[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dan Gray [@credistick](/creator/twitter/credistick) on x 5364 followers Created: 2025-07-18 11:56:04 UTC What does it mean if you see VCs and their portfolio company founders arguing about politics? It may be more of a positive signal than you think, according to research on how political preferences warp investment behavior in venture capital. VC partners are approximately XX% more likely to invest in founders with 'co-partisan' political views, which produces a drag on investment performance. "VC partners are more likely to invest in startups managed by co-partisan CEOs, with stronger effects among donor voters and during election years. Co-partisan investments underperform relative to non-co-partisan deals made by the same VC partners, with higher bankruptcy rates, fewer follow-on investments, and lower round-to-exit multiples. In addition, VC partners are less likely to replace co-partisan CEOs, even when the startup company strongly underperforms." (source: "The Politics of Venture Capital Investment") The paper uses a linked dataset that includes XXXXXX partner–CEO pairs, covering XXXXX startups, XXXXX VC firms, and XXXXX individual VC partners, based on Pitchbook deal data from 2020 to 2023. It also controls for factors like demographics, location, and industry The idea that VCs might bias toward founders with shared attributes is nothing new, and has been studied in the past in relation to more typical characteristics of diversity: "Even though the desire to associate with similar people—a tendency academics call homophily—can bring social benefits to those who exhibit it, including a sense of shared culture and belonging, it can also lead investors and firms to leave a lot of money on the table." (source: "The Other Diversity Dividend") In both cases, perhaps obviously, these factors have a negative influence in investing decisions, erroding the objectivity of VC partners.  XXXXX engagements  **Related Topics** [investment](/topic/investment) [private equity](/topic/private-equity) [vcs](/topic/vcs) [Post Link](https://x.com/credistick/status/1946177145010618713)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dan Gray @credistick on x 5364 followers

Created: 2025-07-18 11:56:04 UTC

Dan Gray @credistick on x 5364 followers

Created: 2025-07-18 11:56:04 UTC

What does it mean if you see VCs and their portfolio company founders arguing about politics?

It may be more of a positive signal than you think, according to research on how political preferences warp investment behavior in venture capital.

VC partners are approximately XX% more likely to invest in founders with 'co-partisan' political views, which produces a drag on investment performance.

