[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Jurrien Timmer [@TimmerFidelity](/creator/twitter/TimmerFidelity) on x 202.1K followers Created: 2025-07-17 13:45:04 UTC With the debt ceiling now passed, the debt is rising again and the jaws between what the Treasury is selling and what the Fed is buying continue to widen. This will only last for so long, in my view. We are now in round two of fiscal dominance, with the first $X trillion helicopter drop taking place during COVID and now the second one about to get underway from the OBBB. The math is simple but difficult: as long as nominal GDP growth outpaces the funding rate (10-year Treasury yield), the debt can be considered sustainable. Hopefully, that happens, as a capex cycle from both the OBBB and the AI boom increases productivity and therefore the non-inflationary speed limit for the US economy. If not, and if the term premium rises further, in a few years we could have an unsustainable debt spiral on our hands, requiring the Fed to re-enter the bond market to suppress the term premium once again.  XXXXXX engagements  **Related Topics** [obbb](/topic/obbb) [underway](/topic/underway) [dominance](/topic/dominance) [fed](/topic/fed) [debt](/topic/debt) [federal reserve](/topic/federal-reserve) [Post Link](https://x.com/TimmerFidelity/status/1945842189189472301)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Jurrien Timmer @TimmerFidelity on x 202.1K followers

Created: 2025-07-17 13:45:04 UTC

Jurrien Timmer @TimmerFidelity on x 202.1K followers

Created: 2025-07-17 13:45:04 UTC

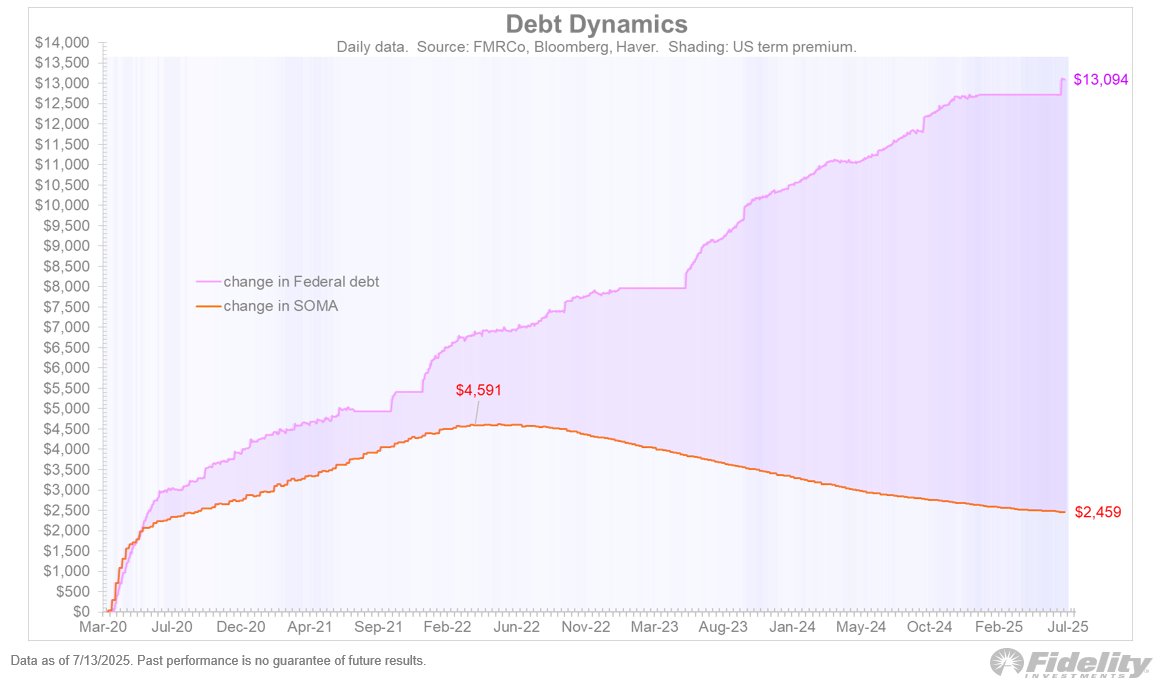

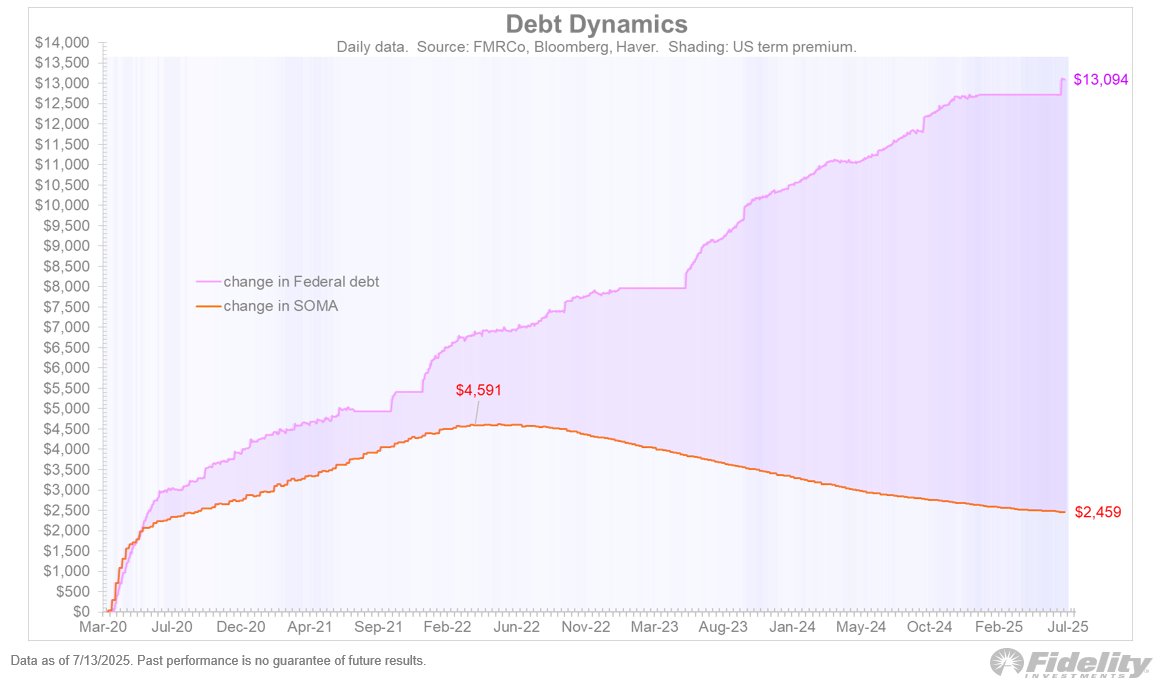

With the debt ceiling now passed, the debt is rising again and the jaws between what the Treasury is selling and what the Fed is buying continue to widen. This will only last for so long, in my view.

We are now in round two of fiscal dominance, with the first $X trillion helicopter drop taking place during COVID and now the second one about to get underway from the OBBB. The math is simple but difficult: as long as nominal GDP growth outpaces the funding rate (10-year Treasury yield), the debt can be considered sustainable. Hopefully, that happens, as a capex cycle from both the OBBB and the AI boom increases productivity and therefore the non-inflationary speed limit for the US economy.

If not, and if the term premium rises further, in a few years we could have an unsustainable debt spiral on our hands, requiring the Fed to re-enter the bond market to suppress the term premium once again.

XXXXXX engagements

Related Topics obbb underway dominance fed debt federal reserve