[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mo Hossain [@MoHossain](/creator/twitter/MoHossain) on x 6306 followers Created: 2025-07-15 01:30:18 UTC Could Japanification be an option? Builders’ mortgage-rate buydowns, which temporarily masked weak home sales, have become cost-prohibitive and are being phased out. This shift is triggering declines in new-home activity and flat-to-falling prices under X% mortgage rates, even as inventories rise. As homeowners eventually decide to relocate—particularly in less-mobile, economically stagnant, lower-income cities—housing may become a pronounced drag on the economy. Will the downturn be confined to pandemic “rush-belt” markets, or will it evolve into a broad-based slump? And might the slide deepen further under the looming effects of OBBB on health care, higher education and student-loan dynamics, nonprofit budgets, federal debt pressures, immigration, and AI-disrupted job markets? 🔻 Builders’ Mortgage Aid Lifts Home Prices, Morgan Stanley Says - Bloomberg ht @RudyHavenstein @wolfofwolfst @VladTheInflator @nickgerli1  XXX engagements  **Related Topics** [rates](/topic/rates) [mortgage rate](/topic/mortgage-rate) [housing market](/topic/housing-market) [Post Link](https://x.com/MoHossain/status/1944932503980270008)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mo Hossain @MoHossain on x 6306 followers

