[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  AlmostMongolian [@AlmostMongolian](/creator/twitter/AlmostMongolian) on x 3154 followers Created: 2025-07-17 15:52:19 UTC $cert.v Q2 production results out—production up by XXX gold equivalent ounces from last quarter. "modestly lower" than management expected. The average realized price per gold was lower than I expected at 2715$, with gold price averaging way above 3000$. The old hedges that were suppressing their price realizations were supposed to be terminated on March 31st. I'm curious about what's going on here. "the hedge is constructed as a zero-cost collar with lower and upper boundaries of US$2,300 and US$2,475 per ounce respectively. The hedging volume is for XXXXX ounces per month for a period of XX months beginning May 2024 and terminating on March 31th, 2025." Production guidance remains at 55-60k GEO for the year. Whether they reach guidance is based on the success of their underground ramp-up, currently underway, and the continued increase in heap leach production If they achieve this guidance, the company is extremely cheap at current gold prices. If Cerrado achieves the lower end of guidance of 55k, Q3 and Q4 would average XXXXXX per quarter for the second half. Q4 would be higher than Q3 because the underground will not be fully ramped up in Q3. "underground mining beneath the Paloma pit. Ore production is expected to ramp up over the coming months and is set to make a material contribution to production rates as the year progresses" "underground operations at Paloma are expected to begin to contribute meaningfully to production in Q3 2025 and beyond as development rates increase and more ore becomes available." So if Q3 production is, for example, XXXXXX GEO, then Q4 production would have to be XXXXXX GEO, which would be XXXXXX GEO annually. The current market cap is 70m USD, EV around 100m, and Cerrado, according to Cerrado, makes 61,1m USD of FCF at XXXXXX GEO and at 3300$ gold price. Reaching above 70k annualized is basically their guidance, at that production rate, if the gold price remains above 3000$, there is no cheaper gold stock. Possibly no cheaper mining stock.  XXXXX engagements  **Related Topics** [$certv](/topic/$certv) [Post Link](https://x.com/AlmostMongolian/status/1945874212729549241)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

