[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eugene Ng [@EugeneNg_VCap](/creator/twitter/EugeneNg_VCap) on x 24.5K followers Created: 2025-07-18 01:58:51 UTC TSMC $TSM 2Q25 Earnings - Rev NT$933.8b +39% ↗️🟢 - GP NT$547.4b +53% ↗️🟢 margin XX% +544 bps ✅ - EBIT NT$463.4b +62% ↗️🟢 margin XX% +708 bps ✅ - Net Inc NT$397.5b +60% ↗️🟢 margin XX% +580 bps ✅ - OCF NT$497.1b +32% ↗️🟢 margin XX% -XXX bps ↘️🔴 - FCF NT$199.8b +16% ↗️🟢 margin XX% -XXX bps ↘️🔴 Biz Metrics - Wafer Revenue by Technology: 3nm 24%, 4nm 36%, 7nm XX% - <=7nm XX% - Revenue by Segment: HPC XX% Smartphone XX% IoT X% Auto X% total - Revenue by Geography: NA XX% China X% APAC X% JP X% EMEA X% 3Q25 Mgmt Guide - Rev US$33bn +38% (midpoint) - GPM XXXX% - EBIT margin XXXX% LT Mgmt Guide - FY25 Rev +30%+ ↗️🟢(raised from 25%) - FY24-29 Rev +20% ↗️🟢 - FY24-29 GPM >53% - FY24-29 ROE >25% X | Strong quarter led by leading edge, offset by weak FX mainly due to continued robust AI and HPC related demand. Moving into the third quarter of 2025, we expect our business in the third quarter to be driven by strong demand for our leading-edge process technologies. our business was supported by strong demand for our industry-leading 3-nanometer and 5-nanometer technologies, partially offset by an unfavorable foreign exchange rate (220bps headwind) X | Gross profit margin decreased 20bps QoQ but offset by +110bps with higher operating leverage Gross margin decreased XXX percentage points sequentially to XXXX% primarily due to an unfavorable foreign exchange rate and margin dilution from our overseas fabs, partially balanced by higher capacity utilization and cost improvement e orts. Due to operating leverage, operating margin increased XXX percentage points sequentially to 49.6%. X | Experienced 100bps GPM dilution from overseas fab ramps with US/Arizona and JP / Kumamoto We also experienced slightly more than 100bps impact from the ramp-up of our overseas fabs, mainly as the margin dilution from our Arizona fab started to kick in. We have just guided our third quarter gross margin to decrease by XXX basis points to XXXX% at the midpoint, primarily due to the continued unfavorable foreign exchange rate and more pronounced dilution from overseas fabs as we ramp up further in Kumamoto and Arizona. X | Expecting continued GPM dilution over the next X years of 200-300bps in the earlier years, and widening to 300-400bps in the later years We continue to forecast the gross margin dilution from the ramp-up of our overseas fabs in the next X years starting from 2025 to be between X% to X% every year in the early stages and widen to X% to X% in the later stages. X | Continue to leverage economies of scale to improve cost structure, still expect TSMC to be the most efficient and cost effective manufacturer in every region that they operate Despite the higher cost of overseas fabs, we will leverage our increasing size in Arizona and work on our operations to improve the cost structure. We will also continue to work closely with our customers and suppliers to manage the impact. Overall, with our fundamental competitive advantages of manufacturing technology leadership and large-scale production base, we expect TSMC to be the most e cient and cost-e ective manufacturer in every region that we operate. X | Six factors determine TSMC’s profitability: Technology leadership, pricing, capacity utilization, cost reduction, technology mix, and FX. And FX is not within their control. As a reminder, X factors determine TSMC's profitability: Leadership technology development and ramp-up, pricing, capacity utilization, cost reduction, technology mix and foreign exchange rate, which is not in our control. When the foreign exchange rate is unfavorable as it is currently, we will focus on the fundamentals of our business and lean on the other X factors to manage through it, and we have successfully done in the past. X | Thinks XX% GPM still achievable, and sees it doing better than that Thus, even with the unfavorable foreign exchange rate, we believe a long-term gross margin of XX% and higher remains well achievable. We are working on it. And we have condence that the XX% gross margin and higher, I still want you guys to pay more attention to and higher. X | TSMC believes in earning their value first, so that they can raise ASPs, hence think >53% GPMs are still achievable And you specifically asked about ASP, raising the price, but the price is just one of the factors. And I believe C.C. just elaborate a lot on earning our value. And at the same time, there are other factors that we can leverage on. So all in all, that's why we're saying XX% and higher gross margin is still achievable. X | Going into 2H25, not seeing any change in customer behaviour, China rebates stimulating more near-term upside, continue to expect mild recovery in non-AI Looking into second half of 2025, we have not seen any change in our customers' behavior