[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Albert Alan [@_AlbertAlan](/creator/twitter/_AlbertAlan) on x 2893 followers Created: 2025-07-17 02:48:02 UTC Dear $OPEN Investors and Broader Market Participants, I wanted to take a moment to provide an educational perspective on the recent upward movement in Opendoor $OPEN stock. For those wondering whether this rally reflects a change in the company’s fundamentals—such as improved profitability, free cash flow growth, or enhanced intrinsic value the answer is, unfortunately, no. Our research continues to show no material improvement in key financial metrics. From a traditional value-investing lens such as that of Benjamin Graham or Warren Buffett there has been no underlying shift in the core business to warrant this price action. Instead, what we are witnessing appears to be a coordinated effort, allegedly led by Eric Jackson, to generate retail investor enthusiasm in hopes of keeping the share price above $X for XX consecutive trading days. The goal of this campaign is to avoid either a 50-to-1 reverse stock split or a potential delisting from the exchange. While the effort is strategic in nature, it does not reflect a business turnaround. In fact, this kind of social media driven push resembles a synthetic version of insider buying a signal without the substance of operational change. While high short interest (currently XXXXX% of float with XXXXX% utilization) creates the conditions for a possible short squeeze, the underlying fundamentals remain weak: the company is not net income positive, is not free cash flow positive, and shows no signs of consistent improvement. While a business recovery might be possible in the future perhaps aided by falling interest rates in 2026 investors should be cautious. Without real change in the business itself, this rally risks leaving late entrants "holding the bag." @ericjackson if I'm missing something here please educate me?  XXXXXX engagements  **Related Topics** [doubled](/topic/doubled) [cash flow](/topic/cash-flow) [$open](/topic/$open) [open opendoor technologies inc](/topic/open-opendoor-technologies-inc) [Post Link](https://x.com/_AlbertAlan/status/1945676839168692732)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Albert Alan @_AlbertAlan on x 2893 followers

