[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-21 12:21:52 UTC Tier1Alpha who gives a more recent update (this morning) says those strikes are likely resetting in a relatively favorable fashion for equities: Dealers will start the week long gamma, implying the conditions for lower volatility remain firmly in place. That said, following last week's monthly options expiration, overall gamma levels should be at their cyclical lows.... Consequently, a modest uptick in realized volatility is reasonable to expect, though it will likely occur within the context of a broader low-volatility regime. In practice, if we were to see a material rise in volatility from here, it would likely take a slow grind lower as we work our way through the net sold positions, until dealers begin significantly offside around the 6140 strike. Below there, the potential for 2-3% daily moves will start to reemerge as dealers become significantly short gamma. These structural dynamics tend to create the conditions for the typical "slowly, then all at once" breakdowns that we continue to see in modern markets.  XXXXX engagements  **Related Topics** [$26bn](/topic/$26bn) [spx](/topic/spx) [volatility](/topic/volatility) [gamma](/topic/gamma) [stocks](/topic/stocks) [Post Link](https://x.com/neilksethi/status/1947270804326027327)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 12:21:52 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-21 12:21:52 UTC

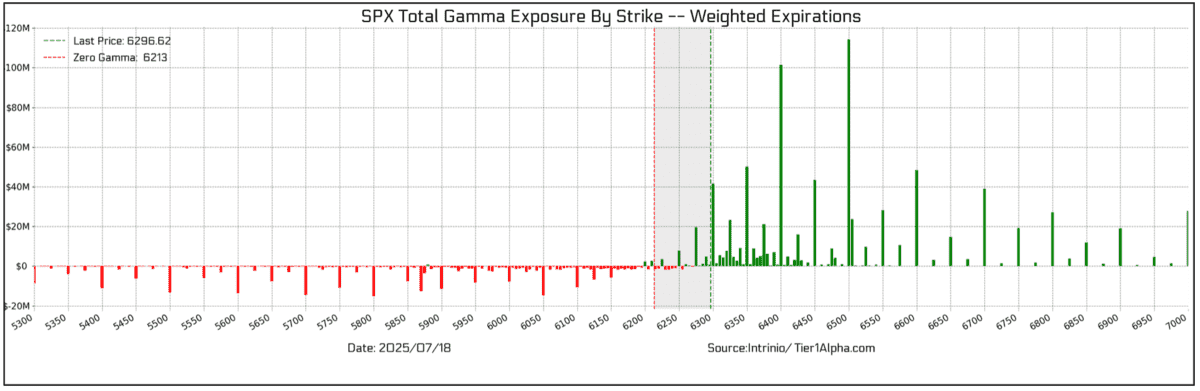

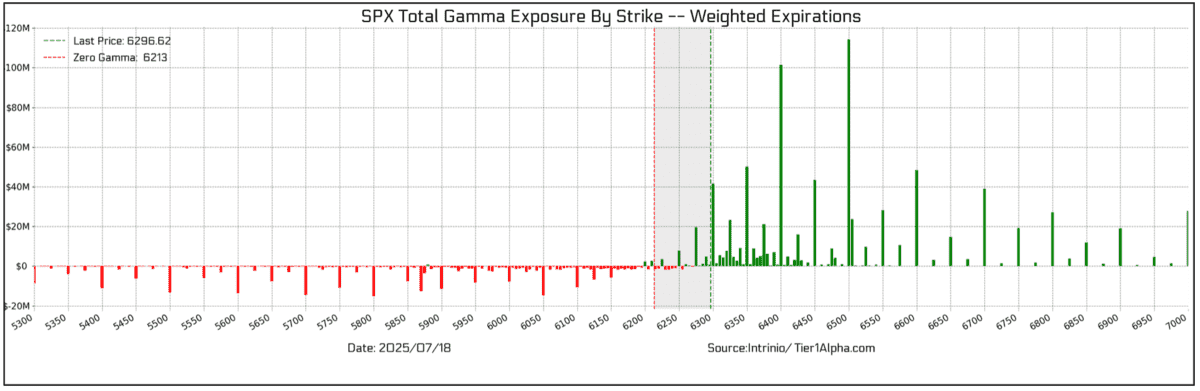

Tier1Alpha who gives a more recent update (this morning) says those strikes are likely resetting in a relatively favorable fashion for equities:

Dealers will start the week long gamma, implying the conditions for lower volatility remain firmly in place. That said, following last week's monthly options expiration, overall gamma levels should be at their cyclical lows.... Consequently, a modest uptick in realized volatility is reasonable to expect, though it will likely occur within the context of a broader low-volatility regime.

In practice, if we were to see a material rise in volatility from here, it would likely take a slow grind lower as we work our way through the net sold positions, until dealers begin significantly offside around the 6140 strike. Below there, the potential for 2-3% daily moves will start to reemerge as dealers become significantly short gamma. These structural dynamics tend to create the conditions for the typical "slowly, then all at once" breakdowns that we continue to see in modern markets.

XXXXX engagements

Related Topics $26bn spx volatility gamma stocks