[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mandeep Bhullar [@mbhullar](/creator/twitter/mbhullar) on x 1712 followers Created: 2025-07-18 00:24:40 UTC Company Name: Netflix Q2 2025 Earnings Summary $NFLX 📊 Key Metrics • Revenue: $11.08B (+15.9% YoY, +5.1% QoQ) 🟢⬆️ • Earnings per Share (EPS): $XXXX (+47.3% YoY, +8.8% QoQ) 🟢 • Operating Income: $3.78B (+45.0% YoY, +12.8% QoQ) 🟢⬆️ • Net Income: $3.13B (+45.5% YoY, +8.1% QoQ) 🟢⬆️ • Free Cash Flow: $2.27B (Q2 2025) vs $1.21B (Q2 2024) 🟢⬆️ • Operating Margin: XXXX% (vs XXXX% YoY, vs XXXX% QoQ) 🟢⬆️ • Debt-to-Equity: Strong balance sheet with $8.2B cash vs $14.5B gross debt 🔮 Financial Outlook • Next Quarter Guidance (Q3 2025): $11.53B revenue (+17.3% YoY), XXXX% operating margin • Full-Year 2025 Guidance: $44.8-$45.2B revenue (raised from $43.5-$44.5B), XXXX% F/X neutral operating margin (30% reported) • Free Cash Flow 2025: Raised to $8.0-$8.5B from ~$8B previously 📈 Positive Highlights • Strong Revenue Growth: XX% YoY growth driven by member expansion, pricing, and advertising • Margin Expansion: Operating margin improved X percentage points YoY to XX% • Content Success: Hit series like Squid Game S3 (122M views), Sirens (56M views), Ginny & Georgia S3 (53M views) • Global Reach: All regions posted double-digit F/X neutral revenue growth • Ad Business: Completed rollout of Netflix Ads Suite across all markets, expecting to roughly double ads revenue in 2025 • Product Innovation: Launched redesigned TV homepage enhancing member experience 📉 Challenges & Concerns • Currency Headwinds: F/X impact limiting reported growth, though company hedges exposure • Content Costs: Higher content amortization expected in H2 2025 due to larger slate • Member Growth: While positive, growth occurred late in quarter limiting Q2 revenue impact • Competitive Landscape: Ongoing streaming wars requiring continued content investment 🔑 Strategic Updates • Content Investment: Over €1B investment in Spain (2025-2028), $1B Fort Monmouth, NJ facility • Technology Platform: Netflix Ads Suite rollout complete, Yahoo DSP integration announced • Live Programming: Expanding with boxing matches (Taylor vs. Serrano, Canelo vs. Crawford), NFL Christmas games • International Partnerships: TF1 partnership in France launching summer 2026 • Gaming: Continued investment in narrative games based on IP (Black Mirror, Squid Game) 💬 CEO Quote "Our business continues to perform well. In Q2, we grew revenue XX% and our operating margin of XX% expanded seven points year over year. We're optimistic heading into the second half of the year, with a standout slate that includes Wednesday S2, the Stranger Things finale, the highly anticipated Canelo-Crawford live boxing match, Adam Sandler's Happy Gilmore 2, Kathryn Bigelow's A House of Dynamite and Guillermo del Toro's Frankenstein." 📅 Upcoming Events • Earnings Call: July 17, 2025 at 1:45pm PT on youtube/netflixir • Live Boxing: Canelo vs. Crawford fight on September 13th • NFL Games: Christmas Day doubleheader (Cowboys vs. Commanders, Lions vs. Vikings) • Content Releases: Wednesday S2, Stranger Things finale, Happy Gilmore X 📈 Analyst Summary Strong Quarter with Raised Guidance: Netflix delivered another exceptional quarter with revenue growth accelerating to XX% YoY and operating margins expanding dramatically to 34%. The company's ability to grow both top-line and improve profitability simultaneously demonstrates the scalability of the streaming model. Key Investment Thesis Validated: The quarter validated Netflix's strategy of investing in diverse, high-quality content while building advertising and live programming capabilities. Global content like Squid Game S3 continues to drive engagement worldwide, while the ads business is gaining momentum. Positive Outlook: Management's raised full-year guidance reflects confidence in the business trajectory, supported by a strong content slate in H2 2025. The combination of subscriber growth, pricing power, and expanding advertising revenue creates multiple growth vectors. Risk Factors: Currency volatility remains a headwind, and the company faces increasing content costs in H2. Competition in streaming remains intense, requiring continued substantial content investment to maintain market position. Overall Assessment: Netflix continues to execute at a high level, delivering growth and profitability while investing for future expansion. The stock should benefit from the raised guidance and strong operational metrics.  XXX engagements  **Related Topics** [$121b](/topic/$121b) [$227b](/topic/$227b) [cash flow](/topic/cash-flow) [$313b](/topic/$313b) [$378b](/topic/$378b) [eps](/topic/eps) [$1108b](/topic/$1108b) [metrics](/topic/metrics) [Post Link](https://x.com/mbhullar/status/1946003149367730599)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mandeep Bhullar @mbhullar on x 1712 followers