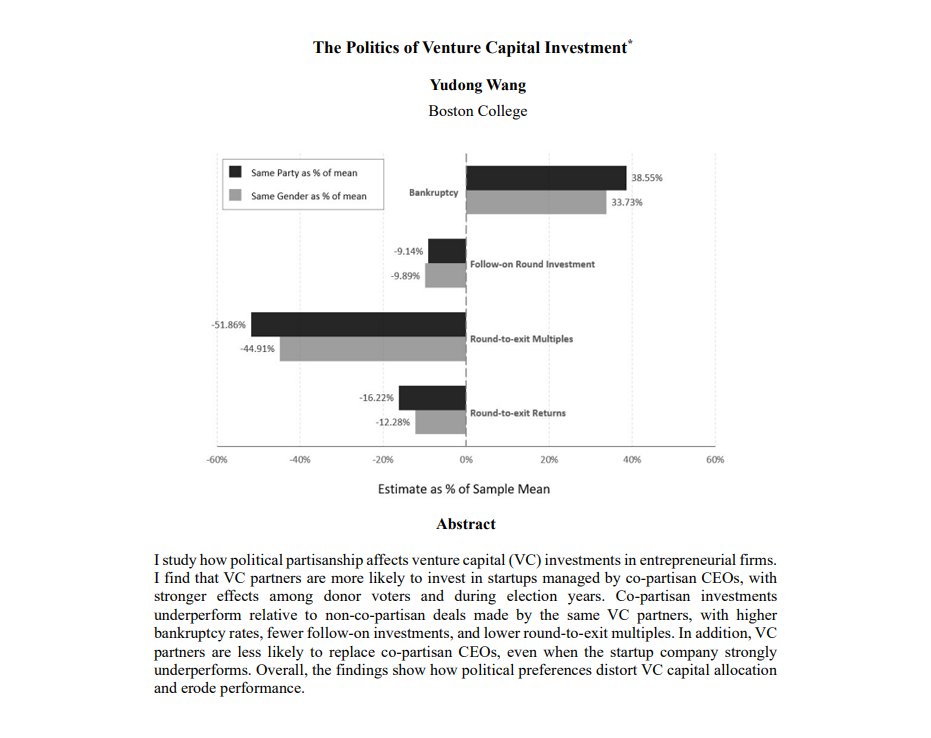

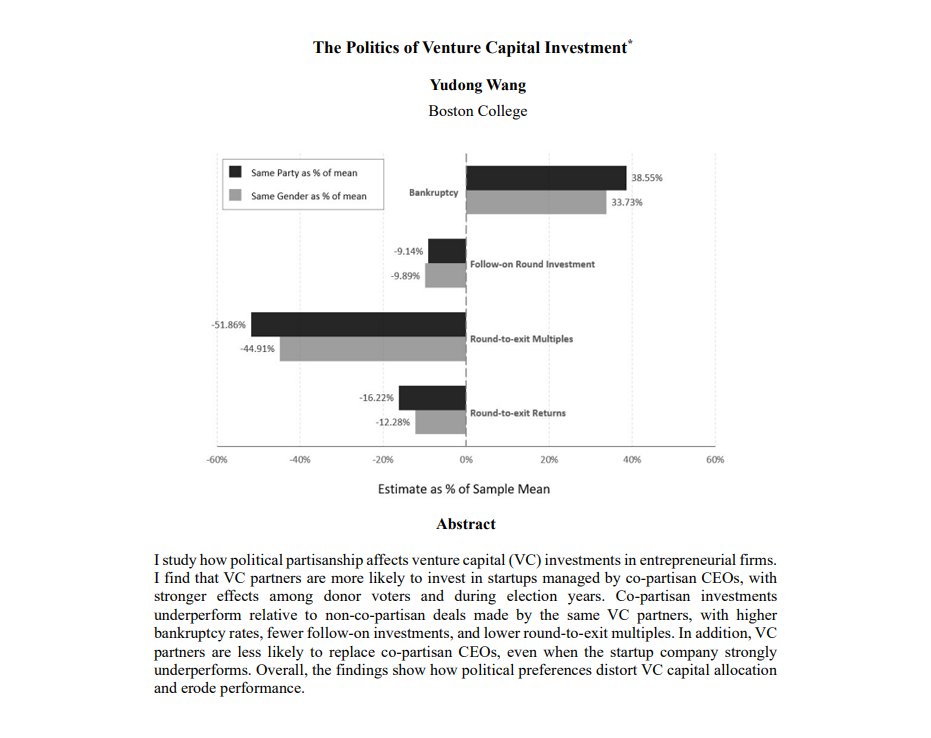

"VC partners are more likely to invest in startups managed by co-partisan CEOs, with stronger effects among donor voters and during election years. Co-partisan investments underperform relative to non-co-partisan deals made by the same VC partners, with higher bankruptcy rates, fewer follow-on investments, and lower round-to-exit multiples. In addition, VC partners are less likely to replace co-partisan CEOs, even when the startup company strongly underperforms."

(source: "The Politics of Venture Capital Investment")

The paper uses a linked dataset that includes XXXXXX partner–CEO pairs, covering XXXXX startups, XXXXX VC firms, and XXXXX individual VC partners, based on Pitchbook deal data from 2020 to 2023. It also controls for factors like demographics, location, and industry

The idea that VCs might bias toward founders with shared attributes is nothing new, and has been studied in the past in relation to more typical characteristics of diversity:

"Even though the desire to associate with similar people—a tendency academics call homophily—can bring social benefits to those who exhibit it, including a sense of shared culture and belonging, it can also lead investors and firms to leave a lot of money on the table."

(source: "The Other Diversity Dividend")

In both cases, perhaps obviously, these factors have a negative influence in investing decisions, erroding the objectivity of VC partners.

XXXXX engagements

Related Topics investment private equity vcs