[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Baatein Stock Ki [@BaateinStockKi](/creator/twitter/BaateinStockKi) on x 2585 followers Created: 2025-07-19 16:42:05 UTC 🚨 HDFC Bank Q1 FY26 Results: Strong All-Round Show 💼 #HDFCBank #Q1Results #Banking 1️⃣ Net Profit: ₹18,155 Cr (+12.2% YoY) – beats street estimates 2️⃣ Net Interest Income (NII): ₹31,438 Cr (+5.4% YoY) • Margins at ~3.35% vs XXXX% YoY 3️⃣ Other Income: ₹21,729 Cr (2x YoY) • Includes ₹9,128 Cr gain from HDB stake sale 4️⃣ Provisions: ₹14,442 Cr (5x YoY) – mostly contingent buffers 5️⃣ Loan & Deposit Growth: • Loans: ₹26.53L Cr (+6.7% YoY) • Deposits: ₹27.64L Cr (+1.8% QoQ) • CASA: XXXX% 6️⃣ Operating Metrics: • OpEx: ₹17,434 Cr (+4.9%) • Cost-to-income: XXXX% 7️⃣ Capital & Asset Quality: • CAR: XXXXX% • No material stress in asset book 8️⃣ Shareholder Rewards: • 1:1 Bonus Issue • ₹5/share Special Interim Dividend • Record date: July 25, payout by Aug XX 🧠 Bottom Line: Strong profit, cautious provisioning, healthy asset quality & first-ever bonus issue signal confidence. Margins under watch, but core fundamentals remain solid. #HDFCBankResults #BonusIssue #Dividend #BankingStocks  XXXXX engagements  **Related Topics** [banking](/topic/banking) [2x](/topic/2x) [$hdb](/topic/$hdb) [$hdfcbankns](/topic/$hdfcbankns) [stocks financial services](/topic/stocks-financial-services) [stocks banks](/topic/stocks-banks) [Post Link](https://x.com/BaateinStockKi/status/1946611514376638945)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Baatein Stock Ki @BaateinStockKi on x 2585 followers