so far. However, we understand there are uncertainties and risk from the potential impact of tariff policies, especially on consumer-related and price-sensitive end market segment. While we observe rebate program in China are stimulating some near-term demand upside, we believe this is a short term in nature and continue to expect a mild recovery in overall non-AI end market segment in 2025. XX | Not yet receive NVIDIA H20 signal yet, good news for NVIDIA and TSMC H20 now is again, according to the trading companies CEO, we did not receive the signal yet. So it's too early to give you an estimate. But certainly, this is a good news, right? I mean that's -- China is a big market and my customer can still continue to supply the chip to the big market. And it's a very positive news for them. And in return, it's a very positive news to TSMC. Whether we are ready to increase our forecast, not yet. Another quarter probably will be more appropriate to answer your question. XX | See robust long-term demand for semiconductors, driven by AI, more computational demand, and rising sovereign demand Having said that, we believe the demand for semiconductors is very fundamental and will continue to be robust. Recent developments are also positive to AI's long-term demand outlook. The explosive growth in token volume demonstrate increasing AI model usage and adoption, which means more and more computation is needed, leading to more leading-edge silicon demand. We also see AI demand continuing to be strong. including the rising demand from sovereign AI. XX | Megatrend demand from AI is getting stronger and stronger, healthy and strong momentum the demand from the AI getting stronger and stronger, if you pay attention to what -- for trading companies, the CEO said. And so the megatrend for the AI continue to be strong and so is the CoWoS. And so now we are -- again, we are in a mode trying to narrow the gap. I don't want to use the balance. The last time you guys misunderstood what I said is -- sorry it's bad worded. So I will say we try to narrow the gap, all right? So momentum is still there and very healthy. XX | Investing USD 165bn in the US to build X advanced wafer manufacturing fabs, X advanced packaging fabs, and X major R&D With a strong collaboration, and support from our leading U.S. customers and the U.S. federal state and city government, we announced our intention to invest a total of USD XXX billion in advanced semiconductor manufacturing in the United States. This expansion includes plans for X advanced wafer manufacturing fab in Arizona, X advanced packaging fabs and a major R&D center to support the strong multiyear demand from our customers. XX | First Arizona fab entered into high-volume production for N4, achieving comparable yields to their Taiwan fabs Next X fabs will be 3nm, N2, and A16, creating a leading edge semiconductor manufacturing cluster in the US Our first fab in Arizona has already successfully entered into high-volume production in 4Q 2024, utilizing N4 process technology with a yield comparable to our fab in Taiwan. The construction of our second fab, which will utilize 3-nanometer process technology is already complete. We are seeing strong interest from our leading U.S. customers and are working on speeding up the volume production schedule by several quarters to support their need. Construction of our third fab, which will utilize 2-nanometer and XX process technologies has already begun, and we will look into speeding up the production schedule as well based on the strong AI-related demand from our customers. Our fourth fab will utilize N2 and A16 process technology and our fifth and sixth fab will use even more advanced technology. The construction and ramp schedule for those fabs will be based on our customers' needs. Our expansion plan will enable TSMC to scale up to a giga fab cluster in Arizona to support the needs of our leading-edge customers in smartphone, AI and HPC applications. We also plan to build X new advanced packaging facilities and establish an R&D center to complete the AI supply chain. After completion, around XX% of our 2-nanometer and more advanced capacity will be located in Arizona, creating an independent leading-edge semiconductor manufacturing cluster in the U.S. XX | Japan Kumamoto specialty fab started volume production in late 2024 with good yields, 2nd fab to start in late 2025 Next, in Japan, thanks to the strong support from the Japan central manufacture and local government, our first specialty technology fab in Kumamoto has already started volume production in late 2024 with very good yield. The construction of our second specialty fab is scheduled to start later this year, subject to the readiness of the local infrastructure. The ramp schedule will be based on our customers' need and market conditions. XX | Progressing smoothly with Germany Dresden specialty fab construction In