[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Tanaka [@Tanaka_L2](/creator/twitter/Tanaka_L2) on x 57.9K followers Created: 2025-07-18 07:45:39 UTC gMantle, We are so back. $NMT will be back to ATH soon. I think @Mantle_Official is doing something most chains aren’t even attempting. It’s turning crypto infra into a banking backend. Let me break this down: 🔻 In #TradFi, your “bank” isn’t just a wallet, it’s a full-stack platform: it handles savings, insurance, bonds, loans, trading, FX. Everything’s siloed behind regulated walls, but the UI is seamless. 🔻 In crypto, we flipped the backend but never fixed the front. You manage stablecoins in one place, yield in another, tokens in a third. That fragmentation kills adoption. Mantle’s UR Neobank changes that. 🔻 UR is Mantle’s on-chain money app, a single, programmable account that bridges fiat + crypto. You can trade, save, invest, and even access tokenized bonds and insurance from one unified interface. ☮️And it’s not just UX, it’s vertical integration: ▫️ Every action on UR routes to Mantle Network ▫️ Every transaction becomes on-chain volume ▫️ Every asset from mETH to tokenized bonds, loops into the MNT economy This is how “banking” logic gets absorbed into crypto: ▫️ You replace the bank ledger with a blockchain ▫️ You replace KYC silos with smart accounts ▫️ You replace yield products with DeFi-native instruments ▫️ And you replace custody with self-sovereignty without killing usability ☮️They’re not stopping there: ▫️ MantleX → investing in on-chain AI agents ▫️ FunctionBTC → synthetic BTC flows ▫️ Lightning Grants → fast capital for builders ▫️ Restaking (cmETH) → built-in EigenLayer access And UR becomes the surface where it all comes together. ☮️To me, Blockchain for Banking is a thesis: → Bring the logic of TradFi onto programmable rails → Make it usable for normal people → Settle everything on-chain, where value flows to token holders I think they’re the closest we’ve seen to turning crypto infra into something you’d actually use instead of a neobank. ☮️Technical View: $MNT is currently trading at $0, 84, recovering from its recent local low around $0.50, with a modest surge in daily volume $366M. I’m expecting it’ll back to ATH – Key resistance: $XXXX – Major breakout level: $XXXX - My first target: 1.5$ – Market cap: $2.83B with 3.37B MNT circulating (~54% unlocked) If the "Blockchain for Banking" narrative gains traction, MNT could become a high-beta bet on mainstream adoption of onchain finance. If #Mantle pulls this off, we’ll stop calling it #DeFi and just call it money.  XXXXXX engagements  **Related Topics** [insurance](/topic/insurance) [savings](/topic/savings) [banking](/topic/banking) [infra](/topic/infra) [$nmt](/topic/$nmt) [Post Link](https://x.com/Tanaka_L2/status/1946114126759276552)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Tanaka @Tanaka_L2 on x 57.9K followers

Created: 2025-07-18 07:45:39 UTC

Tanaka @Tanaka_L2 on x 57.9K followers

Created: 2025-07-18 07:45:39 UTC

gMantle,

We are so back. $NMT will be back to ATH soon.