Created: 2025-07-18 00:24:40 UTC

Mandeep Bhullar @mbhullar on x 1712 followers

Created: 2025-07-18 00:24:40 UTC

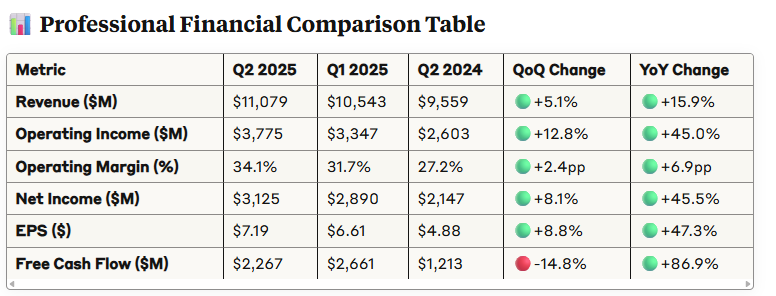

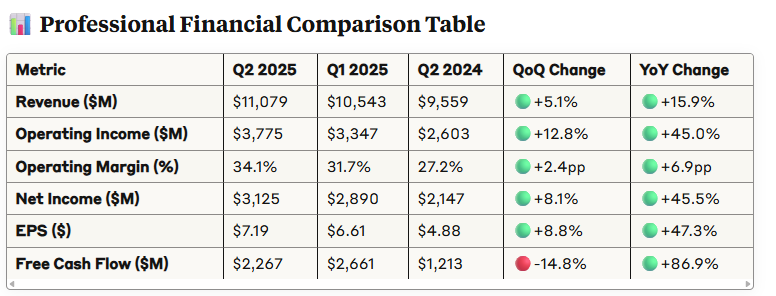

Company Name: Netflix Q2 2025 Earnings Summary $NFLX 📊 Key Metrics

• Revenue: $11.08B (+15.9% YoY, +5.1% QoQ) 🟢⬆️ • Earnings per Share (EPS): $XXXX (+47.3% YoY, +8.8% QoQ) 🟢 • Operating Income: $3.78B (+45.0% YoY, +12.8% QoQ) 🟢⬆️ • Net Income: $3.13B (+45.5% YoY, +8.1% QoQ) 🟢⬆️ • Free Cash Flow: $2.27B (Q2 2025) vs $1.21B (Q2 2024) 🟢⬆️ • Operating Margin: XXXX% (vs XXXX% YoY, vs XXXX% QoQ) 🟢⬆️ • Debt-to-Equity: Strong balance sheet with $8.2B cash vs $14.5B gross debt

🔮 Financial Outlook • Next Quarter Guidance (Q3 2025): $11.53B revenue (+17.3% YoY), XXXX% operating margin • Full-Year 2025 Guidance: $44.8-$45.2B revenue (raised from $43.5-$44.5B), XXXX% F/X neutral operating margin (30% reported) • Free Cash Flow 2025: Raised to $8.0-$8.5B from ~$8B previously

📈 Positive Highlights • Strong Revenue Growth: XX% YoY growth driven by member expansion, pricing, and advertising • Margin Expansion: Operating margin improved X percentage points YoY to XX% • Content Success: Hit series like Squid Game S3 (122M views), Sirens (56M views), Ginny & Georgia S3 (53M views) • Global Reach: All regions posted double-digit F/X neutral revenue growth • Ad Business: Completed rollout of Netflix Ads Suite across all markets, expecting to roughly double ads revenue in 2025 • Product Innovation: Launched redesigned TV homepage enhancing member experience

📉 Challenges & Concerns • Currency Headwinds: F/X impact limiting reported growth, though company hedges exposure • Content Costs: Higher content amortization expected in H2 2025 due to larger slate • Member Growth: While positive, growth occurred late in quarter limiting Q2 revenue impact • Competitive Landscape: Ongoing streaming wars requiring continued content investment

🔑 Strategic Updates

• Content Investment: Over €1B investment in Spain (2025-2028), $1B Fort Monmouth, NJ facility • Technology Platform: Netflix Ads Suite rollout complete, Yahoo DSP integration announced • Live Programming: Expanding with boxing matches (Taylor vs. Serrano, Canelo vs. Crawford), NFL Christmas games • International Partnerships: TF1 partnership in France launching summer 2026 • Gaming: Continued investment in narrative games based on IP (Black Mirror, Squid Game)

💬 CEO Quote "Our business continues to perform well. In Q2, we grew revenue XX% and our operating margin of XX% expanded seven points year over year. We're optimistic heading into the second half of the year, with a standout slate that includes Wednesday S2, the Stranger Things finale, the highly anticipated Canelo-Crawford live boxing match, Adam Sandler's Happy Gilmore 2, Kathryn Bigelow's A House of Dynamite and Guillermo del Toro's Frankenstein."

📅 Upcoming Events

• Earnings Call: July 17, 2025 at 1:45pm PT on youtube/netflixir • Live Boxing: Canelo vs. Crawford fight on September 13th • NFL Games: Christmas Day doubleheader (Cowboys vs. Commanders, Lions vs. Vikings) • Content Releases: Wednesday S2, Stranger Things finale, Happy Gilmore X

📈 Analyst Summary Strong Quarter with Raised Guidance: Netflix delivered another exceptional quarter with revenue growth accelerating to XX% YoY and operating margins expanding dramatically to 34%. The company's ability to grow both top-line and improve profitability simultaneously demonstrates the scalability of the streaming model. Key Investment Thesis Validated: The quarter validated Netflix's strategy of investing in diverse, high-quality content while building advertising and live programming capabilities. Global content like Squid Game S3 continues to drive engagement worldwide, while the ads business is gaining momentum.

Positive Outlook: Management's raised full-year guidance reflects confidence in the business trajectory, supported by a strong content slate in H2 2025. The combination of subscriber growth, pricing power, and expanding advertising revenue creates multiple growth vectors.

Risk Factors: Currency volatility remains a headwind, and the company faces increasing content costs in H2. Competition in streaming remains intense, requiring continued substantial content investment to maintain market position. Overall Assessment: Netflix continues to execute at a high level, delivering growth and profitability while investing for future expansion. The stock should benefit from the raised guidance and strong operational metrics.

XXX engagements

Related Topics $121b $227b cash flow $313b $378b eps $1108b metrics