Europe, we have received strong commitment from the European Commission and the German federal, state and city government and are progressing smoothly with our plans to build a specialty technology fab in Dresden, Germany. The ramp schedule will also based on our customers' need and market conditions. XX | Overseas fabs are all different, US is leading edge, Japan and Germany is specific to CMOS image sensor and automotive Well, you think about the TSMC expansion, the overseas fab in the U.S. is leading edge. In Japan, it's on specialty technology. To be specific, most of the time, it's for the CMOS image sensor. For Germany, it's automotive industry. So they are all not in the same field. So actually, it does not affect. The investment in the U.S. or invest on the leading edge does not affect the investment in Japan or in Germany. XX | Planning to build XX wafer fabs and X packaging facilities in Taiwan over the next few years In Taiwan, with support from the Taiwan government, we plan to build XX wafer manufacturing fab and X advanced packaging facilities over the next several years. We are preparing for multiple phases of 2-nanometer fab in both in both Hsinchu and Kaohsiung Science Parks to support the strong structural demand from our customers. By expanding our global footprint while continuing to invest in Taiwan, TSMC can continue to be the trusted technology and capacity provider of the global IC industry for years to come while delivering profitable growth for our shareholders. XX | Not worried about overcapacity, and it fab buildouts are all related to customer demand So we don't worry too much about what you say, overcapacity. If it is really overcapacity, we will not build a fab in Japan. We will not build a fab in Germany. So it's not overcapacity. It's all related to customers' need, customers' demand, and those are all specialty technologies XX | Current capex investments reflect future growth opportunities, and that will not hesitate to invest, unlikely for capex to fall dramatically the CapEx invested in a given year is for the business opportunities in the following years. And as long as there are business opportunities, we will not hesitate to invest As we just said, the capital expenditure invested in any year is the future growth opportunities. So if we do our job right, the growth in the next few years is likely to exceed the growth in CapEx dollars, Going forward, it's too early to talk about future years CapEx, but I can share with you a company of our size, it's unlikely that you see CapEx dollar amount suddenly drop a lot in any given year XX | CoWoS capacity to still remain tight even till 2026 We are trying very hard to narrow the gap for now and for 2026, the demand momentum are very healthy and very strong. And so we are building many new facilities in the back end to increase the CoWoS capacity to support our customers. AI demand is very strong. And so the CoWoS capacity, the demand is very strong. XX | Expect N2 new tape outs to exceed N3, N2 is on track for volume production in 2H25 with similar ramp profile to N3 Now let me talk about our N2 and A16 status. Our N2 and A16 technologies lead the industry in addressing the insatiable demand for energy-efficient computing and almost all the innovators are working with TSMC. We expect the number of new tapeouts for 2nm technology in the rst X years to be higher than both 3nm and 5nm in the first X years, fueled by both smartphone and HPC applications, N2 will deliver full node performance and power benefit with XX to XX speed improvement at the same power or XX% to XX% power improvement at the same speed and more than XX% chip density increase as compared with N3E. N2 is well on track for volume production in the second half of 2025 as scheduled with a ramp profile similar to N3. XX | N2P and A16 scheduled for volume production in 2H26, expect both nodes to be big for TSMC With our strategy of continuous enhancement, we also introduced N2P as an extension of our N2 family, N2P features further performance and power benefits on top of N2 and volume production is scheduled for second half 2026. We also introduced A16 featuring our best-in-class Super Power Rail or SPR. Compared with N2P, A16 provides a further X% to XX% speed improvement at the same power or XX% to XX% power improvement at the same speed and additional X% to XX% chip density gain. A16 is best suited for specific HPC products with complex signal routes and dense power delivery network. Volume production is on track for second half 2026. We believe N2, N2P, A16 and its derivatives will fuel our N2 family to be another large and long-lasting node for TSMC. XX | A14 progressing well, scheduled for volume production for 2028 Finally, let me talk about our A14 status. Featuring our second-generation nanosheet transistor structure, A14 will deliver another full node stride from N2 with performance and power benefits