[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cryptovicci 🌐 [@cryptovicci](/creator/twitter/cryptovicci) on x 2452 followers Created: 2025-07-16 10:15:04 UTC 💵 How does D&A help $MARA with cash and taxes? Even though MARA already paid cash upfront for mining equipment (using capital raised in previous years), accounting rules let them spread the cost over time. Here’s the genius play: ✅ Depreciation is a non-cash expense ✅ It lowers paper profits → reduces taxes ✅ But MARA keeps real cash in the business The biggest win? It lets @MARA hold XXX% of its mined BTC since Q2-2024 when full HODL strategy initiated, unlike other miners who must sell to cover operating costs. At current Bitcoin prices, the ~$69,000 difference between accounting cost and cash cost per BTC is freed up as real cash for every coin mined. Q1 XXXXX BTC x 69K = ~$158 million freed up cash With Bitcoin at ATH, MARA sit on a growing treasury of hard assets = unforced, undiluted. ✅ CapEx paid years ago (PAST) ✅ D&A frees cash today (PRESENT) ✅ BTC holdings grow untouched (FUTURE) 🧠 Genius. #MARA #Bitcoin #Cashflow #AccountingAlpha #BTCtreasury  XXXXX engagements  **Related Topics** [$165k](/topic/$165k) [$1005k](/topic/$1005k) [$357k](/topic/$357k) [coins energy](/topic/coins-energy) [$117k](/topic/$117k) [accounting](/topic/accounting) [mining](/topic/mining) [$mara](/topic/$mara) [Post Link](https://x.com/cryptovicci/status/1945426951545532714)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptovicci 🌐 @cryptovicci on x 2452 followers

Created: 2025-07-16 10:15:04 UTC

Cryptovicci 🌐 @cryptovicci on x 2452 followers

Created: 2025-07-16 10:15:04 UTC

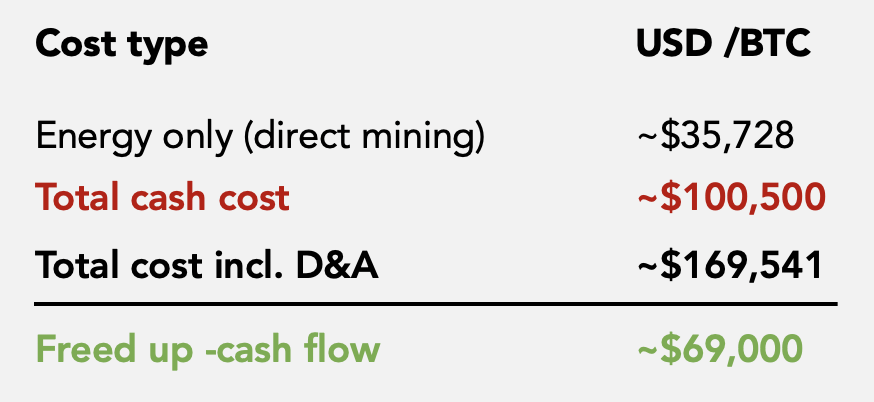

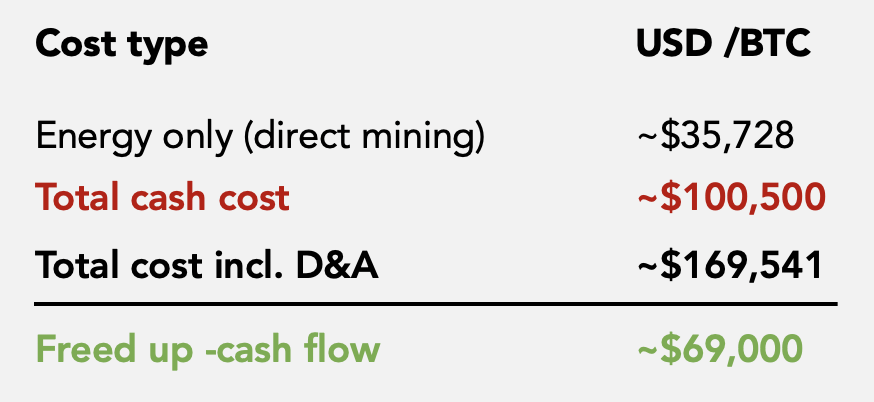

💵 How does D&A help $MARA with cash and taxes?

Even though MARA already paid cash upfront for mining equipment (using capital raised in previous years), accounting rules let them spread the cost over time.

Here’s the genius play: ✅ Depreciation is a non-cash expense ✅ It lowers paper profits → reduces taxes ✅ But MARA keeps real cash in the business

The biggest win? It lets @MARA hold XXX% of its mined BTC since Q2-2024 when full HODL strategy initiated, unlike other miners who must sell to cover operating costs.

At current Bitcoin prices, the ~$69,000 difference between accounting cost and cash cost per BTC is freed up as real cash for every coin mined.

Q1 XXXXX BTC x 69K = ~$158 million freed up cash

With Bitcoin at ATH, MARA sit on a growing treasury of hard assets = unforced, undiluted.

✅ CapEx paid years ago (PAST) ✅ D&A frees cash today (PRESENT) ✅ BTC holdings grow untouched (FUTURE)

🧠 Genius. #MARA #Bitcoin #Cashflow #AccountingAlpha #BTCtreasury

XXXXX engagements

Related Topics $165k $1005k $357k coins energy $117k accounting mining $mara