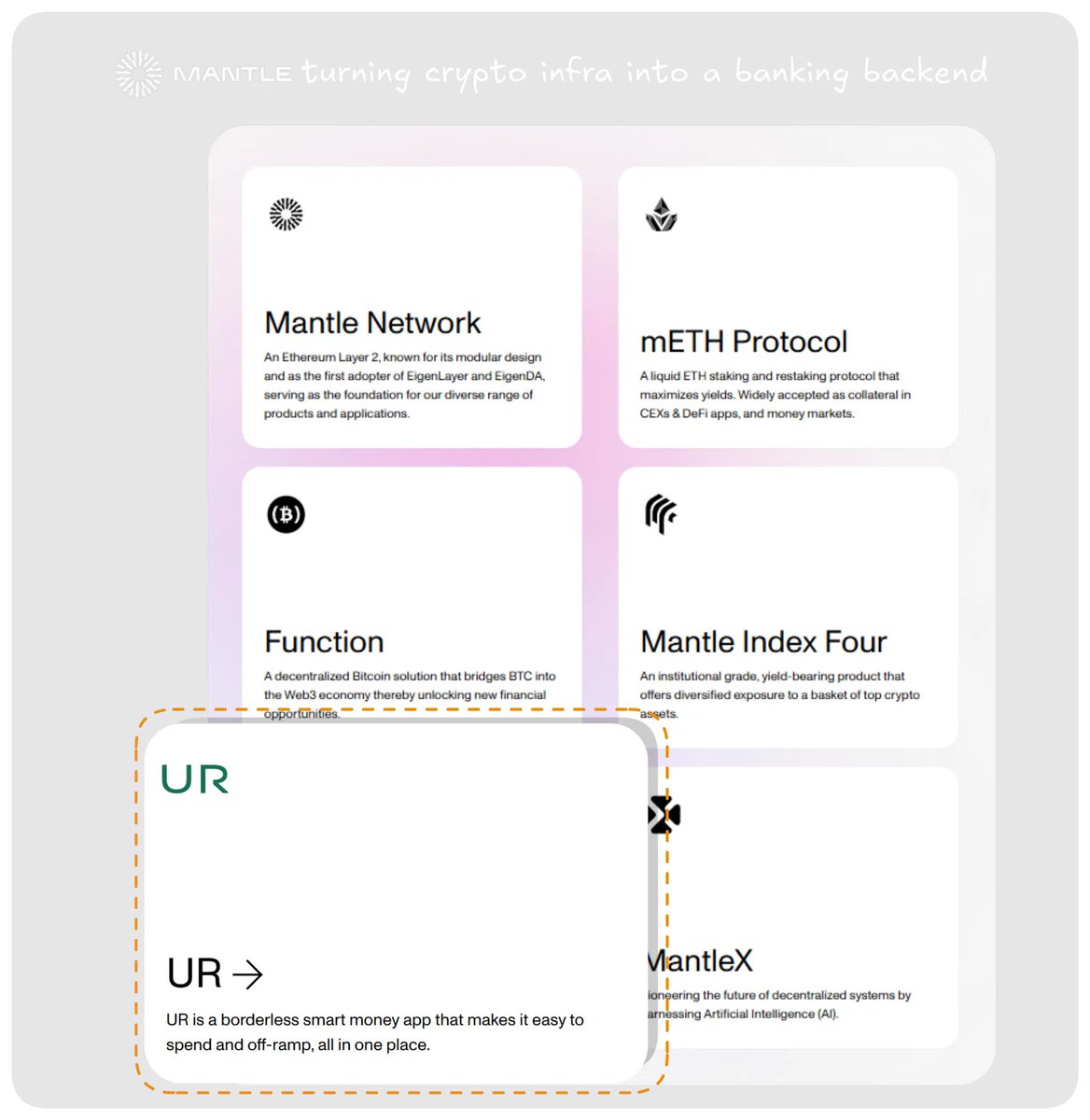

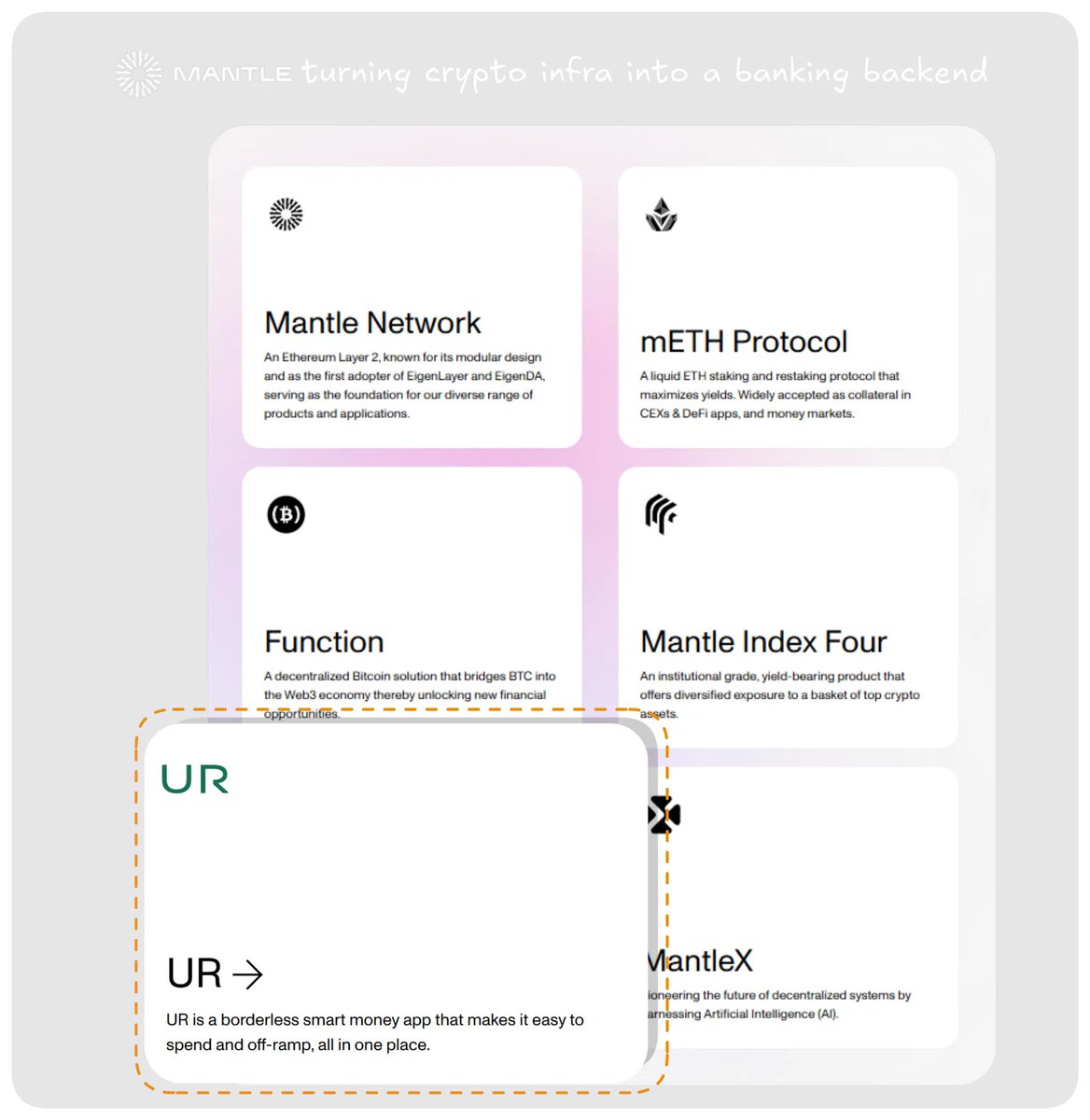

I think @Mantle_Official is doing something most chains aren’t even attempting.

It’s turning crypto infra into a banking backend.

Let me break this down:

🔻 In #TradFi, your “bank” isn’t just a wallet, it’s a full-stack platform:

it handles savings, insurance, bonds, loans, trading, FX.

Everything’s siloed behind regulated walls, but the UI is seamless.

🔻 In crypto, we flipped the backend but never fixed the front.

You manage stablecoins in one place, yield in another, tokens in a third.

That fragmentation kills adoption.

Mantle’s UR Neobank changes that.

🔻 UR is Mantle’s on-chain money app, a single, programmable account that bridges fiat + crypto.

You can trade, save, invest, and even access tokenized bonds and insurance from one unified interface. ☮️And it’s not just UX, it’s vertical integration:

▫️ Every action on UR routes to Mantle Network

▫️ Every transaction becomes on-chain volume

▫️ Every asset from mETH to tokenized bonds, loops into the MNT economy

This is how “banking” logic gets absorbed into crypto:

▫️ You replace the bank ledger with a blockchain

▫️ You replace KYC silos with smart accounts

▫️ You replace yield products with DeFi-native instruments

▫️ And you replace custody with self-sovereignty without killing usability

☮️They’re not stopping there:

▫️ MantleX → investing in on-chain AI agents

▫️ FunctionBTC → synthetic BTC flows

▫️ Lightning Grants → fast capital for builders

▫️ Restaking (cmETH) → built-in EigenLayer access

And UR becomes the surface where it all comes together.

☮️To me, Blockchain for Banking is a thesis:

→ Bring the logic of TradFi onto programmable rails

→ Make it usable for normal people

→ Settle everything on-chain, where value flows to token holders

I think they’re the closest we’ve seen to turning crypto infra into something you’d actually use instead of a neobank.

☮️Technical View:

$MNT is currently trading at $0, 84, recovering from its recent local low around $0.50, with a modest surge in daily volume $366M. I’m expecting it’ll back to ATH

– Key resistance: $XXXX

– Major breakout level: $XXXX

- My first target: 1.5$

– Market cap: $2.83B with 3.37B MNT circulating (~54% unlocked)

If the "Blockchain for Banking" narrative gains traction, MNT could become a high-beta bet on mainstream adoption of onchain finance.

If #Mantle pulls this off, we’ll stop calling it #DeFi and just call it money.

XXXXXX engagements