to address the increasing structural demand for high-performance and energy-e cient computing. Compared with N2, A16 will provide XX to XX speed improvement at the same power or XX% to XX% power improvement at the same speed and about XX% chip density gain. Our A14 technology development is on track and progressing well with device performance and yield improvement on or ahead of schedule. Volume production is scheduled for 2028. We will continue our strategy of continuous enhancement with A14, including a Super Power Rail offering planned for 2029. We believe A14 and its derivative will further extend our technology leadership position and enable TSMC to capture the growth opportunities well into the future. XX | TSMC using AI in operation and manufacturing Your second question on AI benefits. I think we also talked about that before. We use that in operation, in manufacturing. We also use that in R&D. And just think about if we are able to produce X% of productivity gains in a company of our size, that equals to USD X billion. XX | Probably need 6-12 months for on-device edge AI to see an explosion As the last time I say, I say that it takes X to X years for my customer to complete their new design on the product. The momentum is still going. They are still continue to -- as time goes by, as I said, the increase on the edge device, the number of the units is actually mild. But then the die size increase. We continue to see that. And the die size increased by about X% to 10%. And that kind of trend continued. Okay? So you have to wait another probably X months or X year to see an explosion. XX | Capacity remains tight with will continue to be so for a couple of years, working hard to narrow gap we have to share our value because of very tight in N3 capacity. It will be continued for a couple of years, very tight. And in fact, N5 also very tight. The demand is high because of a lot of AI products still in the 4-nanometer technology node, and they will transition to 3-nanometer probably in next X years. So in meanwhile, N5 are still very tight in capacity. N3 even tighter. And so we are working hard. XX | TSMC has advantage to be able to adjust or convert capacity between nodes One of the TSMC's advantage is that we have giga fab cluster. And so we have between N7, N5, N3, even the future N2, we have almost for each node, we have about XX% to XX% [indiscernible] tools. So it's not free, but it's much easier for TSMC to adjust or convert the capacity between those nodes. And today, let me share with you, we are using the N7 capacity to support N5 because the N5 is too tight. And then we are converting N5 to N3 as you just pointed out. We'll continue to do that. And so today, we are -- our leading edge technology is capacity. We define N7 and below are all very tight. And at same time, we are working very hard to, again, using my sentence to narrow the gap between the demand and the capacity XX | Think humanoid robots are still too early because it is complicated, one customer (Tesla) thinks it will be 10X of EVs Brad, it's too early -- actually, it's too early to say the humanoid robot will play a role in this year. Next year, probably still too early because it's so complicated. You know that humanoid robot will be most of the time will be used. I think the first one will be used in the medical industry to taking care of the people getting over like me. And I probably someday I need some humanoid robot to help me. But it's very complicated because it's not -- we are talking about the brand only. Actually, you are talking about a lot of sensor -- sensor technology, the image sensor, the pressure sensor, the temperature sensor and all the feedback to the CPU. And so it's very complicated. And since it's dealing with human being directly, has to be very, very careful. But then once you start to fly, it was a big, big plus. I talked to one of my customers and he say that the EV car is nothing -- is robot will be 10x of that. I'm waiting for that. ➡️ Key takeaways from TSMC Earnings: Expect TSMC to continue its outperformance against the foundry industry, supported by long-term structural demand from AI accelerators be it GPUs or custom ASICs, and strong CAPEX reflects their growth outlook. CoWOS advanced packaging supply capacity remains tight. Expecting some downside with lower GPMs guide, but pricings discussions could well have some upside to it. TSMC continues to be the dominant foundry for advanced semiconductor manufacturing with its scale, efficiency, and technological expertise.  XXXXX engagements  **Related Topics** [metrics](/topic/metrics) [$1998b](/topic/$1998b) [$4971b](/topic/$4971b) [$3975b](/topic/$3975b) [$4634b](/topic/$4634b) [$5474b](/topic/$5474b) [$9338b](/topic/$9338b) [nt](/topic/nt) [Post Link](https://x.com/EugeneNg_VCap/status/1946026851610263968)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-07-18 01:58:51 UTC

