[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Wealth Counter - NISM Certified RA (Stock Market) [@Wealth_Counter](/creator/twitter/Wealth_Counter) on x 4161 followers Created: 2025-07-19 09:35:51 UTC ICICI Bank – #ICICIBank QoQ: Muted | YoY: Good Steady financial delivery backed by solid retail and treasury income, with healthy YoY growth in interest and net profit. Asset quality remained stable and core operating metrics reflected strong underlying performance despite sequential softness. Interest Earned: XXXXXX (QoQ: +1.4%, YoY: +10.1%) Financing Profit: -XXXXX (QoQ: -51.0%, YoY: flat) Financing Margin: -XXXX% (QoQ: +13.2 pp, YoY: +1.2 pp) Net Profit: XXXXXX (QoQ: +0.7%, YoY: +16.0%) Gross NPA: XXX% (QoQ: +33 bps, YoY: -XX bps) Net NPA: XXXX% (QoQ: +2 bps, YoY: -X bps) Provisions: XXXXX (QoQ: +104.7%, YoY: +36.8%) Segment-wise summary Retail Banking QoQ: Muted | YoY: Good Stable sequentially, while showing healthy growth on YoY basis led by volume uptick. Revenue: XXXXXX (QoQ: -0.4%, YoY: +8.2%) Wholesale Banking QoQ: Muted | YoY: Good Largely steady QoQ; YoY uptick likely aided by improved corporate credit momentum. Revenue: XXXXXX (QoQ: -0.4%, YoY: +10.6%) Treasury QoQ: Good | YoY: Good Healthy sequential and annual growth, possibly benefiting from higher yields or trading gains. Revenue: XXXXXX (QoQ: +6.3%, YoY: +13.2%) Other Banking QoQ: Good | YoY: Good Strong YoY and QoQ jump, albeit on a low base; possibly fee-based growth. Revenue: XXXXX (QoQ: +19.8%, YoY: +41.1%) Life Insurance QoQ: Poor | YoY: Good Sharp QoQ drop, but YoY growth remains solid. Needs monitoring. Revenue: XXXXXX (QoQ: -37.9%, YoY: +6.5%) General Insurance QoQ: Ok | YoY: Ok Moderate pickup seen both QoQ and YoY, likely supported by stable underwriting. Revenue: XXXXX (QoQ: +6.7%, YoY: +11.7%) Others QoQ: Good | YoY: Good Consistent growth both sequentially and annually; possible support from fintech or allied services. Revenue: XXXXX (QoQ: +13.3%, YoY: +18.9%)  XXXXX engagements  **Related Topics** [metrics](/topic/metrics) [stocks](/topic/stocks) [alternative investment](/topic/alternative-investment) [$ibn](/topic/$ibn) [$icicibankns](/topic/$icicibankns) [stocks financial services](/topic/stocks-financial-services) [stocks banks](/topic/stocks-banks) [Post Link](https://x.com/Wealth_Counter/status/1946504248025366694)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Wealth Counter - NISM Certified RA (Stock Market) @Wealth_Counter on x 4161 followers

Created: 2025-07-19 09:35:51 UTC

Wealth Counter - NISM Certified RA (Stock Market) @Wealth_Counter on x 4161 followers

