[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Compounding Lab [@CompoundingLab](/creator/twitter/CompoundingLab) on x XXX followers Created: 2025-07-16 17:58:00 UTC Stocks battle: $GD vs $NOC Here we can see that companies have been performing in tandem - with very comparable metrics in most categories. Stock returns for Northrop were XX% on average, outperforming General Dynamics by 4%. They both possess wide moat due to high switching costs, intangible assets and cost advantage. Companies primarily sell to a single buyer which is the procurement arm of the US Department of Defense. (This is referred to as a monopsony in economics textbooks) Valuation favours Northrop Grumman as more attractively priced in relation to intrinsic value.  XXX engagements  **Related Topics** [categories](/topic/categories) [$noc](/topic/$noc) [stocks](/topic/stocks) [$gd](/topic/$gd) [stocks industrials](/topic/stocks-industrials) [stocks defense](/topic/stocks-defense) [northrop grumman corp](/topic/northrop-grumman-corp) [Post Link](https://x.com/CompoundingLab/status/1945543455196803337)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-16 17:58:00 UTC

Compounding Lab @CompoundingLab on x XXX followers

Created: 2025-07-16 17:58:00 UTC

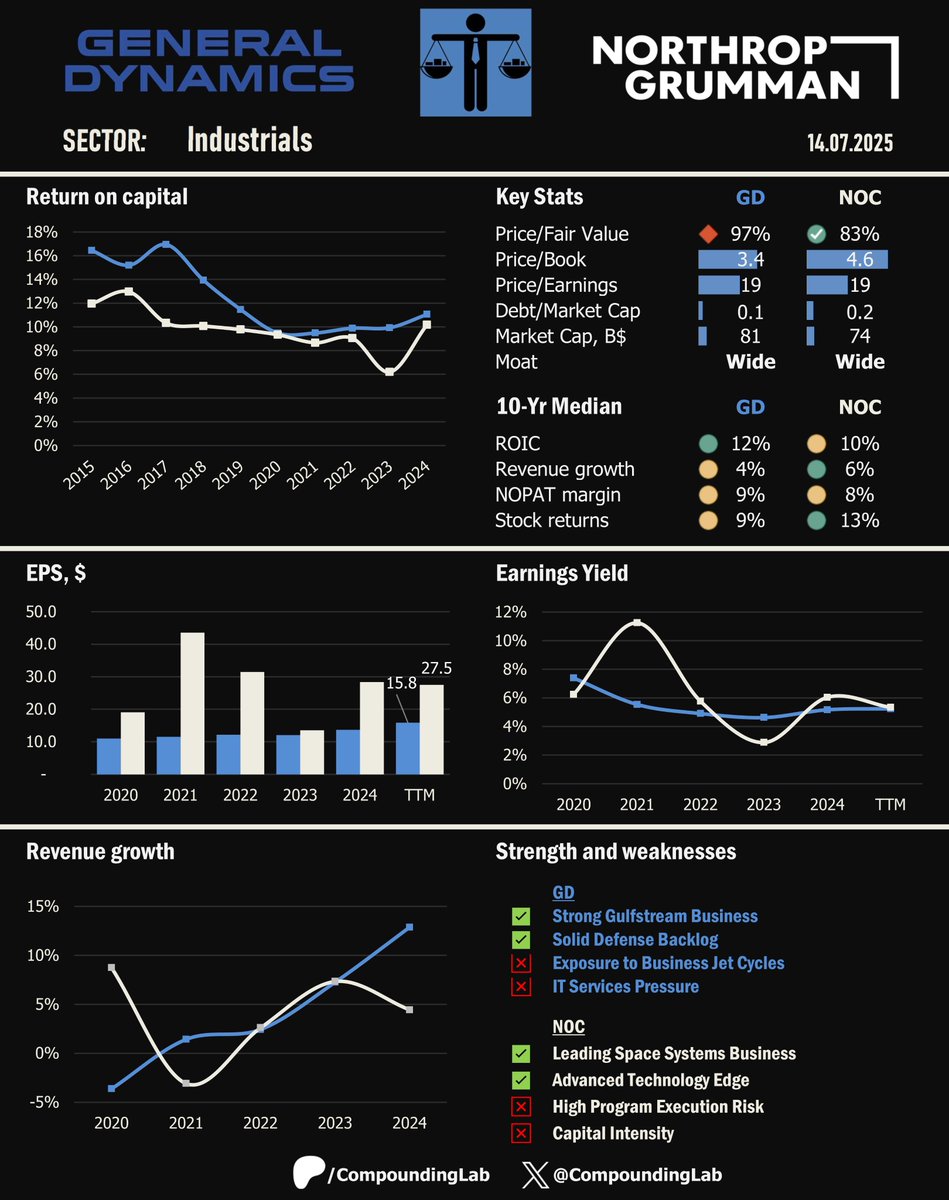

Stocks battle: $GD vs $NOC

Here we can see that companies have been performing in tandem - with very comparable metrics in most categories. Stock returns for Northrop were XX% on average, outperforming General Dynamics by 4%.

They both possess wide moat due to high switching costs, intangible assets and cost advantage.

Companies primarily sell to a single buyer which is the procurement arm of the US Department of Defense. (This is referred to as a monopsony in economics textbooks)

Valuation favours Northrop Grumman as more attractively priced in relation to intrinsic value.

XXX engagements

Related Topics categories $noc stocks $gd stocks industrials stocks defense northrop grumman corp