Eugene Ng @EugeneNg_VCap on x 24.5K followers

Created: 2025-07-18 01:58:51 UTC

TSMC $TSM 2Q25 Earnings

- Rev NT$933.8b +39% ↗️🟢

- GP NT$547.4b +53% ↗️🟢 margin XX% +544 bps ✅

- EBIT NT$463.4b +62% ↗️🟢 margin XX% +708 bps ✅

- Net Inc NT$397.5b +60% ↗️🟢 margin XX% +580 bps ✅

- OCF NT$497.1b +32% ↗️🟢 margin XX% -XXX bps ↘️🔴

- FCF NT$199.8b +16% ↗️🟢 margin XX% -XXX bps ↘️🔴

Biz Metrics

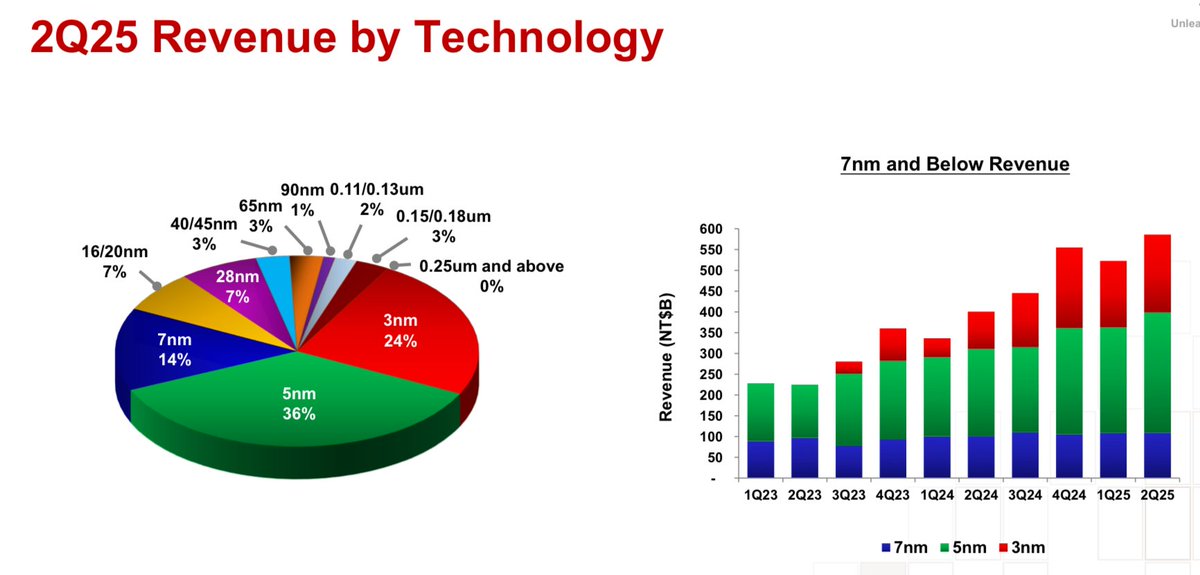

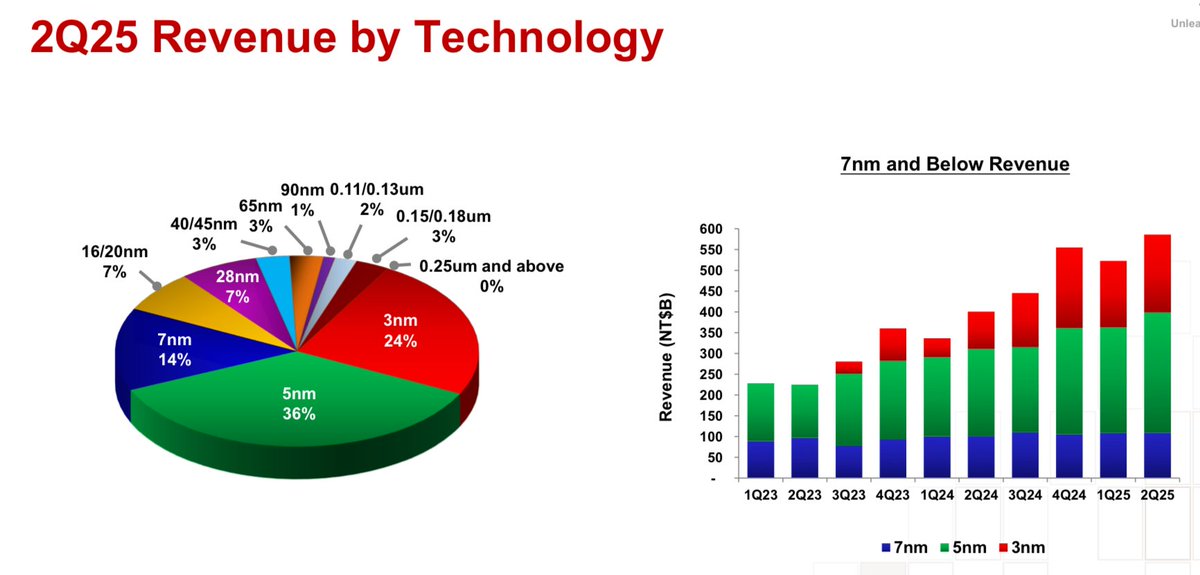

- Wafer Revenue by Technology: 3nm 24%, 4nm 36%, 7nm XX%

- <=7nm XX%

- Revenue by Segment: HPC XX% Smartphone XX% IoT X% Auto X% total

- Revenue by Geography: NA XX% China X% APAC X% JP X% EMEA X% 3Q25 Mgmt Guide

- Rev US$33bn +38% (midpoint)

- GPM XXXX%

- EBIT margin XXXX%

LT Mgmt Guide

- FY25 Rev +30%+ ↗️🟢(raised from 25%)

- FY24-29 Rev +20% ↗️🟢

- FY24-29 GPM >53%

- FY24-29 ROE >25%

X | Strong quarter led by leading edge, offset by weak FX

mainly due to continued robust AI and HPC related demand. Moving into the third quarter of 2025, we expect our business in the third quarter to be driven by strong demand for our leading-edge process technologies.

our business was supported by strong demand for our industry-leading 3-nanometer and 5-nanometer technologies, partially offset by an unfavorable foreign exchange rate (220bps headwind)

X | Gross profit margin decreased 20bps QoQ but offset by +110bps with higher operating leverage

Gross margin decreased XXX percentage points sequentially to XXXX% primarily due to an unfavorable foreign exchange rate and margin dilution from our overseas fabs, partially balanced by higher capacity utilization and cost improvement e orts. Due to operating leverage, operating margin increased XXX percentage points sequentially to 49.6%.

