[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.3K followers Created: 2025-07-20 13:20:00 UTC Barclays: Our baseline outlook is roughly in line with the implications of simple Taylor-type rules that express the federal funds rate as a function of core PCE inflation, the unemployment rate, an estimate of the neutral real interest rate, and, in the case of the inertial Taylor rule, the prior month's federal funds rate. According to these rules, the current level of policy rates (shown in black in Figure 6) is not particularly elevated. So, regardless of who is the FOMC chair, we think that the rest of the FOMC will likely find little reason to lower rates more rapidly than indicated here, unless they fear a sharp deterioration in labor market conditions.  XXXXX engagements  **Related Topics** [rates](/topic/rates) [fed rate](/topic/fed-rate) [gdp growth](/topic/gdp-growth) [inflation](/topic/inflation) [$barcl](/topic/$barcl) [neil](/topic/neil) [Post Link](https://x.com/neilksethi/status/1946923044217446899)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.3K followers

Created: 2025-07-20 13:20:00 UTC

Neil Sethi @neilksethi on x 12.3K followers

Created: 2025-07-20 13:20:00 UTC

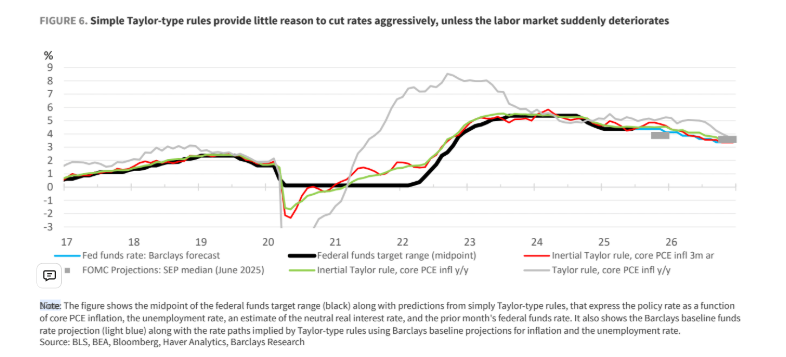

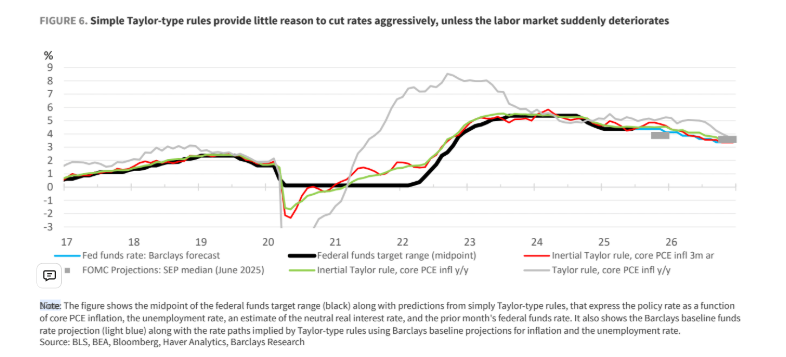

Barclays: Our baseline outlook is roughly in line with the implications of simple Taylor-type rules that express the federal funds rate as a function of core PCE inflation, the unemployment rate, an estimate of the neutral real interest rate, and, in the case of the inertial Taylor rule, the prior month's federal funds rate. According to these rules, the current level of policy rates (shown in black in Figure 6) is not particularly elevated.

So, regardless of who is the FOMC chair, we think that the rest of the FOMC will likely find little reason to lower rates more rapidly than indicated here, unless they fear a sharp deterioration in labor market conditions.

XXXXX engagements

Related Topics rates fed rate gdp growth inflation $barcl neil