[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Convexititties, CFA [@convexititties](/creator/twitter/convexititties) on x 2637 followers Created: 2025-07-16 04:01:41 UTC Housing doomers, let’s not forget that the Fed also controls the pace of its MBS runoff. If it meaningfully curtails its runoff, the added liquidity alone could support a XXX bp decline in mortgage spreads, in my view. That would get you to XXXX% mortgage rates with a XXXX% 10-yr yield (today’s level). I know mortgage doomers are fully convinced that the long end will rise again if the Fed makes additional rate cuts, but, if the curve shifts in a parallel manner, you could get to X% mortgages with just XXX bps of cuts, or XXX% with XXX bps, which would result in a FFR of 2.75-3.00%, which is roughly neutral with the current inflation rate.  XXX engagements  **Related Topics** [rates](/topic/rates) [mortgage rate](/topic/mortgage-rate) [housing market](/topic/housing-market) [fed](/topic/fed) [federal reserve](/topic/federal-reserve) [Post Link](https://x.com/convexititties/status/1945332987475771572)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Convexititties, CFA @convexititties on x 2637 followers

Created: 2025-07-16 04:01:41 UTC

Convexititties, CFA @convexititties on x 2637 followers

Created: 2025-07-16 04:01:41 UTC

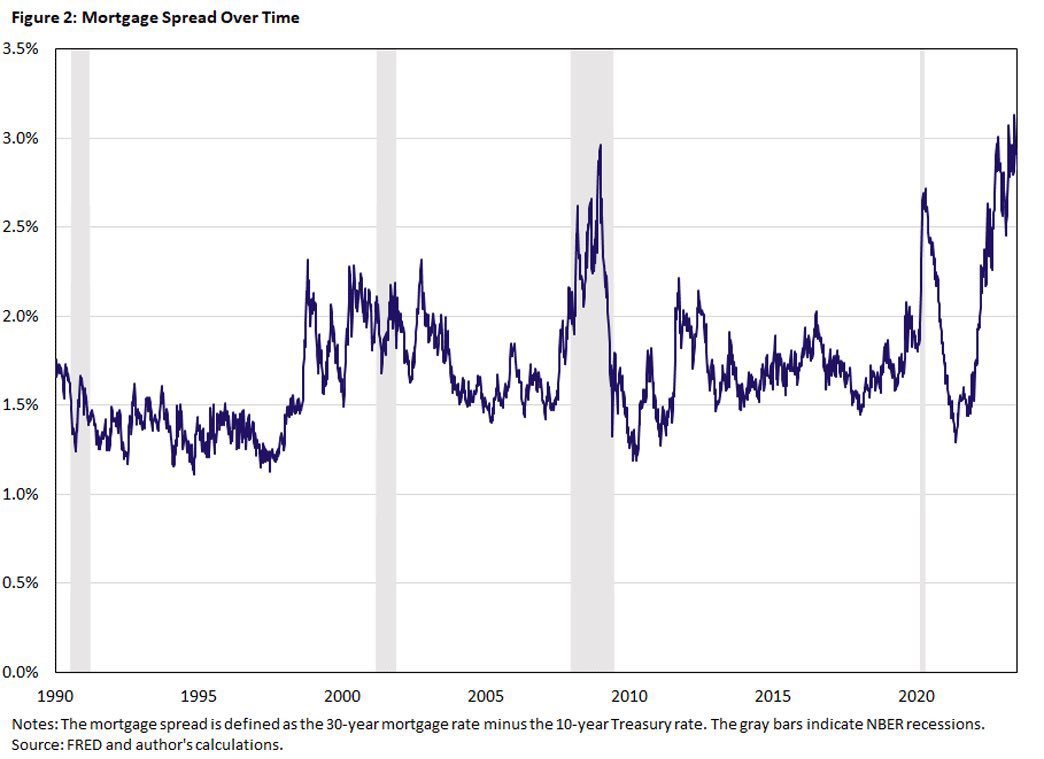

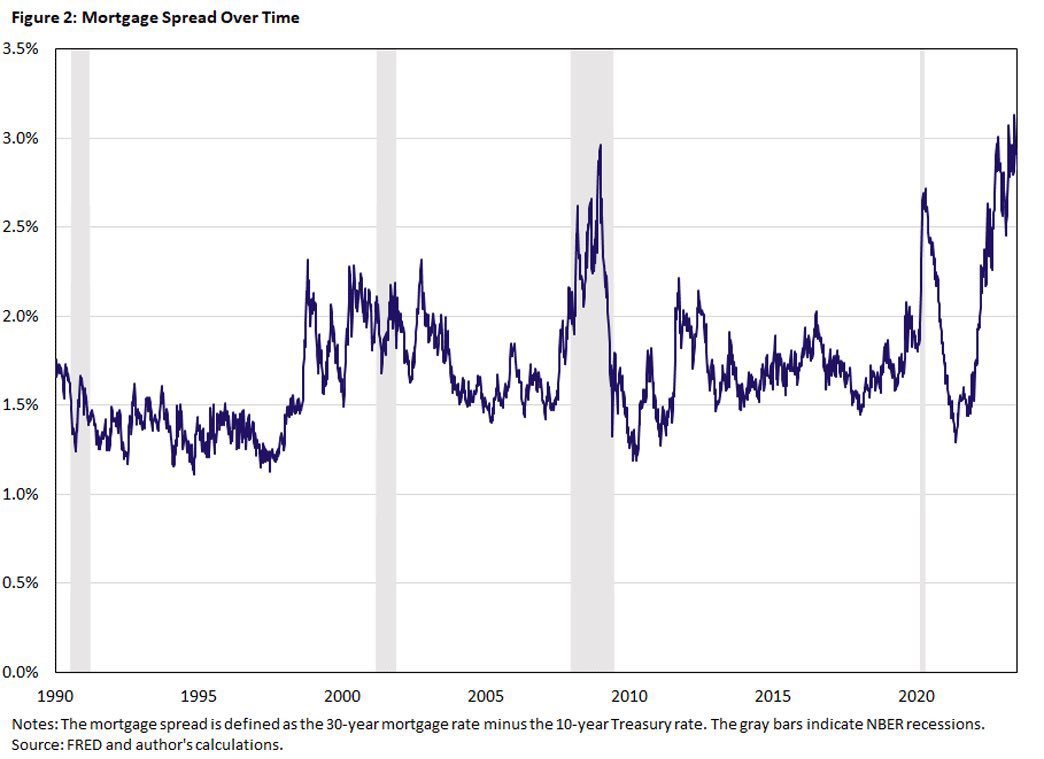

Housing doomers, let’s not forget that the Fed also controls the pace of its MBS runoff. If it meaningfully curtails its runoff, the added liquidity alone could support a XXX bp decline in mortgage spreads, in my view. That would get you to XXXX% mortgage rates with a XXXX% 10-yr yield (today’s level). I know mortgage doomers are fully convinced that the long end will rise again if the Fed makes additional rate cuts, but, if the curve shifts in a parallel manner, you could get to X% mortgages with just XXX bps of cuts, or XXX% with XXX bps, which would result in a FFR of 2.75-3.00%, which is roughly neutral with the current inflation rate.

XXX engagements

Related Topics rates mortgage rate housing market fed federal reserve