[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.3K followers Created: 2025-07-19 17:40:00 UTC The upside to the 60/40 portfolio has been in drawdowns says Morningstar: The table shows how all stock market declines and 60/40 portfolio declines of the past XXX years compare with the worst downturn since 1870—the stock market crash of the Great Depression. That is, the stock market crash during the Great Depression has a “pain relative to worst historical loss” of 100%. And during this same period, a 60/40 portfolio only has a “pain relative to worst historical loss” of 23%. So because the 60/40 portfolio declined XX% versus the stock market’s XX% (and because it recovered to its previous high so much faster), investors who held the 60/40 portfolio only experienced about a fourth of the pain that those who held all stocks did. As you can see, the 60/40 portfolio experienced less pain than the stock market during nearly every market crash of the past XXX years. In aggregate, a 60/40 portfolio experienced XX% less pain than an all-equities portfolio during the stock market crashes of the past XXX years. Interestingly, there was only one period that saw more pain for the 60/40 portfolio than for the stock market—the period we’re in now.  XXXXX engagements  **Related Topics** [inflation](/topic/inflation) [economic uncertainty](/topic/economic-uncertainty) [stocks](/topic/stocks) [neil](/topic/neil) [Post Link](https://x.com/neilksethi/status/1946626087749890138)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.3K followers

Created: 2025-07-19 17:40:00 UTC

Neil Sethi @neilksethi on x 12.3K followers

Created: 2025-07-19 17:40:00 UTC

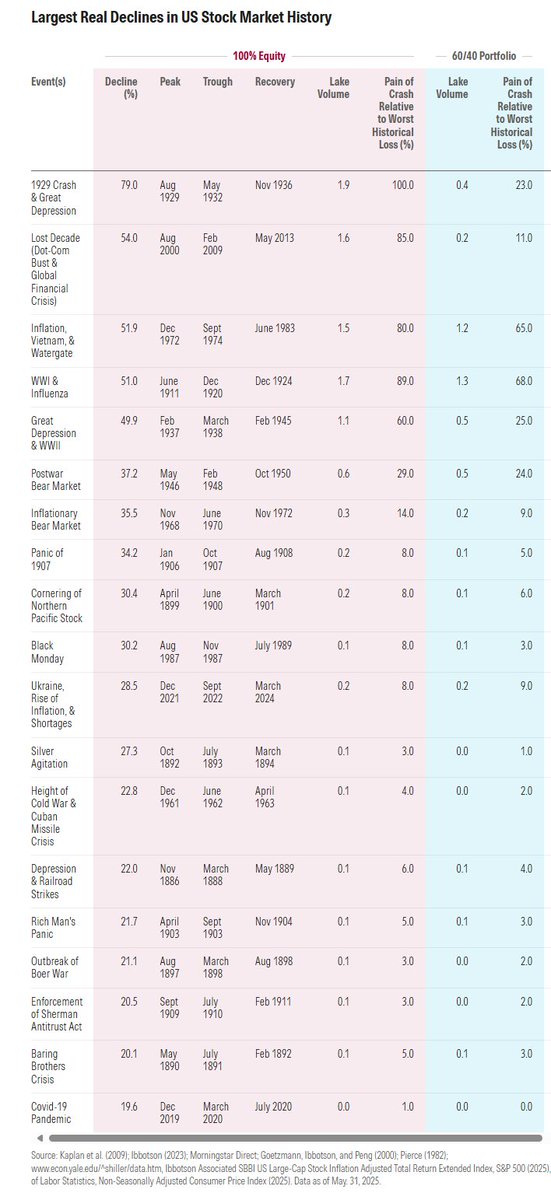

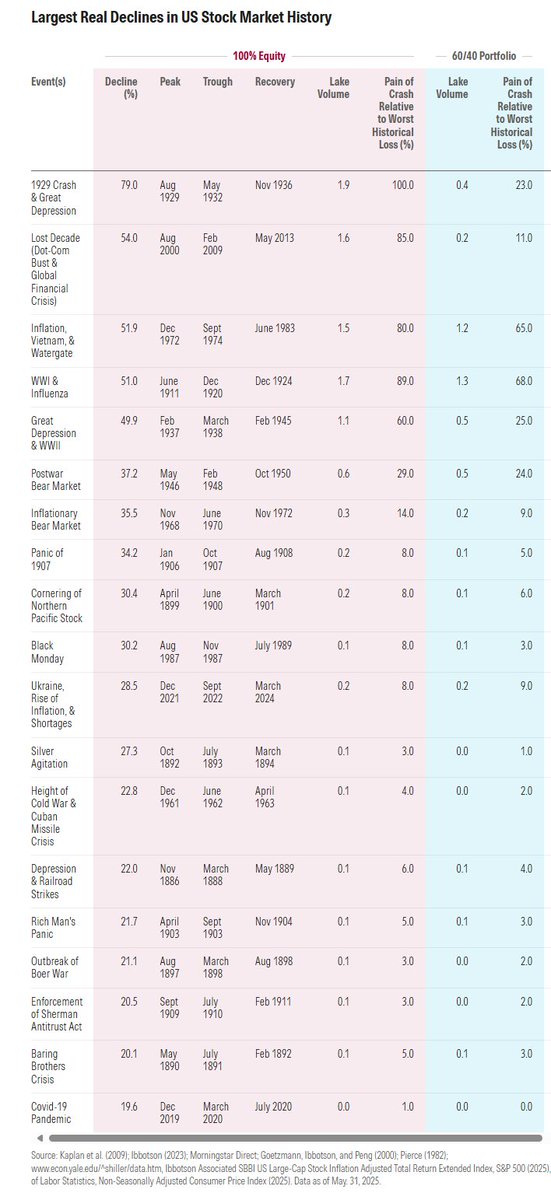

The upside to the 60/40 portfolio has been in drawdowns says Morningstar:

The table shows how all stock market declines and 60/40 portfolio declines of the past XXX years compare with the worst downturn since 1870—the stock market crash of the Great Depression.

That is, the stock market crash during the Great Depression has a “pain relative to worst historical loss” of 100%. And during this same period, a 60/40 portfolio only has a “pain relative to worst historical loss” of 23%. So because the 60/40 portfolio declined XX% versus the stock market’s XX% (and because it recovered to its previous high so much faster), investors who held the 60/40 portfolio only experienced about a fourth of the pain that those who held all stocks did.

As you can see, the 60/40 portfolio experienced less pain than the stock market during nearly every market crash of the past XXX years. In aggregate, a 60/40 portfolio experienced XX% less pain than an all-equities portfolio during the stock market crashes of the past XXX years.

Interestingly, there was only one period that saw more pain for the 60/40 portfolio than for the stock market—the period we’re in now.

XXXXX engagements

Related Topics inflation economic uncertainty stocks neil