[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  AltayCap [@AltayCapital](/creator/twitter/AltayCapital) on x 12.7K followers Created: 2025-07-14 22:36:27 UTC TOC 8841. JPY ¥705/share today. Deeply discounted real estate company. ¥62bn jmcap, back out ncav valued at ¥32bn ish. FMV (appraisals) vs book value of RE reveals gap of ¥115 bn ish of value. In 2007 management tried to take private at ¥800/share there was a counter bid at ¥1,100 which was raised to ¥1,300. Couldn't get enough shares to tender at that price so deal died. It's been dead money since. I like it today because 1) TSE reforms pushing for better capital efficiency. 2) co has been doing buybacks. 3) The president (family owns a huge stake) died in January. Taxes due Nov. 4) real estate has been the focus of take probates and are easy to finance. I like this idea because downside looks muted. This is not very volatile. Current numbers suck because main property was emptied out for renovations and is getting leased back up. Also not a nanocap. Mcap is $420million.  XXXXX engagements  **Related Topics** [money](/topic/money) [stocks](/topic/stocks) [coins real estate](/topic/coins-real-estate) [japanese yen](/topic/japanese-yen) [Post Link](https://x.com/AltayCapital/status/1944888753732116788)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

AltayCap @AltayCapital on x 12.7K followers

Created: 2025-07-14 22:36:27 UTC

AltayCap @AltayCapital on x 12.7K followers

Created: 2025-07-14 22:36:27 UTC

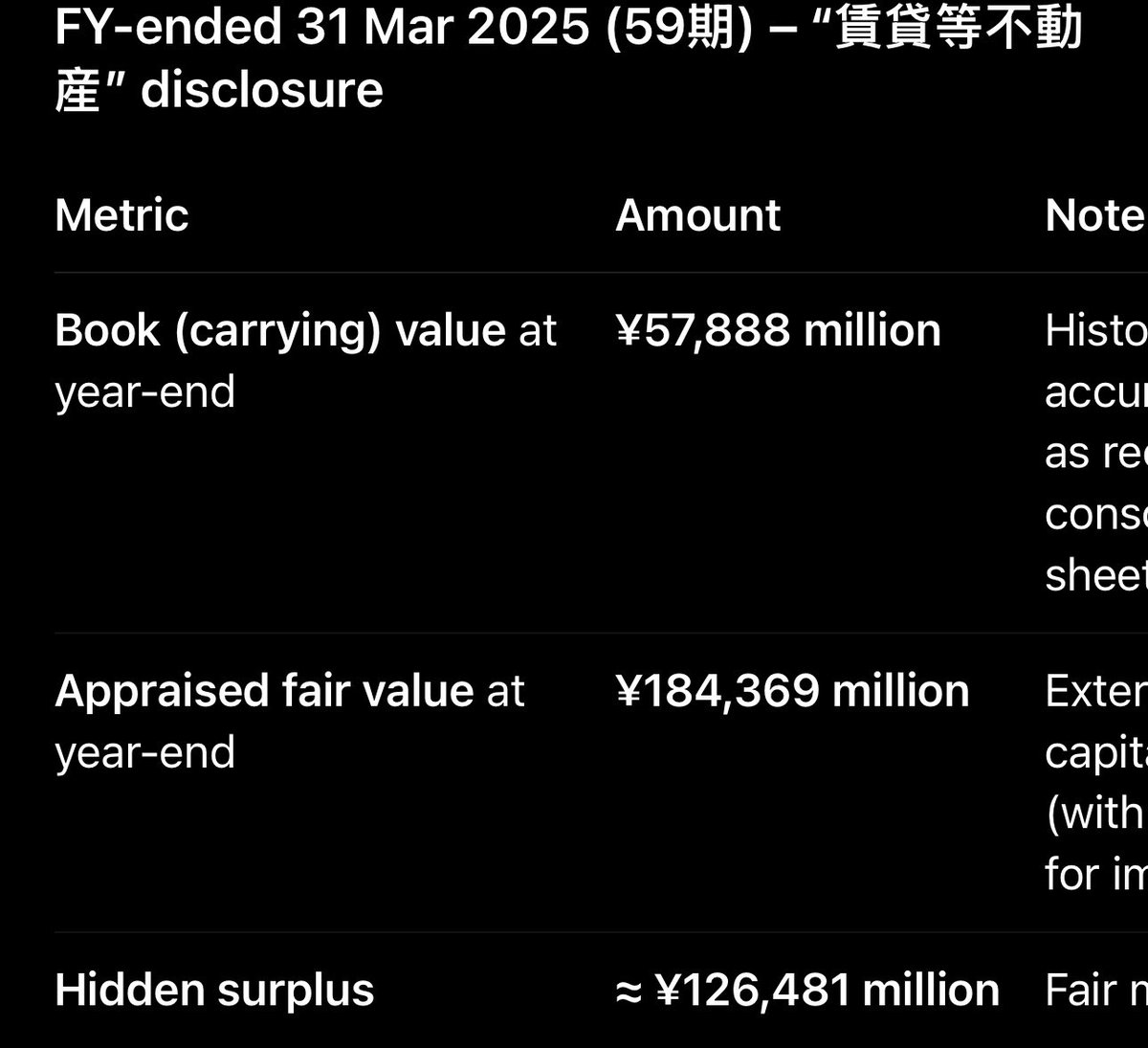

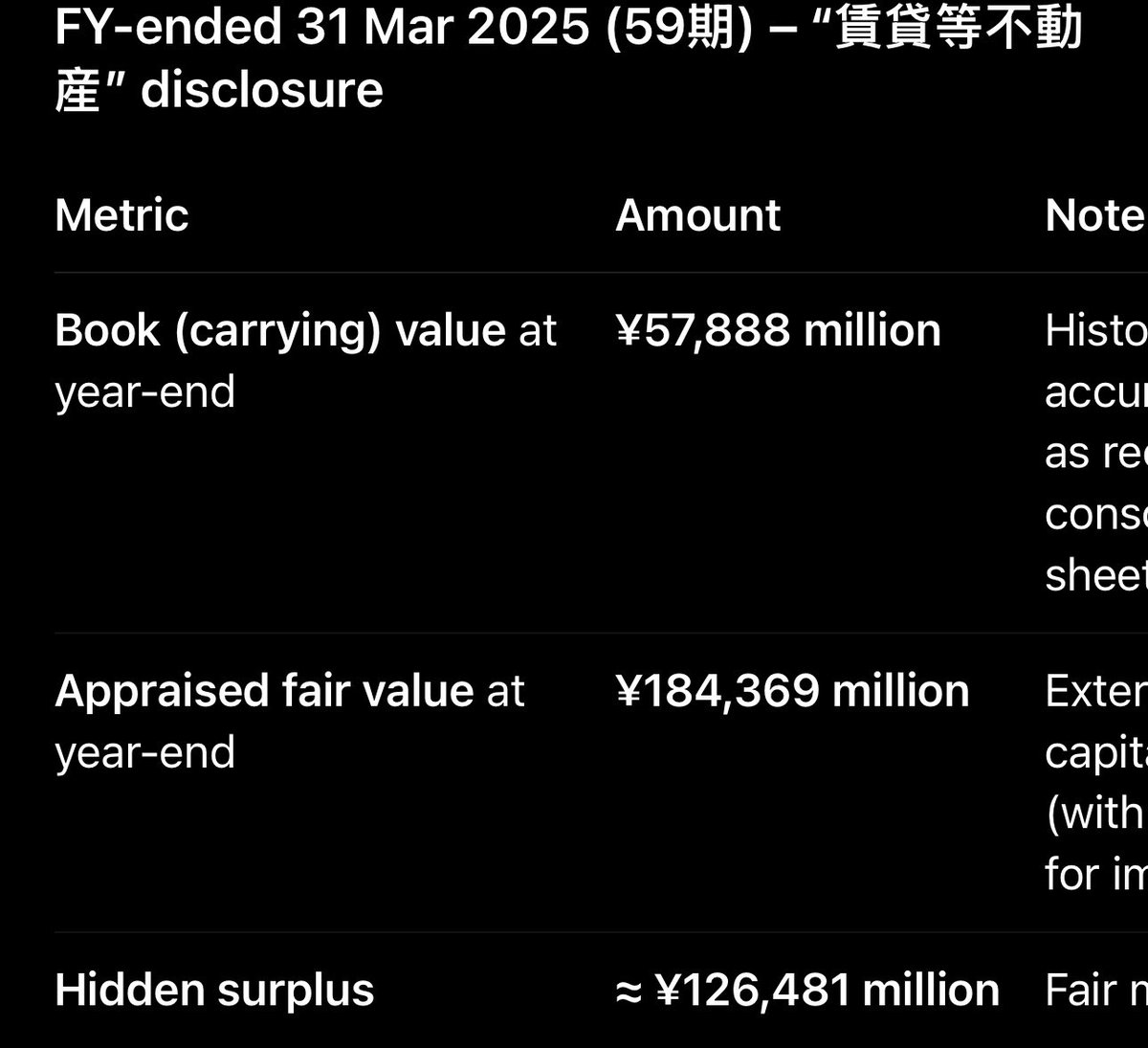

TOC 8841. JPY ¥705/share today. Deeply discounted real estate company. ¥62bn jmcap, back out ncav valued at ¥32bn ish. FMV (appraisals) vs book value of RE reveals gap of ¥115 bn ish of value. In 2007 management tried to take private at ¥800/share there was a counter bid at ¥1,100 which was raised to ¥1,300. Couldn't get enough shares to tender at that price so deal died. It's been dead money since.

I like it today because 1) TSE reforms pushing for better capital efficiency. 2) co has been doing buybacks. 3) The president (family owns a huge stake) died in January. Taxes due Nov. 4) real estate has been the focus of take probates and are easy to finance.

I like this idea because downside looks muted. This is not very volatile. Current numbers suck because main property was emptied out for renovations and is getting leased back up. Also not a nanocap. Mcap is $420million.

XXXXX engagements

Related Topics money stocks coins real estate japanese yen