[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Stuart A. Brown [@StuOnGold](/creator/twitter/StuOnGold) on x 8965 followers Created: 2025-07-19 22:30:56 UTC THE CAMPBELL'S COMPANY $CPB had unusual volume of 8.24M shares 7/10. The current trading volume is XXXXX% above the average 50-day volume. This indicates a significant deviation from the average trading activity. In 2017, it completed its $XXX million acquisition of Pacific Foods of Oregon -- expanding its portfolio of soups, broths, & plant-based beverages. In 2018, Campbell's bought Snyder's-Lance for a whopping $XXX billion -- which was a play in snacks like pretzels, chips, & cookies. It then bought Sovos Brands for $XXX billion in 2024 -- which gave Campbell's a variety of pasta sauces, dry pasta, frozen entrées & pizzas, and yogurt products. Combined, these three acquisitions amount to $XXX billion -- which is more than Campbell's market cap at the time of this writing of $XXX billion. So, in hindsight, Campbell's clearly overpaid for these brands. Campbell's has struggled to convert these acquisitions into high-margin sales growth. In fact, its earnings & operating margin are around 5-year lows. The good news is that Campbell's still generates a ton of free cash flow, which more than covers its sizable dividend (yielding 5.1%). Campbell's stock is beyond cheap -- with a XXXX forward price-to-earnings (P/E) ratio compared to a 10-year median P/E of XXXX. Add it all up, and now is an incredible opportunity for investors who believe Campbell's can turn its business around to scoop up shares of the packaged food giant. Note: historic high volume on 7/10 forming a bullish hammer candlestick. ~Motley Fool  XXXXX engagements  **Related Topics** [beverages](/topic/beverages) [pacific](/topic/pacific) [acquisition](/topic/acquisition) [stocks](/topic/stocks) [$cpb](/topic/$cpb) [stocks consumer defensive](/topic/stocks-consumer-defensive) [Post Link](https://x.com/StuOnGold/status/1946699302325358799)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Stuart A. Brown @StuOnGold on x 8965 followers