Created: 2025-07-19 16:42:05 UTC

Baatein Stock Ki @BaateinStockKi on x 2585 followers

Created: 2025-07-19 16:42:05 UTC

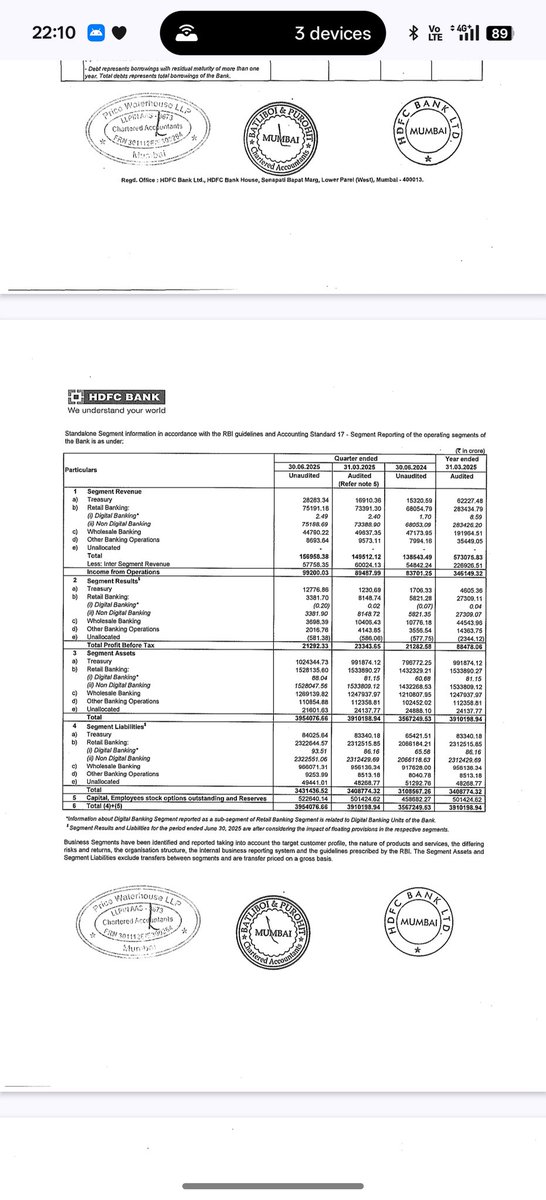

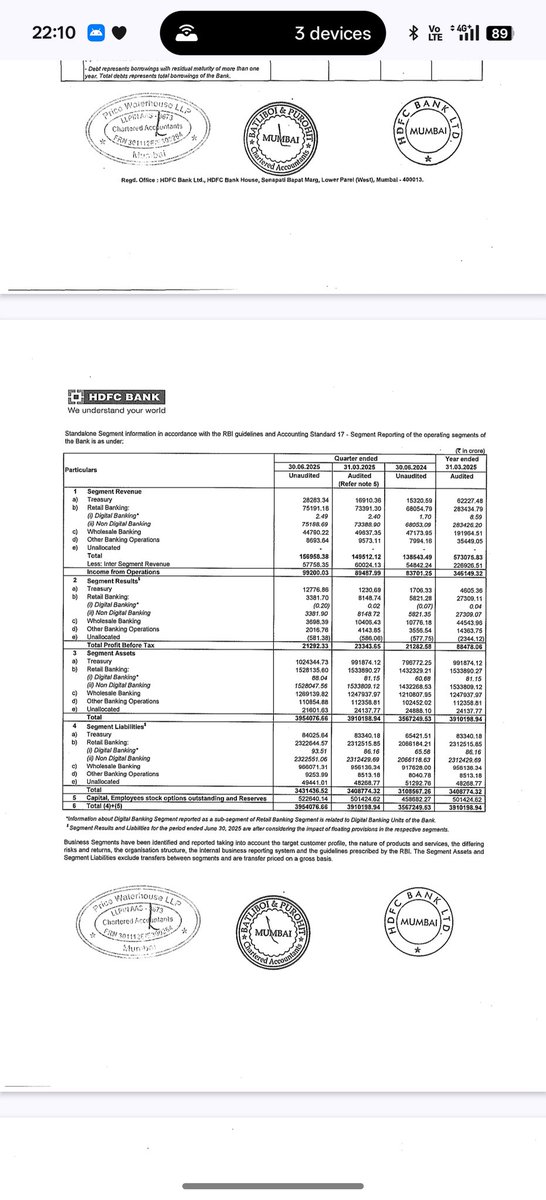

🚨 HDFC Bank Q1 FY26 Results: Strong All-Round Show 💼

#HDFCBank #Q1Results #Banking

1️⃣ Net Profit: ₹18,155 Cr (+12.2% YoY) – beats street estimates 2️⃣ Net Interest Income (NII): ₹31,438 Cr (+5.4% YoY) • Margins at ~3.35% vs XXXX% YoY

3️⃣ Other Income: ₹21,729 Cr (2x YoY) • Includes ₹9,128 Cr gain from HDB stake sale

4️⃣ Provisions: ₹14,442 Cr (5x YoY) – mostly contingent buffers

5️⃣ Loan & Deposit Growth: • Loans: ₹26.53L Cr (+6.7% YoY) • Deposits: ₹27.64L Cr (+1.8% QoQ) • CASA: XXXX%

6️⃣ Operating Metrics: • OpEx: ₹17,434 Cr (+4.9%) • Cost-to-income: XXXX%

7️⃣ Capital & Asset Quality: • CAR: XXXXX% • No material stress in asset book

8️⃣ Shareholder Rewards: • 1:1 Bonus Issue • ₹5/share Special Interim Dividend • Record date: July 25, payout by Aug XX

🧠 Bottom Line: Strong profit, cautious provisioning, healthy asset quality & first-ever bonus issue signal confidence. Margins under watch, but core fundamentals remain solid.

#HDFCBankResults #BonusIssue #Dividend #BankingStocks

XXXXX engagements

Related Topics banking 2x $hdb $hdfcbankns stocks financial services stocks banks