X | Experienced 100bps GPM dilution from overseas fab ramps with US/Arizona and JP / Kumamoto

We also experienced slightly more than 100bps impact from the ramp-up of our overseas fabs, mainly as the margin dilution from our Arizona fab started to kick in. We have just guided our third quarter gross margin to decrease by XXX basis points to XXXX% at the midpoint, primarily due to the continued unfavorable foreign exchange rate and more pronounced dilution from overseas fabs as we ramp up further in Kumamoto and Arizona.

X | Expecting continued GPM dilution over the next X years of 200-300bps in the earlier years, and widening to 300-400bps in the later years

We continue to forecast the gross margin dilution from the ramp-up of our overseas fabs in the next X years starting from 2025 to be between X% to X% every year in the early stages and widen to X% to X% in the later stages.

X | Continue to leverage economies of scale to improve cost structure, still expect TSMC to be the most efficient and cost effective manufacturer in every region that they operate

Despite the higher cost of overseas fabs, we will leverage our increasing size in Arizona and work on our operations to improve the cost structure. We will also continue to work closely with our customers and suppliers to manage the impact. Overall, with our fundamental competitive advantages of manufacturing technology leadership and large-scale production base, we expect TSMC to be the most e cient and cost-e ective manufacturer in every region that we operate.

X | Six factors determine TSMC’s profitability: Technology leadership, pricing, capacity utilization, cost reduction, technology mix, and FX. And FX is not within their control.

As a reminder, X factors determine TSMC's profitability: Leadership technology development and ramp-up, pricing, capacity utilization, cost reduction, technology mix and foreign exchange rate, which is not in our control.

When the foreign exchange rate is unfavorable as it is currently, we will focus on the fundamentals of our business and lean on the other X factors to manage through it, and we have successfully done in the past.

X | Thinks XX% GPM still achievable, and sees it doing better than that

Thus, even with the unfavorable foreign exchange rate, we believe a long-term gross margin of XX% and higher remains well achievable.

We are working on it. And we have condence that the XX% gross margin and higher, I still want you guys to pay more attention to and higher.

X | TSMC believes in earning their value first, so that they can raise ASPs, hence think >53% GPMs are still achievable

And you specifically asked about ASP, raising the price, but the price is just one of the factors. And I believe C.C. just elaborate a lot on earning our value. And at the same time, there are other factors that we can leverage on. So all in all, that's why we're saying XX% and higher gross margin is still achievable.

X | Going into 2H25, not seeing any change in customer behaviour, China rebates stimulating more near-term upside, continue to expect mild recovery in non-AI

Looking into second half of 2025, we have not seen any change in our customers' behavior so far. However, we understand there are uncertainties and risk from the potential impact of tariff policies, especially on consumer-related and price-sensitive end market segment. While we observe rebate program in China are stimulating some near-term demand upside, we believe this is a short term in nature and continue to expect a mild recovery in overall non-AI end market segment in 2025.

XX | Not yet receive NVIDIA H20 signal yet, good news for NVIDIA and TSMC

H20 now is again, according to the trading companies CEO, we did not receive the signal yet. So it's too early to give you an estimate. But certainly, this is a good news, right? I mean that's -- China is a big market and my customer can still continue to supply the chip to the big market. And it's a very positive news for them. And in return, it's a very positive news to TSMC. Whether we are ready to increase our forecast, not yet. Another quarter probably will be more appropriate to answer your question.

XX | See robust long-term demand for semiconductors, driven by AI, more computational demand, and rising sovereign demand

Having said that, we believe the demand for semiconductors is very fundamental and will continue to be robust. Recent developments are also positive to AI's long-term demand outlook. The explosive growth in token volume demonstrate increasing AI model usage and adoption, which means more and more computation is needed, leading to more leading-edge silicon demand. We also see AI demand continuing to be strong. including the rising demand from sovereign AI.

XX | Megatrend demand from AI is getting stronger and stronger, healthy and strong momentum

the demand from the AI getting stronger and stronger, if you pay attention to what -- for trading companies, the CEO said. And so the megatrend for the AI continue to be strong and so is the CoWoS. And so now we are -- again, we are in a mode trying to narrow the gap. I don't want to use the balance. The last time you guys misunderstood what I said is -- sorry it's bad worded. So I will say we try to narrow the gap, all right? So momentum is still there and very healthy.

XX | Investing USD 165bn in the US to build X advanced wafer manufacturing fabs, X advanced packaging fabs, and X major R&D

With a strong collaboration, and support from our leading U.S. customers and the U.S. federal state and city government, we announced our intention to invest a total of USD XXX billion in advanced semiconductor manufacturing in the United States. This expansion includes plans for X advanced wafer manufacturing fab in Arizona, X advanced packaging fabs and a major R&D center to support the strong multiyear demand from our customers.

