[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Martin Bradstreet [@ALEXEIMARTOV](/creator/twitter/ALEXEIMARTOV) on x 1918 followers Created: 2025-07-20 23:40:11 UTC 7/20/25 Portfolio Update and thoughts going into the week Longs (140.4%) $9984.T XXXX% $7808.T XXX% $GOOG XXX% $U XXX% $BATS XXX% $4374.T XXX% $GENI XXX% $KSPI XXX% $MGA XXX% $9312.T XXX% $BIDU XXX% $DLO XXX% $MRVL XXX% $NVCR 260116C00020000 XXX% $IGIC XXX% $DHI XXX% $9468.T XXX% Shorts (-60.7%) Cash XXXX% Top Shorts: $EWJ XXX% $U 260116C00040000 XXX% $RBLX XXX% $ARKK XXX% $TEM XXX% $CTAS XXX% $WMT XXX% $TSLA XXX% $MNDY XXX% $IBM XXX% Overall i've been a bit more diversified than I am usually and sitting at XX% long. Still pretty scared of the market overall, my base case is just AI super growth, everything else pretty mediocre, but so far at least it seems like the economy is holding up. Last week $U went absolutely nuts - a company i'm very familiar with (having run a video game studio) and have been in since $XX (sold half oops). I think their prospects are better than ever but to me, too much too fast, so i hedged the entire position by selling $XX Jan 2026 calls for $XXXX. I just don't see it, its already a little over its skis, and i'd be happy with $XXXXX a share in Jan. This was much better than just selling the shares in 2025. Hopefully the options just expire worthless and then i can hang onto the rest of the position long term, but if we have to close it out so be it. Japan opening soon, though nothing too crazy here. I do wonder if i should maybe pile more into 4374, but i haven't done the obsessive work i would need to do to justify averaging up here. I just know its at least as good a spot as when i bought it. Anything on your mind going into this week?  XXX engagements  **Related Topics** [rblx](/topic/rblx) [goog](/topic/goog) [$rblx](/topic/$rblx) [$ewj](/topic/$ewj) [$9468t](/topic/$9468t) [$dhi](/topic/$dhi) [$igic](/topic/$igic) [$mrvl](/topic/$mrvl) [Post Link](https://x.com/ALEXEIMARTOV/status/1947079119768084985)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Martin Bradstreet @ALEXEIMARTOV on x 1918 followers

