[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Richie B [@wannabefresh](/creator/twitter/wannabefresh) on x 5828 followers Created: 2025-07-14 16:41:53 UTC Random Thought. Here's a simple way to understand the value of @YieldMaxETFs: People love to yell “NAV erosion!” or “You’re missing out on growth!” but they’re missing the bigger picture. Owning these assets have a similar concept of being a day trader. Most day traders set aside a specific pool of capital just to run plays, quick moves, short-term income. They’re not using that capital for long-term growth. It’s a separate strategy, with a different purpose. High-yield ETFs work the same way. Take $PLTY for example. I own XXXXXX shares with a $XXXXX average. If I were trading, I’d constantly stress over when to sell. $68? Wait longer? Take profit? What if it dips? But with YieldMax doing the work, I don’t need to time anything. I get paid monthly, regardless of price action, and I still own every share. No selling. No stressing. No screen-watching. Just passive cash flow while I focus on other businesses. If we celebrate traders for running their plays, why shame income investors for doing the same, just smarter and more hands-off? 💡TLDR: High-yield ETFs are like hiring a trader to generate income for you… without lifting a finger. Example below, I don't have to worry about selling. I'll let YM do it for me while retaining my shares. 🫡  XXXXXX engagements  **Related Topics** [trader](/topic/trader) [nav](/topic/nav) [Post Link](https://x.com/wannabefresh/status/1944799524192706809)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Richie B @wannabefresh on x 5828 followers

Created: 2025-07-14 16:41:53 UTC

Richie B @wannabefresh on x 5828 followers

Created: 2025-07-14 16:41:53 UTC

Random Thought. Here's a simple way to understand the value of @YieldMaxETFs:

People love to yell “NAV erosion!” or “You’re missing out on growth!” but they’re missing the bigger picture.

Owning these assets have a similar concept of being a day trader.

Most day traders set aside a specific pool of capital just to run plays, quick moves, short-term income. They’re not using that capital for long-term growth. It’s a separate strategy, with a different purpose.

High-yield ETFs work the same way.

