[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jurrien Timmer [@TimmerFidelity](/creator/twitter/TimmerFidelity) on x 202.1K followers Created: 2025-07-17 13:59:46 UTC If the Fed is forced back into the bond market to hold down nominal and real rates, the dollar may well lose more of its supremacy premium. Currencies are the release valve for unsustainable fiscal policy, as Japan found out a few years ago. The same is now true for the dollar, which continues to lose strength despite the Fed’s hawkish policy stance.  XXXXXX engagements  **Related Topics** [japan](/topic/japan) [currencies](/topic/currencies) [money](/topic/money) [rates](/topic/rates) [fed](/topic/fed) [federal reserve](/topic/federal-reserve) [Post Link](https://x.com/TimmerFidelity/status/1945845887042998546)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jurrien Timmer @TimmerFidelity on x 202.1K followers

Created: 2025-07-17 13:59:46 UTC

Jurrien Timmer @TimmerFidelity on x 202.1K followers

Created: 2025-07-17 13:59:46 UTC

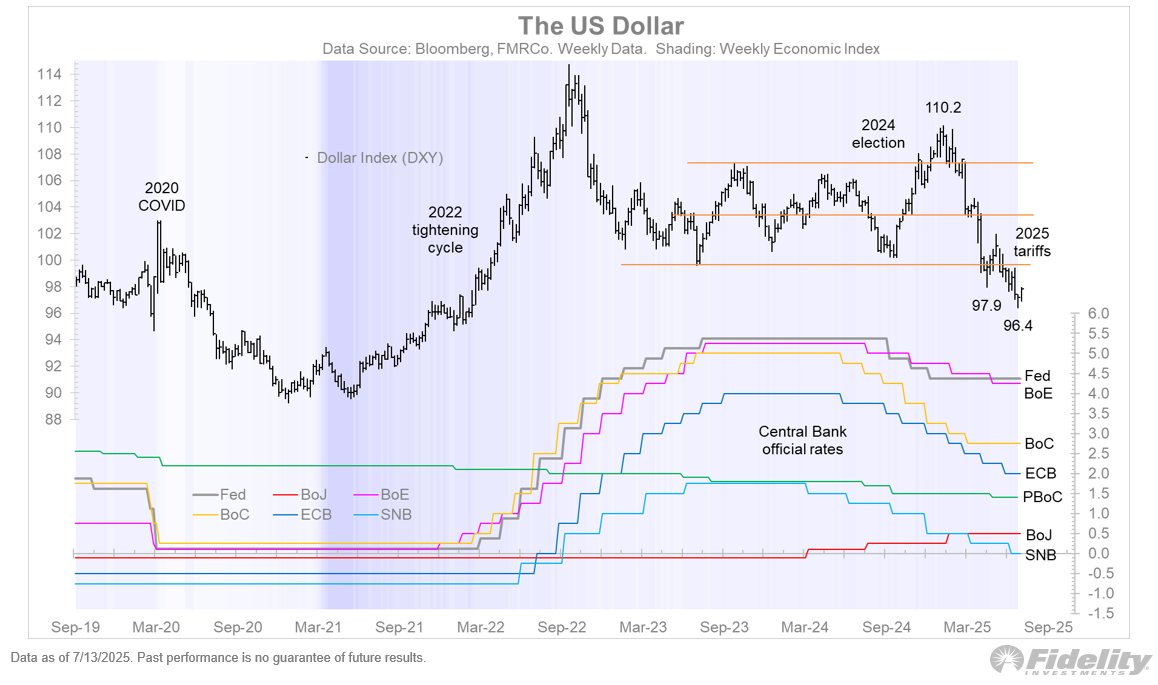

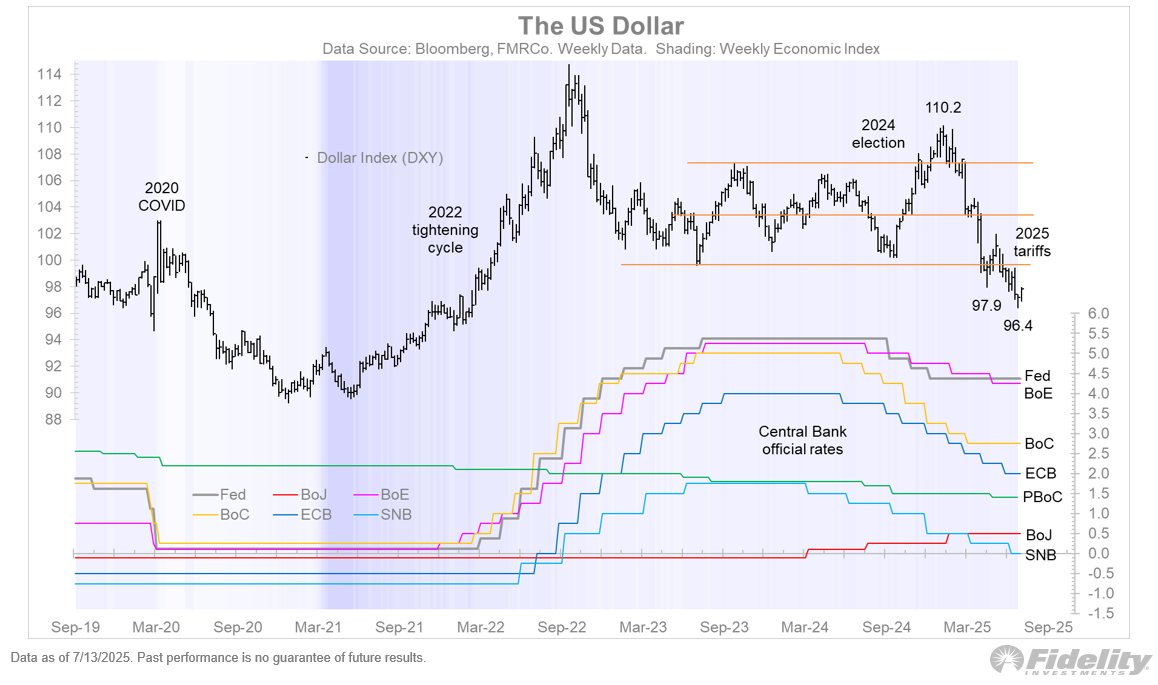

If the Fed is forced back into the bond market to hold down nominal and real rates, the dollar may well lose more of its supremacy premium. Currencies are the release valve for unsustainable fiscal policy, as Japan found out a few years ago. The same is now true for the dollar, which continues to lose strength despite the Fed’s hawkish policy stance.

XXXXXX engagements

Related Topics japan currencies money rates fed federal reserve