XX | First Arizona fab entered into high-volume production for N4, achieving comparable yields to their Taiwan fabs Next X fabs will be 3nm, N2, and A16, creating a leading edge semiconductor manufacturing cluster in the US

Our first fab in Arizona has already successfully entered into high-volume production in 4Q 2024, utilizing N4 process technology with a yield comparable to our fab in Taiwan. The construction of our second fab, which will utilize 3-nanometer process technology is already complete. We are seeing strong interest from our leading U.S. customers and are working on speeding up the volume production schedule by several quarters to support their need. Construction of our third fab, which will utilize 2-nanometer and XX process technologies has already begun, and we will look into speeding up the production schedule as well based on the strong AI-related demand from our customers.

Our fourth fab will utilize N2 and A16 process technology and our fifth and sixth fab will use even more advanced technology. The construction and ramp schedule for those fabs will be based on our customers' needs. Our expansion plan will enable TSMC to scale up to a giga fab cluster in Arizona to support the needs of our leading-edge customers in smartphone, AI and HPC applications. We also plan to build X new advanced packaging facilities and establish an R&D center to complete the AI supply chain. After completion, around XX% of our 2-nanometer and more advanced capacity will be located in Arizona, creating an independent leading-edge semiconductor manufacturing cluster in the U.S.

XX | Japan Kumamoto specialty fab started volume production in late 2024 with good yields, 2nd fab to start in late 2025

Next, in Japan, thanks to the strong support from the Japan central manufacture and local government, our first specialty technology fab in Kumamoto has already started volume production in late 2024 with very good yield. The construction of our second specialty fab is scheduled to start later this year, subject to the readiness of the local infrastructure. The ramp schedule will be based on our customers' need and market conditions.

XX | Progressing smoothly with Germany Dresden specialty fab construction

In Europe, we have received strong commitment from the European Commission and the German federal, state and city government and are progressing smoothly with our plans to build a specialty technology fab in Dresden, Germany. The ramp schedule will also based on our customers' need and market conditions.

XX | Overseas fabs are all different, US is leading edge, Japan and Germany is specific to CMOS image sensor and automotive

Well, you think about the TSMC expansion, the overseas fab in the U.S. is leading edge. In Japan, it's on specialty technology. To be specific, most of the time, it's for the CMOS image sensor. For Germany, it's automotive industry. So they are all not in the same field. So actually, it does not affect. The investment in the U.S. or invest on the leading edge does not affect the investment in Japan or in Germany.

XX | Planning to build XX wafer fabs and X packaging facilities in Taiwan over the next few years

In Taiwan, with support from the Taiwan government, we plan to build XX wafer manufacturing fab and X advanced packaging facilities over the next several years. We are preparing for multiple phases of 2-nanometer fab in both in both Hsinchu and Kaohsiung Science Parks to support the strong structural demand from our customers. By expanding our global footprint while continuing to invest in Taiwan, TSMC can continue to be the trusted technology and capacity provider of the global IC industry for years to come while delivering profitable growth for our shareholders.

XX | Not worried about overcapacity, and it fab buildouts are all related to customer demand

So we don't worry too much about what you say, overcapacity. If it is really overcapacity, we will not build a fab in Japan. We will not build a fab in Germany. So it's not overcapacity. It's all related to customers' need, customers' demand, and those are all specialty technologies

XX | Current capex investments reflect future growth opportunities, and that will not hesitate to invest, unlikely for capex to fall dramatically

the CapEx invested in a given year is for the business opportunities in the following years. And as long as there are business opportunities, we will not hesitate to invest

As we just said, the capital expenditure invested in any year is the future growth opportunities. So if we do our job right, the growth in the next few years is likely to exceed the growth in CapEx dollars,

Going forward, it's too early to talk about future years CapEx, but I can share with you a company of our size, it's unlikely that you see CapEx dollar amount suddenly drop a lot in any given year

XX | CoWoS capacity to still remain tight even till 2026

We are trying very hard to narrow the gap for now and for 2026, the demand momentum are very healthy and very strong. And so we are building many new facilities in the back end to increase the CoWoS capacity to support our customers. AI demand is very strong. And so the CoWoS capacity, the demand is very strong.

XX | Expect N2 new tape outs to exceed N3, N2 is on track for volume production in 2H25 with similar ramp profile to N3

Now let me talk about our N2 and A16 status. Our N2 and A16 technologies lead the industry in addressing the insatiable demand for energy-efficient computing and almost all the innovators are working with TSMC. We expect the number of new tapeouts for 2nm technology in the rst X years to be higher than both 3nm and 5nm in the first X years, fueled by both smartphone and HPC applications, N2 will deliver full node performance and power benefit with XX to XX speed improvement at the same power or XX% to XX% power improvement at the same speed and more than XX% chip density increase as compared with N3E. N2 is well on track for volume production in the second half of 2025 as scheduled with a ramp profile similar to N3.

