[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Houssam Kayyal حسام كيال [@hkayyal](/creator/twitter/hkayyal) on x XXX followers Created: 2025-07-15 15:55:42 UTC Tracxn’s UAE Tech H1 2025 Report shows a major funding rebound: $1B was raised, up XXX% from H2 2024 ($438M), though still XX% below H1 2024 ($1.8B). Late-stage funding drove the recovery, jumping to $817M (+583% vs H2 2024). Seed funding fell sharply to $32.7M (–74%), while early-stage funding hit $167M (–13% vs H2 2024, +4% vs H1 2024). Enterprise apps led with $728M, followed by fintech ($286M) and retail ($172M). Big deals: Vista Global ($600M) and Tabby ($160M). Dubai startups dominated with XX% of total funding. Top investors included XXX Global, Wamda Capital, and MEVP. Despite weaker seed activity, strong late-stage rounds reaffirm UAE’s resilience as a leading MENA tech hub. #UAE #Tech #Startups #Investment  XXX engagements  **Related Topics** [fintech](/topic/fintech) [$728m](/topic/$728m) [$167m](/topic/$167m) [$327m](/topic/$327m) [$817m](/topic/$817m) [$18b](/topic/$18b) [$438m](/topic/$438m) [h2](/topic/h2) [Post Link](https://x.com/hkayyal/status/1945150287024386276)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Houssam Kayyal حسام كيال @hkayyal on x XXX followers

Created: 2025-07-15 15:55:42 UTC

Houssam Kayyal حسام كيال @hkayyal on x XXX followers

Created: 2025-07-15 15:55:42 UTC

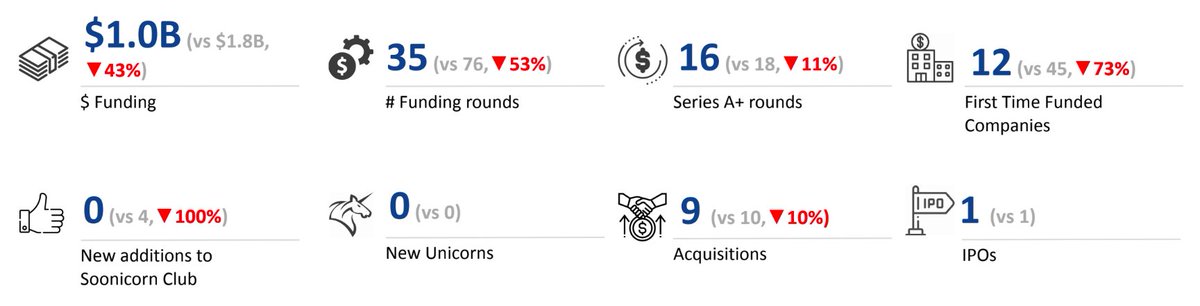

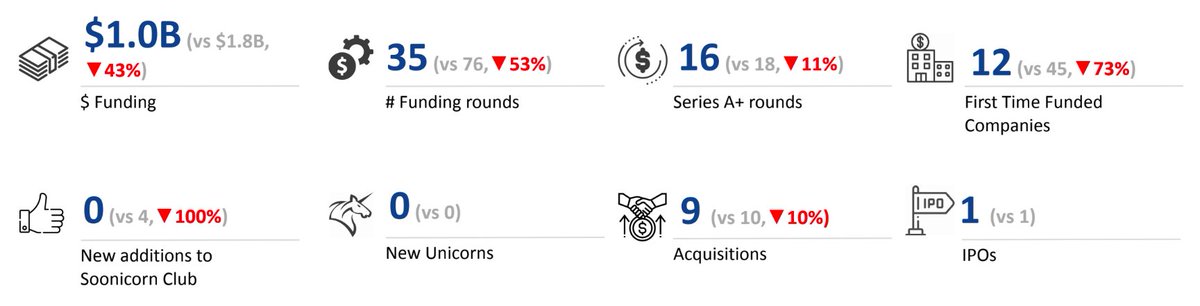

Tracxn’s UAE Tech H1 2025 Report shows a major funding rebound: $1B was raised, up XXX% from H2 2024 ($438M), though still XX% below H1 2024 ($1.8B).

Late-stage funding drove the recovery, jumping to $817M (+583% vs H2 2024). Seed funding fell sharply to $32.7M (–74%), while early-stage funding hit $167M (–13% vs H2 2024, +4% vs H1 2024).

Enterprise apps led with $728M, followed by fintech ($286M) and retail ($172M). Big deals: Vista Global ($600M) and Tabby ($160M). Dubai startups dominated with XX% of total funding.

Top investors included XXX Global, Wamda Capital, and MEVP. Despite weaker seed activity, strong late-stage rounds reaffirm UAE’s resilience as a leading MENA tech hub.

#UAE #Tech #Startups #Investment

XXX engagements

Related Topics fintech $728m $167m $327m $817m $18b $438m h2