the Fed independence risk,” said Meghan Swiber, a US rates strategist at Bank of America. “Ultimately if you’re putting pressure on the Fed in an environment where unemployment is low and we’re still seeing inflation a far cry from the Fed’s target, you ultimately have the market trading and perceiving more persistent upside risk to the inflation landscape.” “The nightmare scenario is the Fed loses its independence, tariff inflation is big and the fiscal policy turns out to be more simulative ahead of mid-term election, and it’s all happening at the same time,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle. “If the FOMC actually follows Waller’s advice, a backdrop of rising market-based measures of inflation expectations means higher long-term yields are more likely. After the Fed’s first rate cut last year, long-term rates only stopped rising when the Fed stopped cutting the fed funds rate. If the Fed stands pat on rates with one or two dissents, the uncertainty stemming from such a scenario could add to the term premium and raise long-term rates anyway. Ironically, those outcomes would put the Fed under even more pressure from Trump to cut borrowing costs.” -Edward Harrison, BBG macro strategist.  XXXXX engagements  **Related Topics** [neil](/topic/neil) [united states](/topic/united-states) [bank of](/topic/bank-of) [rates](/topic/rates) [fed](/topic/fed) [federal reserve](/topic/federal-reserve) [inflation](/topic/inflation) [bank of america](/topic/bank-of-america) [Post Link](https://x.com/neilksethi/status/1947290465130500185)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 13:40:00 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 13:40:00 UTC