XX | N2P and A16 scheduled for volume production in 2H26, expect both nodes to be big for TSMC

With our strategy of continuous enhancement, we also introduced N2P as an extension of our N2 family, N2P features further performance and power benefits on top of N2 and volume production is scheduled for second half 2026. We also introduced A16 featuring our best-in-class Super Power Rail or SPR. Compared with N2P, A16 provides a further X% to XX% speed improvement at the same power or XX% to XX% power improvement at the same speed and additional X% to XX% chip density gain. A16 is best suited for specific HPC products with complex signal routes and dense power delivery network. Volume production is on track for second half 2026. We believe N2, N2P, A16 and its derivatives will fuel our N2 family to be another large and long-lasting node for TSMC.

XX | A14 progressing well, scheduled for volume production for 2028

Finally, let me talk about our A14 status. Featuring our second-generation nanosheet transistor structure, A14 will deliver another full node stride from N2 with performance and power benefits to address the increasing structural demand for high-performance and energy-e cient computing. Compared with N2, A16 will provide XX to XX speed improvement at the same power or XX% to XX% power improvement at the same speed and about XX% chip density gain. Our A14 technology development is on track and progressing well with device performance and yield improvement on or ahead of schedule. Volume production is scheduled for 2028. We will continue our strategy of continuous enhancement with A14, including a Super Power Rail offering planned for 2029. We believe A14 and its derivative will further extend our technology leadership position and enable TSMC to capture the growth opportunities well into the future.

XX | TSMC using AI in operation and manufacturing

Your second question on AI benefits. I think we also talked about that before. We use that in operation, in manufacturing. We also use that in R&D. And just think about if we are able to produce X% of productivity gains in a company of our size, that equals to USD X billion.

XX | Probably need 6-12 months for on-device edge AI to see an explosion

As the last time I say, I say that it takes X to X years for my customer to complete their new design on the product. The momentum is still going. They are still continue to -- as time goes by, as I said, the increase on the edge device, the number of the units is actually mild. But then the die size increase. We continue to see that. And the die size increased by about X% to 10%. And that kind of trend continued. Okay? So you have to wait another probably X months or X year to see an explosion.

XX | Capacity remains tight with will continue to be so for a couple of years, working hard to narrow gap

we have to share our value because of very tight in N3 capacity. It will be continued for a couple of years, very tight. And in fact, N5 also very tight. The demand is high because of a lot of AI products still in the 4-nanometer technology node, and they will transition to 3-nanometer probably in next X years. So in meanwhile, N5 are still very tight in capacity. N3 even tighter. And so we are working hard.

XX | TSMC has advantage to be able to adjust or convert capacity between nodes

One of the TSMC's advantage is that we have giga fab cluster. And so we have between N7, N5, N3, even the future N2, we have almost for each node, we have about XX% to XX% [indiscernible] tools. So it's not free, but it's much easier for TSMC to adjust or convert the capacity between those nodes. And today, let me share with you, we are using the N7 capacity to support N5 because the N5 is too tight. And then we are converting N5 to N3 as you just pointed out. We'll continue to do that. And so today, we are -- our leading edge technology is capacity. We define N7 and below are all very tight. And at same time, we are working very hard to, again, using my sentence to narrow the gap between the demand and the capacity

XX | Think humanoid robots are still too early because it is complicated, one customer (Tesla) thinks it will be 10X of EVs

Brad, it's too early -- actually, it's too early to say the humanoid robot will play a role in this year. Next year, probably still too early because it's so complicated. You know that humanoid robot will be most of the time will be used. I think the first one will be used in the medical industry to taking care of the people getting over like me. And I probably someday I need some humanoid robot to help me. But it's very complicated because it's not -- we are talking about the brand only. Actually, you are talking about a lot of sensor -- sensor technology, the image sensor, the pressure sensor, the temperature sensor and all the feedback to the CPU. And so it's very complicated. And since it's dealing with human being directly, has to be very, very careful. But then once you start to fly, it was a big, big plus. I talked to one of my customers and he say that the EV car is nothing -- is robot will be 10x of that. I'm waiting for that.

➡️ Key takeaways from TSMC Earnings:

Expect TSMC to continue its outperformance against the foundry industry, supported by long-term structural demand from AI accelerators be it GPUs or custom ASICs, and strong CAPEX reflects their growth outlook. CoWOS advanced packaging supply capacity remains tight. Expecting some downside with lower GPMs guide, but pricings discussions could well have some upside to it. TSMC continues to be the dominant foundry for advanced semiconductor manufacturing with its scale, efficiency, and technological expertise.

XXXXX engagements

Related Topics metrics $1998b $4971b $3975b $4634b $5474b $9338b nt