Created: 2025-07-15 01:30:18 UTC

Mo Hossain @MoHossain on x 6306 followers

Created: 2025-07-15 01:30:18 UTC

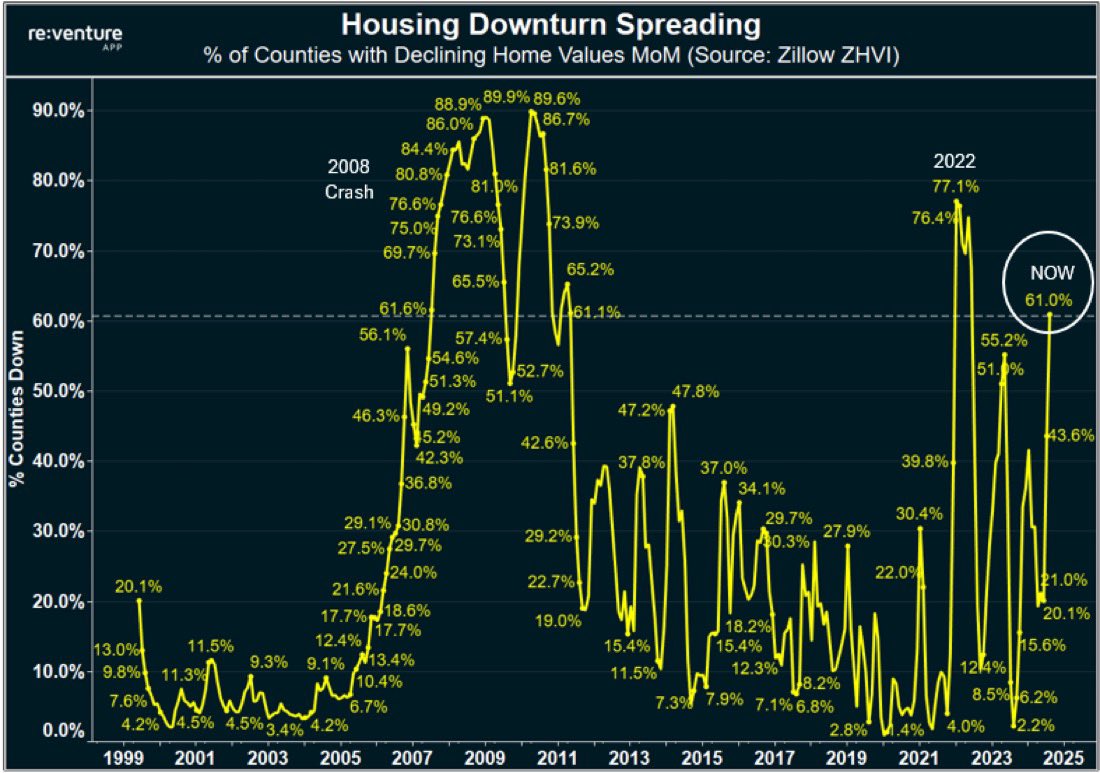

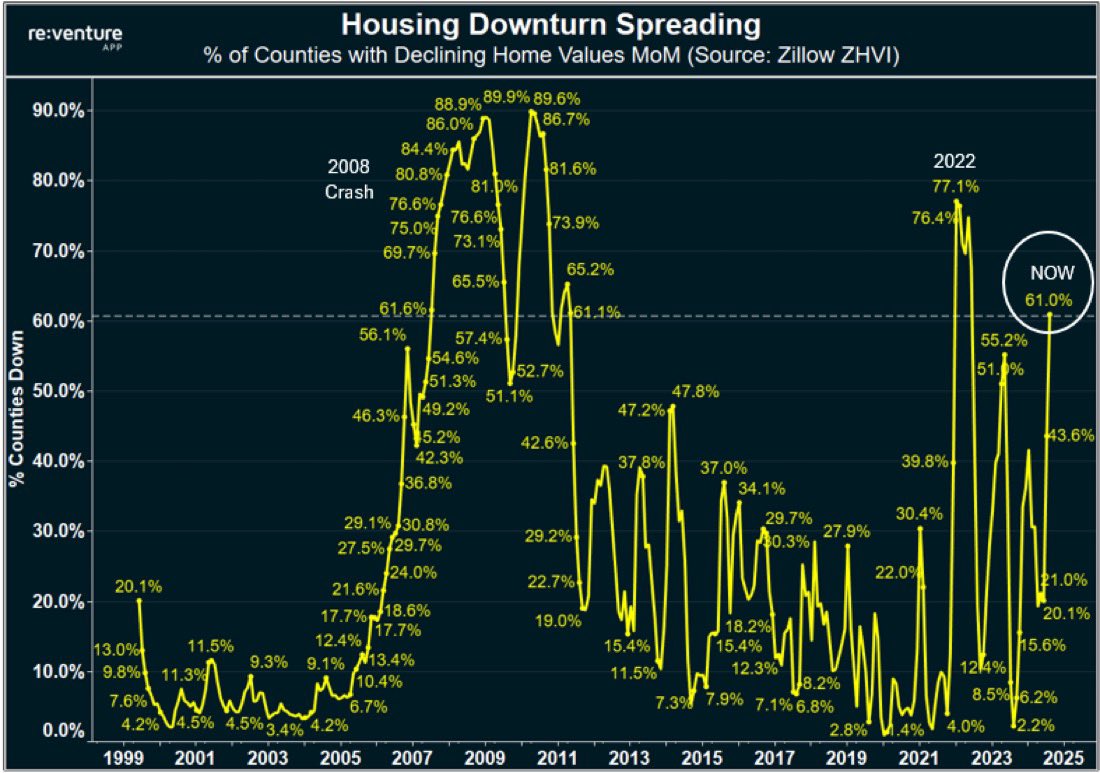

Could Japanification be an option?

Builders’ mortgage-rate buydowns, which temporarily masked weak home sales, have become cost-prohibitive and are being phased out. This shift is triggering declines in new-home activity and flat-to-falling prices under X% mortgage rates, even as inventories rise.

As homeowners eventually decide to relocate—particularly in less-mobile, economically stagnant, lower-income cities—housing may become a pronounced drag on the economy. Will the downturn be confined to pandemic “rush-belt” markets, or will it evolve into a broad-based slump? And might the slide deepen further under the looming effects of OBBB on health care, higher education and student-loan dynamics, nonprofit budgets, federal debt pressures, immigration, and AI-disrupted job markets? 🔻

Builders’ Mortgage Aid Lifts Home Prices, Morgan Stanley Says - Bloomberg ht @RudyHavenstein @wolfofwolfst @VladTheInflator @nickgerli1

XXX engagements

Related Topics rates mortgage rate housing market