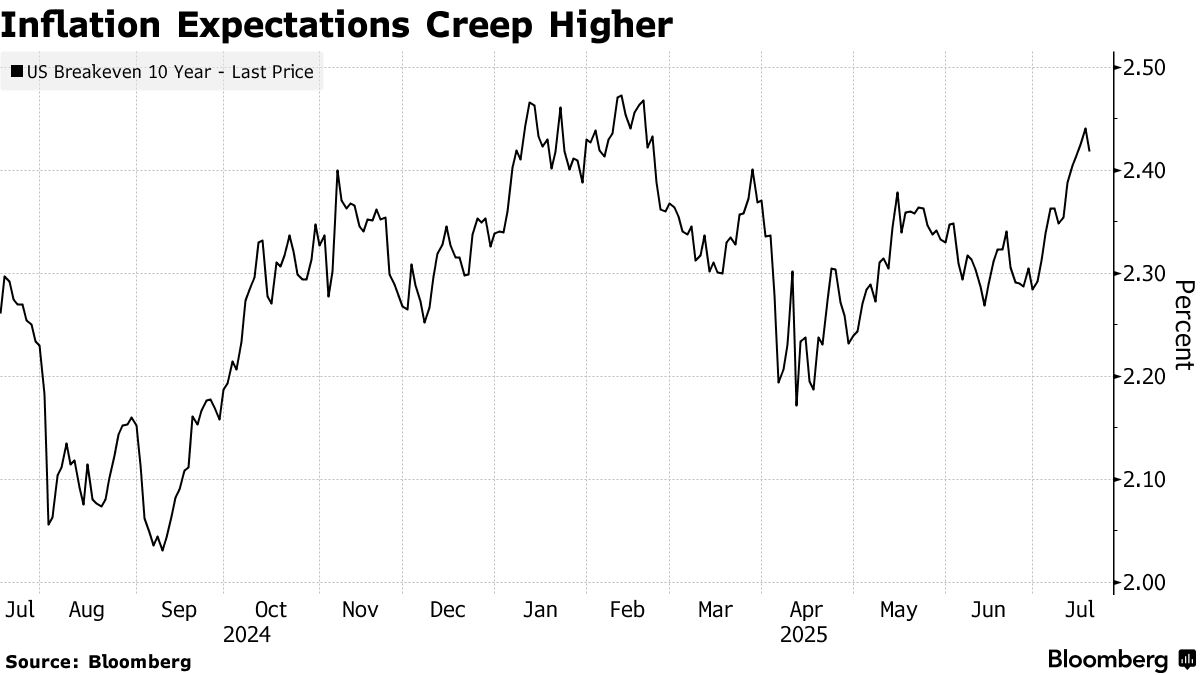

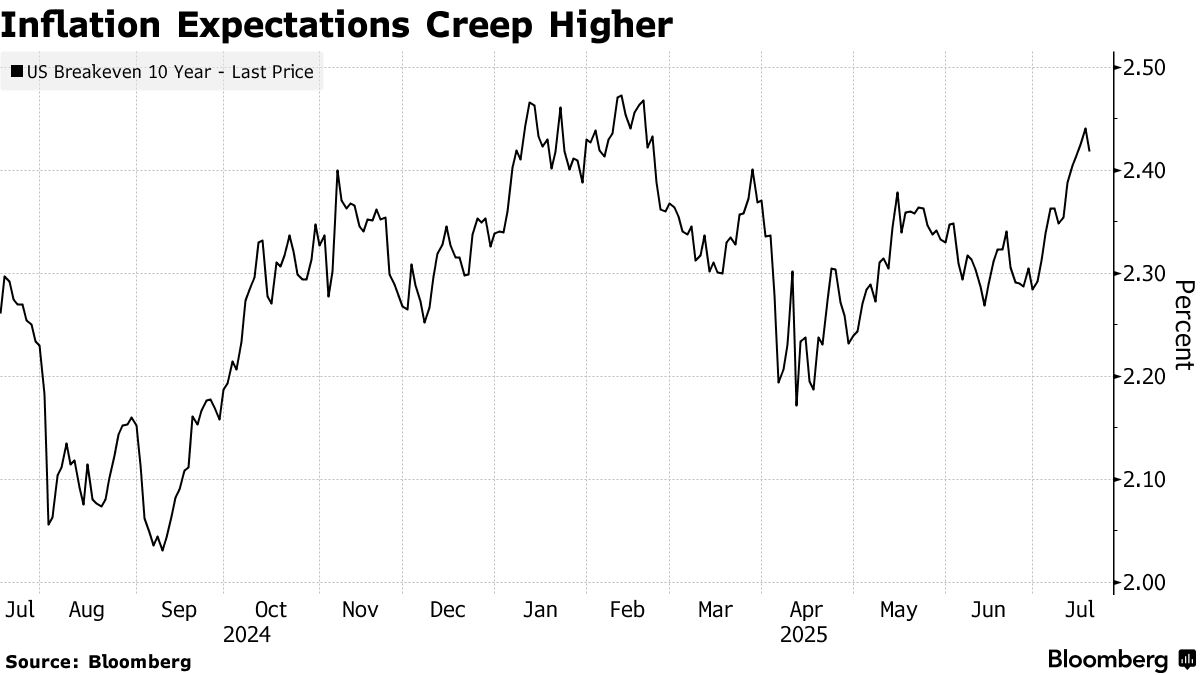

“We’re seeing an inflation market pricing a premium around the Fed independence risk,” said Meghan Swiber, a US rates strategist at Bank of America. “Ultimately if you’re putting pressure on the Fed in an environment where unemployment is low and we’re still seeing inflation a far cry from the Fed’s target, you ultimately have the market trading and perceiving more persistent upside risk to the inflation landscape.”

“The nightmare scenario is the Fed loses its independence, tariff inflation is big and the fiscal policy turns out to be more simulative ahead of mid-term election, and it’s all happening at the same time,” said Ed Al-Hussainy, global rates strategist at Columbia Threadneedle.

“If the FOMC actually follows Waller’s advice, a backdrop of rising market-based measures of inflation expectations means higher long-term yields are more likely. After the Fed’s first rate cut last year, long-term rates only stopped rising when the Fed stopped cutting the fed funds rate. If the Fed stands pat on rates with one or two dissents, the uncertainty stemming from such a scenario could add to the term premium and raise long-term rates anyway. Ironically, those outcomes would put the Fed under even more pressure from Trump to cut borrowing costs.” -Edward Harrison, BBG macro strategist.

XXXXX engagements

Related Topics neil united states bank of rates fed federal reserve inflation bank of america