AlmostMongolian @AlmostMongolian on x 3154 followers

Created: 2025-07-17 15:52:19 UTC

AlmostMongolian @AlmostMongolian on x 3154 followers

Created: 2025-07-17 15:52:19 UTC

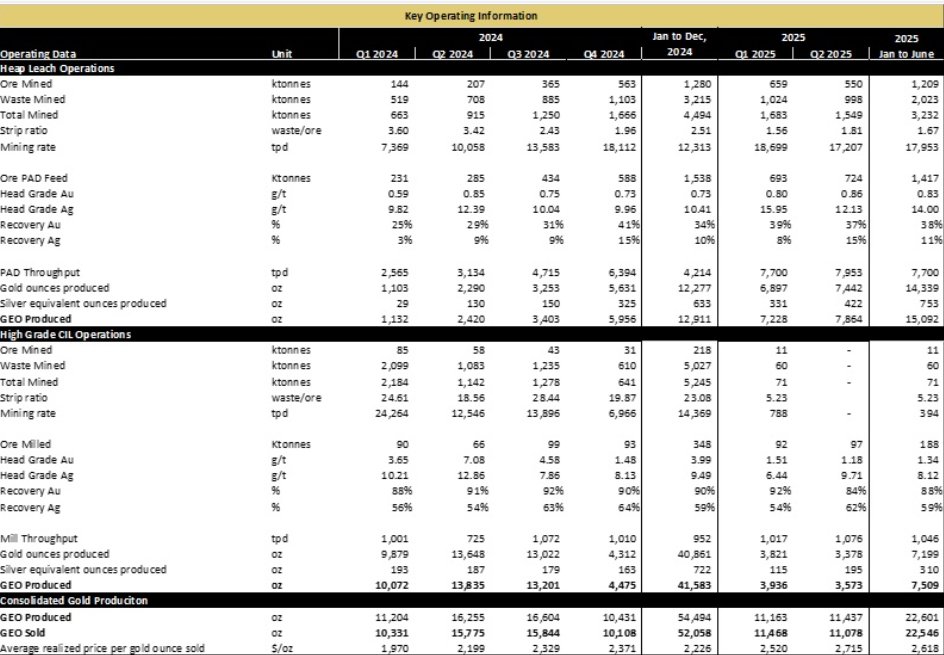

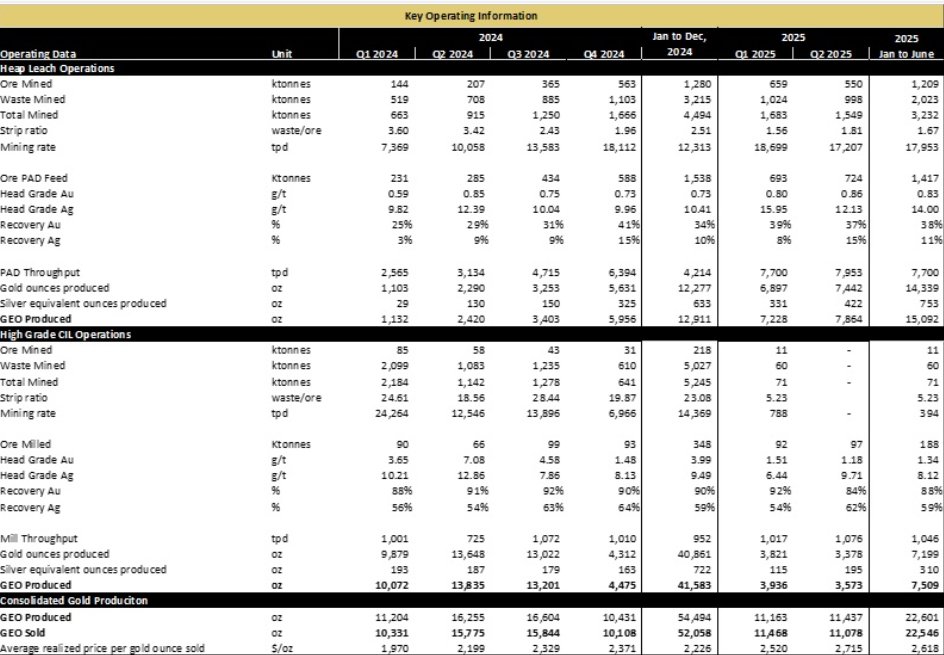

$cert.v Q2 production results out—production up by XXX gold equivalent ounces from last quarter. "modestly lower" than management expected. The average realized price per gold was lower than I expected at 2715$, with gold price averaging way above 3000$. The old hedges that were suppressing their price realizations were supposed to be terminated on March 31st. I'm curious about what's going on here. "the hedge is constructed as a zero-cost collar with lower and upper boundaries of US$2,300 and US$2,475 per ounce respectively. The hedging volume is for XXXXX ounces per month for a period of XX months beginning May 2024 and terminating on March 31th, 2025." Production guidance remains at 55-60k GEO for the year. Whether they reach guidance is based on the success of their underground ramp-up, currently underway, and the continued increase in heap leach production If they achieve this guidance, the company is extremely cheap at current gold prices. If Cerrado achieves the lower end of guidance of 55k, Q3 and Q4 would average XXXXXX per quarter for the second half. Q4 would be higher than Q3 because the underground will not be fully ramped up in Q3. "underground mining beneath the Paloma pit. Ore production is expected to ramp up over the coming months and is set to make a material contribution to production rates as the year progresses" "underground operations at Paloma are expected to begin to contribute meaningfully to production in Q3 2025 and beyond as development rates increase and more ore becomes available." So if Q3 production is, for example, XXXXXX GEO, then Q4 production would have to be XXXXXX GEO, which would be XXXXXX GEO annually. The current market cap is 70m USD, EV around 100m, and Cerrado, according to Cerrado, makes 61,1m USD of FCF at XXXXXX GEO and at 3300$ gold price. Reaching above 70k annualized is basically their guidance, at that production rate, if the gold price remains above 3000$, there is no cheaper gold stock. Possibly no cheaper mining stock.

XXXXX engagements

Related Topics $certv