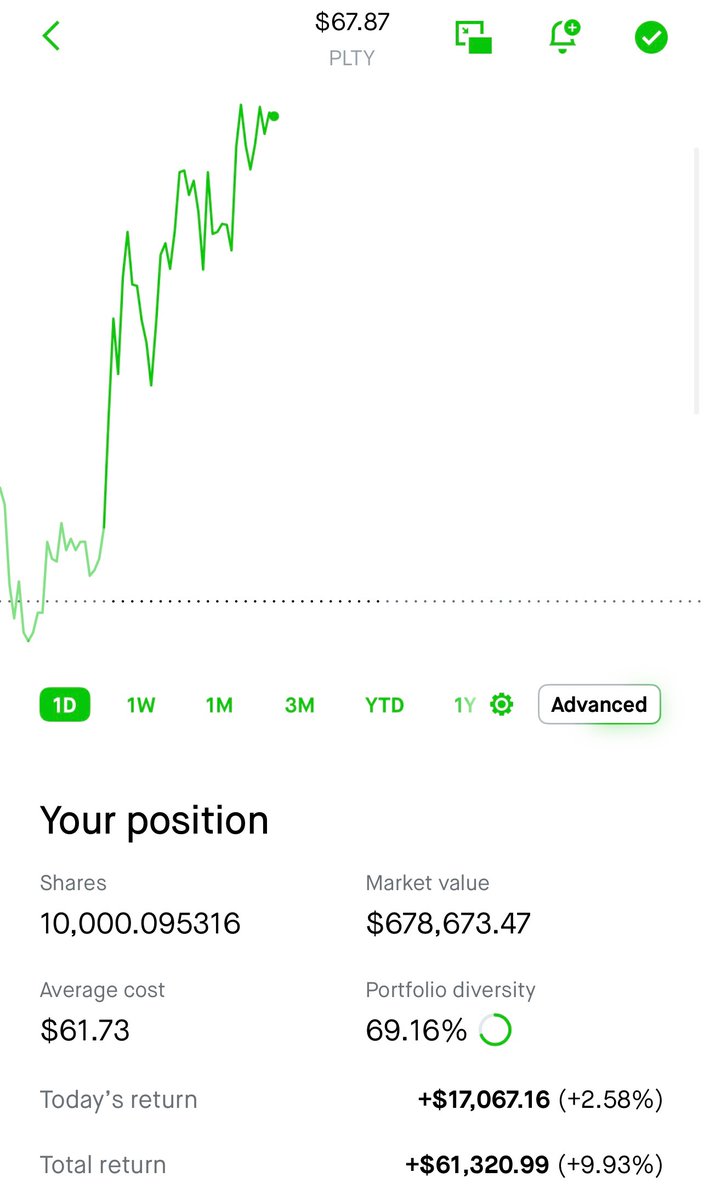

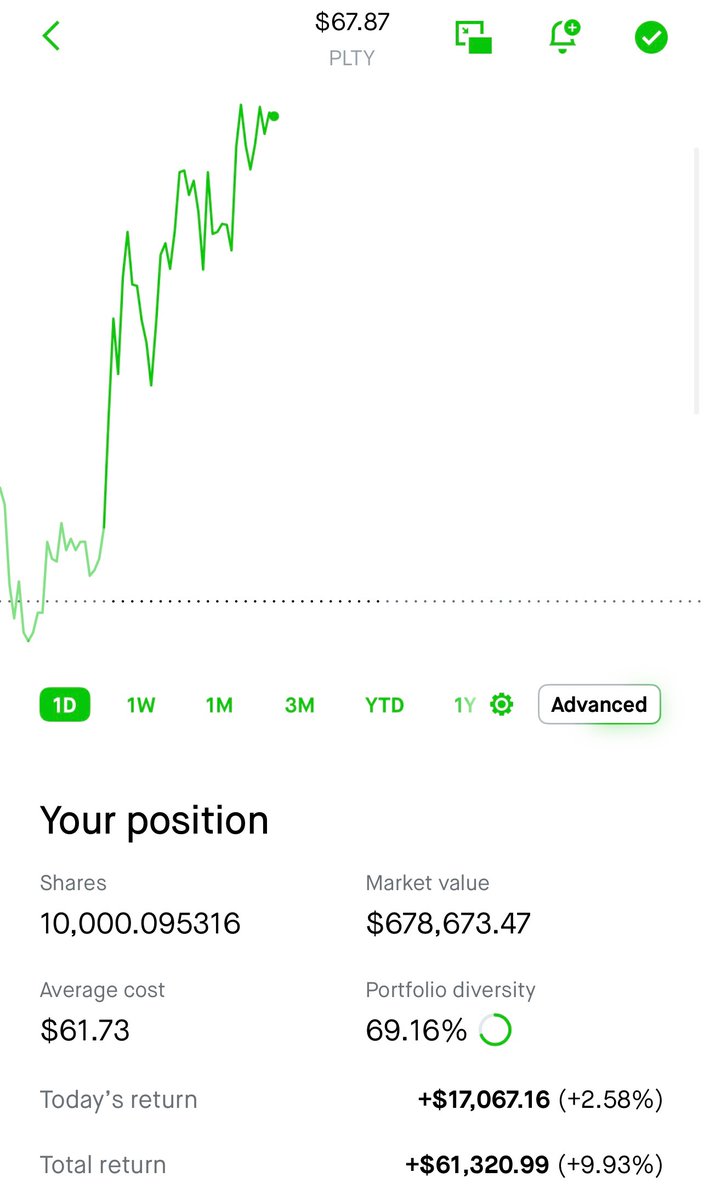

Take $PLTY for example. I own XXXXXX shares with a $XXXXX average. If I were trading, I’d constantly stress over when to sell. $68? Wait longer? Take profit? What if it dips?

But with YieldMax doing the work, I don’t need to time anything. I get paid monthly, regardless of price action, and I still own every share.

No selling. No stressing. No screen-watching. Just passive cash flow while I focus on other businesses.

If we celebrate traders for running their plays, why shame income investors for doing the same, just smarter and more hands-off?

💡TLDR: High-yield ETFs are like hiring a trader to generate income for you… without lifting a finger. Example below, I don't have to worry about selling. I'll let YM do it for me while retaining my shares. 🫡

XXXXXX engagements