Created: 2025-07-20 23:40:11 UTC

Martin Bradstreet @ALEXEIMARTOV on x 1918 followers

Created: 2025-07-20 23:40:11 UTC

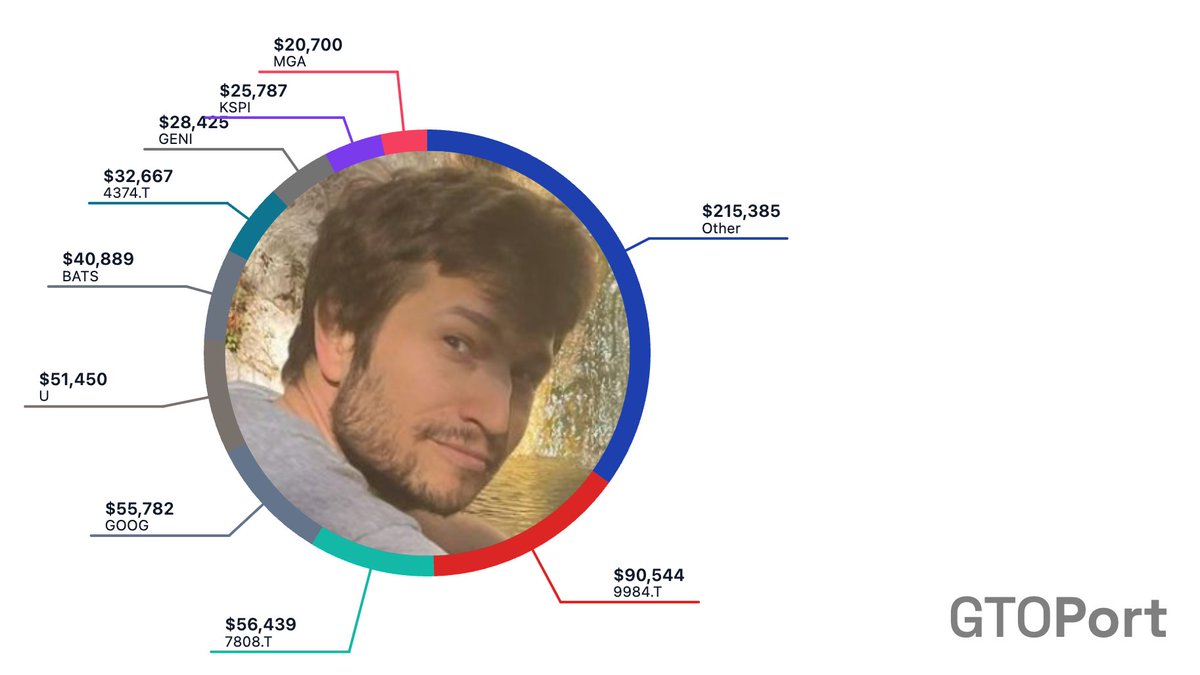

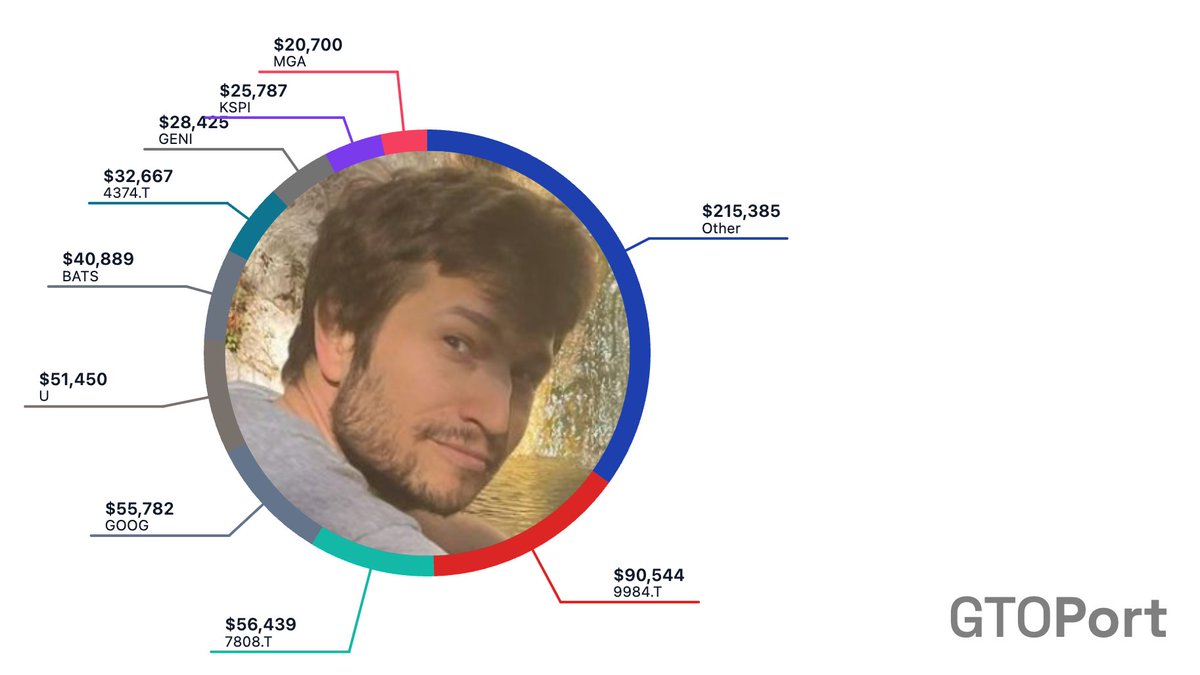

7/20/25 Portfolio Update and thoughts going into the week Longs (140.4%) $9984.T XXXX% $7808.T XXX% $GOOG XXX% $U XXX% $BATS XXX% $4374.T XXX% $GENI XXX% $KSPI XXX% $MGA XXX% $9312.T XXX% $BIDU XXX% $DLO XXX% $MRVL XXX% $NVCR 260116C00020000 XXX% $IGIC XXX% $DHI XXX% $9468.T XXX%

Shorts (-60.7%)

Cash XXXX%

Top Shorts: $EWJ XXX% $U 260116C00040000 XXX% $RBLX XXX% $ARKK XXX% $TEM XXX% $CTAS XXX% $WMT XXX% $TSLA XXX% $MNDY XXX% $IBM XXX%

Overall i've been a bit more diversified than I am usually and sitting at XX% long. Still pretty scared of the market overall, my base case is just AI super growth, everything else pretty mediocre, but so far at least it seems like the economy is holding up.

Last week $U went absolutely nuts - a company i'm very familiar with (having run a video game studio) and have been in since $XX (sold half oops). I think their prospects are better than ever but to me, too much too fast, so i hedged the entire position by selling $XX Jan 2026 calls for $XXXX. I just don't see it, its already a little over its skis, and i'd be happy with $XXXXX a share in Jan. This was much better than just selling the shares in 2025. Hopefully the options just expire worthless and then i can hang onto the rest of the position long term, but if we have to close it out so be it.

Japan opening soon, though nothing too crazy here. I do wonder if i should maybe pile more into 4374, but i haven't done the obsessive work i would need to do to justify averaging up here. I just know its at least as good a spot as when i bought it.

Anything on your mind going into this week?

XXX engagements