Created: 2025-07-19 09:35:51 UTC

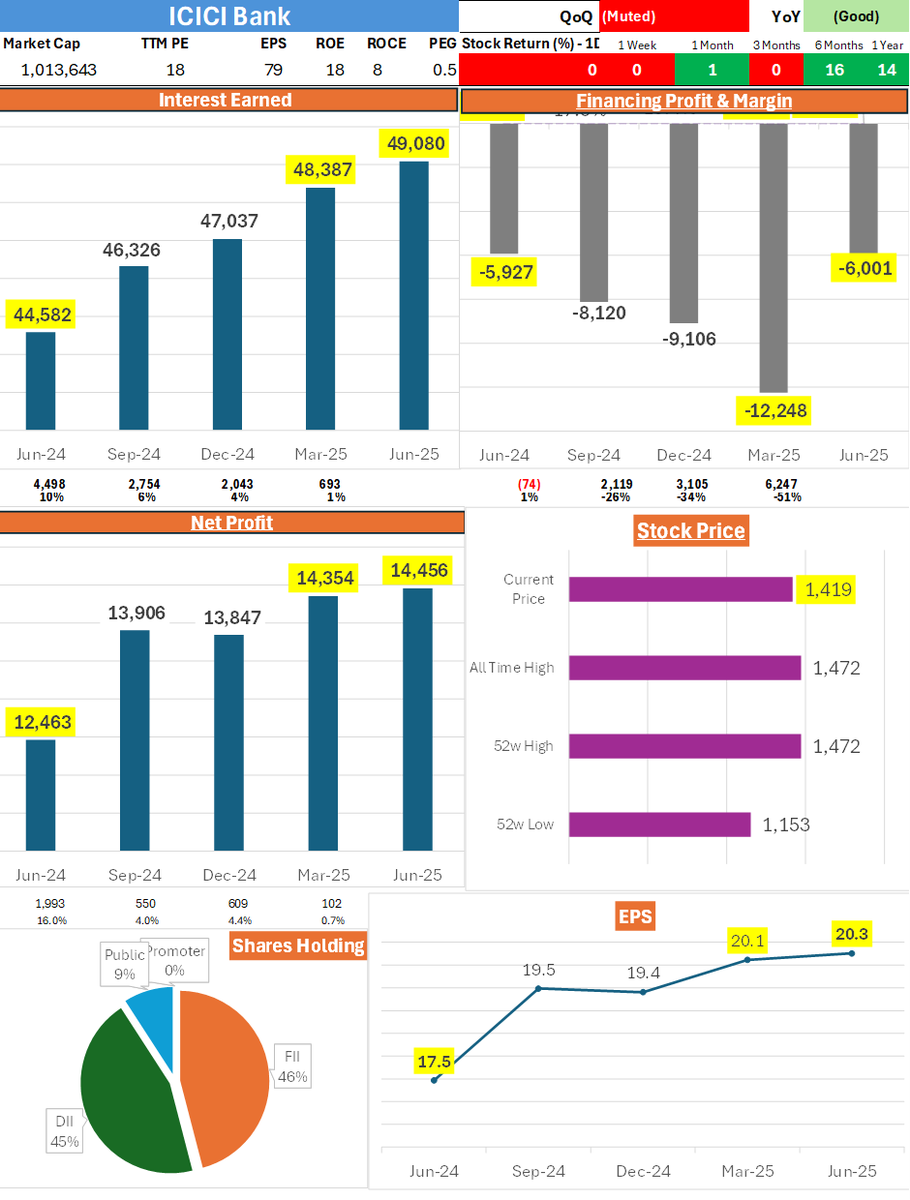

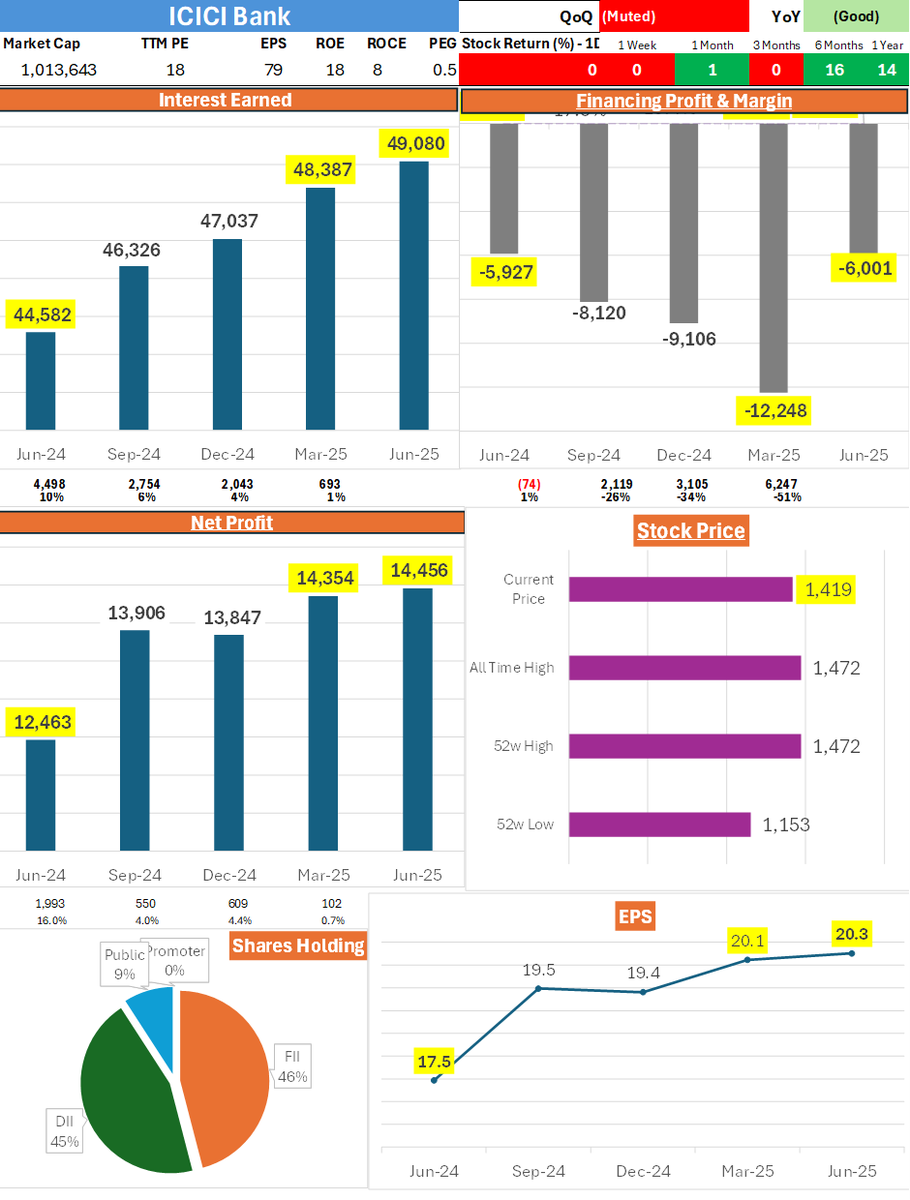

ICICI Bank – #ICICIBank QoQ: Muted | YoY: Good

Steady financial delivery backed by solid retail and treasury income, with healthy YoY growth in interest and net profit. Asset quality remained stable and core operating metrics reflected strong underlying performance despite sequential softness.

Interest Earned: XXXXXX (QoQ: +1.4%, YoY: +10.1%) Financing Profit: -XXXXX (QoQ: -51.0%, YoY: flat) Financing Margin: -XXXX% (QoQ: +13.2 pp, YoY: +1.2 pp) Net Profit: XXXXXX (QoQ: +0.7%, YoY: +16.0%)

Gross NPA: XXX% (QoQ: +33 bps, YoY: -XX bps) Net NPA: XXXX% (QoQ: +2 bps, YoY: -X bps) Provisions: XXXXX (QoQ: +104.7%, YoY: +36.8%)

Segment-wise summary

Retail Banking QoQ: Muted | YoY: Good Stable sequentially, while showing healthy growth on YoY basis led by volume uptick. Revenue: XXXXXX (QoQ: -0.4%, YoY: +8.2%)

Wholesale Banking QoQ: Muted | YoY: Good Largely steady QoQ; YoY uptick likely aided by improved corporate credit momentum.

Revenue: XXXXXX (QoQ: -0.4%, YoY: +10.6%) Treasury QoQ: Good | YoY: Good Healthy sequential and annual growth, possibly benefiting from higher yields or trading gains. Revenue: XXXXXX (QoQ: +6.3%, YoY: +13.2%)

Other Banking QoQ: Good | YoY: Good Strong YoY and QoQ jump, albeit on a low base; possibly fee-based growth. Revenue: XXXXX (QoQ: +19.8%, YoY: +41.1%) Life Insurance QoQ: Poor | YoY: Good Sharp QoQ drop, but YoY growth remains solid. Needs monitoring. Revenue: XXXXXX (QoQ: -37.9%, YoY: +6.5%)

General Insurance QoQ: Ok | YoY: Ok Moderate pickup seen both QoQ and YoY, likely supported by stable underwriting. Revenue: XXXXX (QoQ: +6.7%, YoY: +11.7%)

Others QoQ: Good | YoY: Good Consistent growth both sequentially and annually; possible support from fintech or allied services. Revenue: XXXXX (QoQ: +13.3%, YoY: +18.9%)

XXXXX engagements

Related Topics metrics stocks alternative investment $ibn $icicibankns stocks financial services stocks banks