Created: 2025-07-17 02:48:02 UTC

Albert Alan @_AlbertAlan on x 2893 followers

Created: 2025-07-17 02:48:02 UTC

Dear $OPEN Investors and Broader Market Participants,

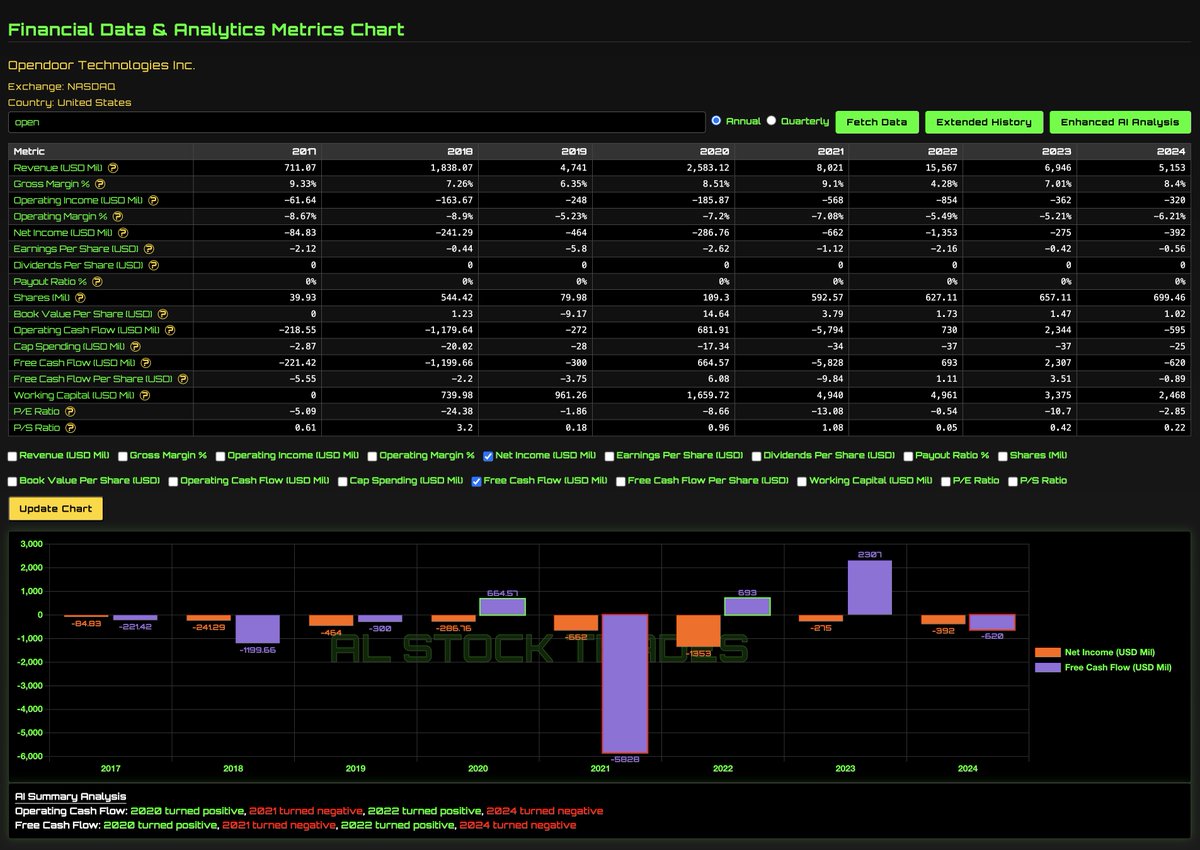

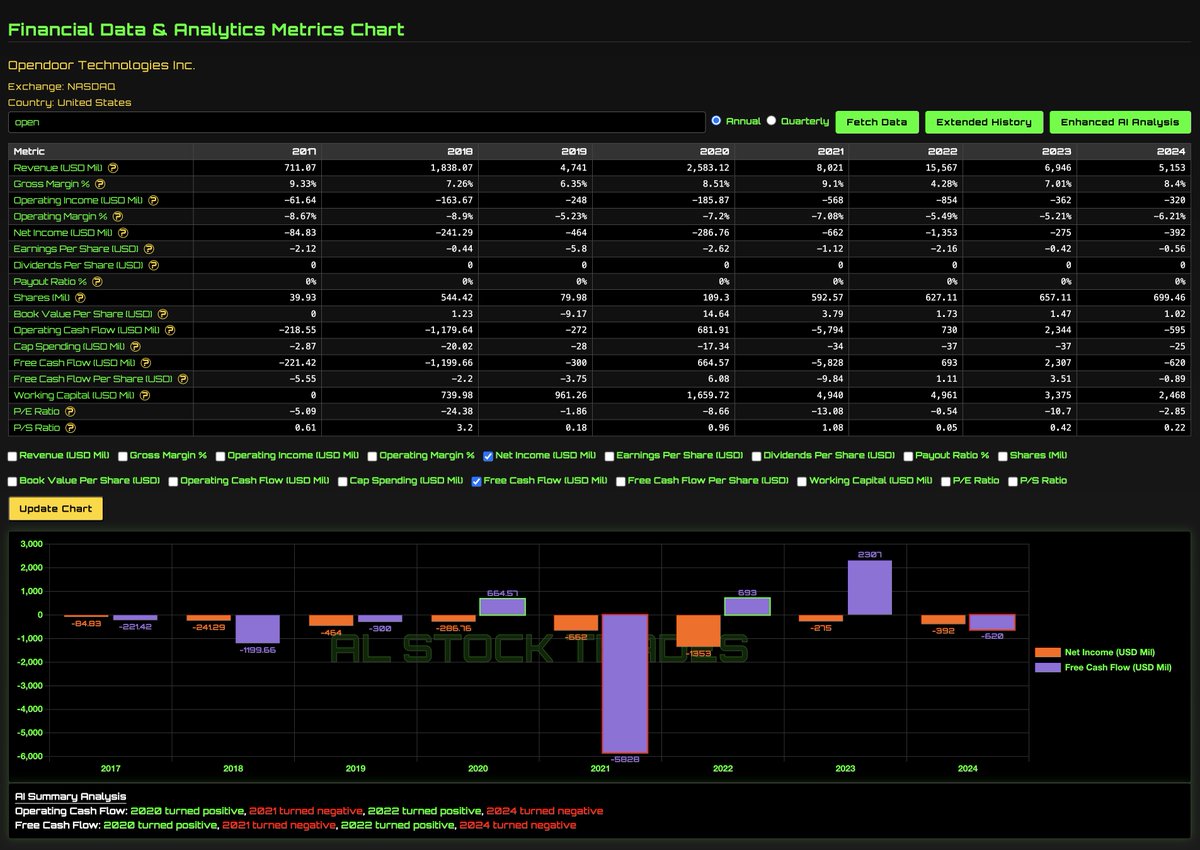

I wanted to take a moment to provide an educational perspective on the recent upward movement in Opendoor $OPEN stock. For those wondering whether this rally reflects a change in the company’s fundamentals—such as improved profitability, free cash flow growth, or enhanced intrinsic value the answer is, unfortunately, no. Our research continues to show no material improvement in key financial metrics. From a traditional value-investing lens such as that of Benjamin Graham or Warren Buffett there has been no underlying shift in the core business to warrant this price action.

Instead, what we are witnessing appears to be a coordinated effort, allegedly led by Eric Jackson, to generate retail investor enthusiasm in hopes of keeping the share price above $X for XX consecutive trading days. The goal of this campaign is to avoid either a 50-to-1 reverse stock split or a potential delisting from the exchange. While the effort is strategic in nature, it does not reflect a business turnaround. In fact, this kind of social media driven push resembles a synthetic version of insider buying a signal without the substance of operational change.

While high short interest (currently XXXXX% of float with XXXXX% utilization) creates the conditions for a possible short squeeze, the underlying fundamentals remain weak: the company is not net income positive, is not free cash flow positive, and shows no signs of consistent improvement. While a business recovery might be possible in the future perhaps aided by falling interest rates in 2026 investors should be cautious. Without real change in the business itself, this rally risks leaving late entrants "holding the bag."

@ericjackson if I'm missing something here please educate me?

XXXXXX engagements

Related Topics doubled cash flow $open open opendoor technologies inc