Created: 2025-07-19 22:30:56 UTC

Stuart A. Brown @StuOnGold on x 8965 followers

Created: 2025-07-19 22:30:56 UTC

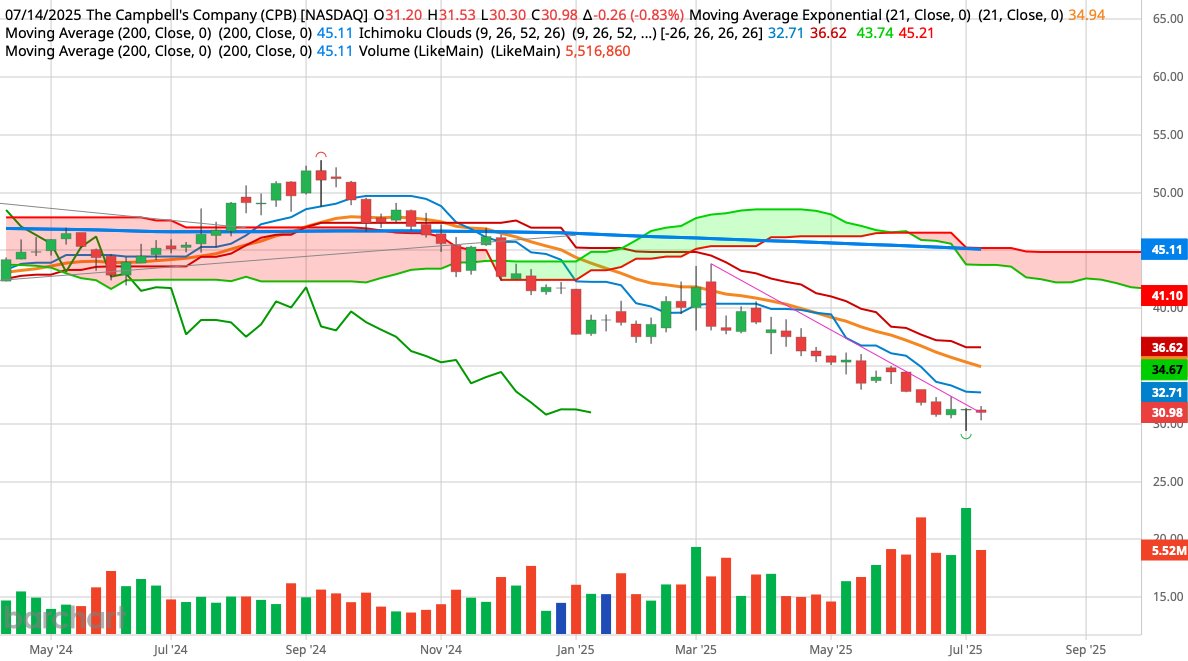

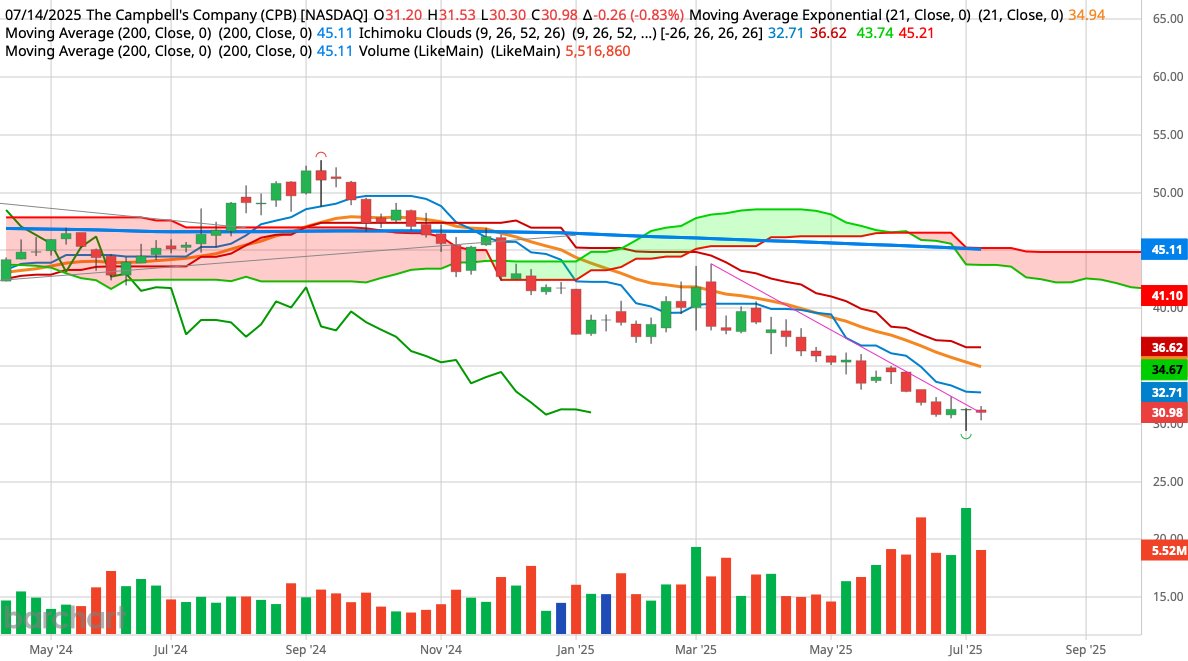

THE CAMPBELL'S COMPANY $CPB had unusual volume of 8.24M shares 7/10. The current trading volume is XXXXX% above the average 50-day volume. This indicates a significant deviation from the average trading activity. In 2017, it completed its $XXX million acquisition of Pacific Foods of Oregon -- expanding its portfolio of soups, broths, & plant-based beverages. In 2018, Campbell's bought Snyder's-Lance for a whopping $XXX billion -- which was a play in snacks like pretzels, chips, & cookies. It then bought Sovos Brands for $XXX billion in 2024 -- which gave Campbell's a variety of pasta sauces, dry pasta, frozen entrées & pizzas, and yogurt products. Combined, these three acquisitions amount to $XXX billion -- which is more than Campbell's market cap at the time of this writing of $XXX billion. So, in hindsight, Campbell's clearly overpaid for these brands.

Campbell's has struggled to convert these acquisitions into high-margin sales growth. In fact, its earnings & operating margin are around 5-year lows. The good news is that Campbell's still generates a ton of free cash flow, which more than covers its sizable dividend (yielding 5.1%).

Campbell's stock is beyond cheap -- with a XXXX forward price-to-earnings (P/E) ratio compared to a 10-year median P/E of XXXX.

Add it all up, and now is an incredible opportunity for investors who believe Campbell's can turn its business around to scoop up shares of the packaged food giant. Note: historic high volume on 7/10 forming a bullish hammer candlestick. ~Motley Fool

XXXXX engagements

Related Topics beverages pacific acquisition stocks $cpb stocks consumer defensive