[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-17 15:14:11 UTC Despite the stronger than expected June retail sales and July Philly Fed manufacturing index and low weekly jobless claims, Goldman cuts Q2 GDP tracking estimate by 0.1pp to +2.9% (quarter-over-quarter annualized) as core retail sales growth for both April and May was revised down. Their Q2 domestic final sales estimate remained at +0.9%. They also lowered their June core PCE estimate to XXXX% (from 0.26%) on the soft import prices data, corresponding to a year-over-year rate of +2.73%. "Headline import prices rose XXX% in June, below expectations. Import prices ex-petroleum were flat, also below expectations. Prices rose for consumer goods (+0.4%), industrial supplies (+0.2%), were flat for capital goods, and declined for food and beverages (-0.8%) and autos (-0.1%). The international airfares component of import prices, which is source data for the foreign travel component of core PCE, declined -XXX% (SA by GS)."  XXXXX engagements  **Related Topics** [inflation](/topic/inflation) [gdp](/topic/gdp) [fed](/topic/fed) [gdp growth](/topic/gdp-growth) [Post Link](https://x.com/neilksethi/status/1945864615184707631)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-17 15:14:11 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-17 15:14:11 UTC

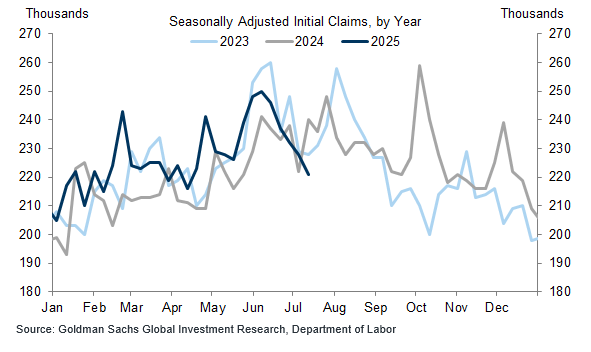

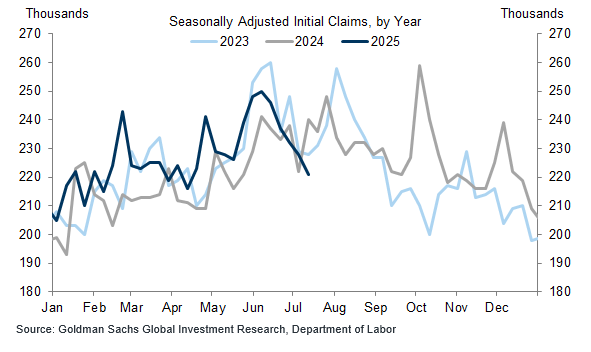

Despite the stronger than expected June retail sales and July Philly Fed manufacturing index and low weekly jobless claims, Goldman cuts Q2 GDP tracking estimate by 0.1pp to +2.9% (quarter-over-quarter annualized) as core retail sales growth for both April and May was revised down. Their Q2 domestic final sales estimate remained at +0.9%.

They also lowered their June core PCE estimate to XXXX% (from 0.26%) on the soft import prices data, corresponding to a year-over-year rate of +2.73%.

"Headline import prices rose XXX% in June, below expectations. Import prices ex-petroleum were flat, also below expectations. Prices rose for consumer goods (+0.4%), industrial supplies (+0.2%), were flat for capital goods, and declined for food and beverages (-0.8%) and autos (-0.1%). The international airfares component of import prices, which is source data for the foreign travel component of core PCE, declined -XXX% (SA by GS)."

XXXXX engagements

Related Topics inflation gdp fed gdp growth