[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  David Auerbach ⭕️ [@DailyREITBeat](/creator/twitter/DailyREITBeat) on x 3886 followers Created: 2025-07-14 13:14:16 UTC REITs were again relatively active on the capital-raising front this week, announcing a combined $1B in total fundraising activity following a combined haul of over $5B in the prior three weeks. Net lease REIT WP Carey (WPC) raised $400M via an underwritten public offering of five-year senior notes due 2030 at a XXXX% interest rate. Mall REIT CBL Properties (CBL) closed on a $78.0M non-recourse loan secured by Cross Creek Mall in Fayetteville, NC. The new five-year loan bears a fixed interest rate of 6.856%, and proceeds from the loan were used to retire the existing $81.9M loan secured by the property, which bore an interest rate of XXXX% and was scheduled to mature in August 2025. Apartment REIT Veris Residential (VRE) amended its $500M credit facility established in April 2024, noting that the transaction "reflects its continued progress in advancing its 2025 corporate plan to sell non-strategic assets and reduce leverage." The jump in capital-raising activity in recent weeks follows a slow start to 2025 as REITs continue to wait for a significant pullback in interest rates to refinance their longer-term debt.  XX engagements  **Related Topics** [$780m](/topic/$780m) [fed rate](/topic/fed-rate) [primary market](/topic/primary-market) [$400m](/topic/$400m) [reit](/topic/reit) [$5b](/topic/$5b) [$1b](/topic/$1b) [Post Link](https://x.com/DailyREITBeat/status/1944747275936285139)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

David Auerbach ⭕️ @DailyREITBeat on x 3886 followers

Created: 2025-07-14 13:14:16 UTC

David Auerbach ⭕️ @DailyREITBeat on x 3886 followers

Created: 2025-07-14 13:14:16 UTC

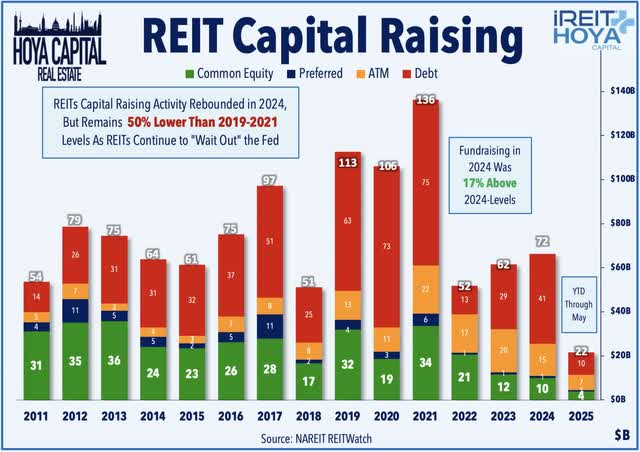

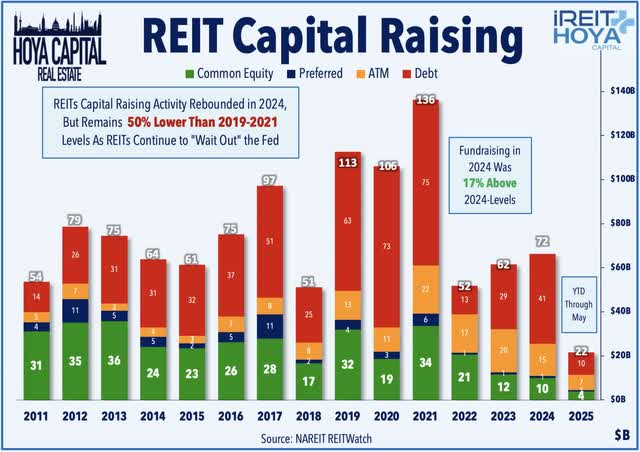

REITs were again relatively active on the capital-raising front this week, announcing a combined $1B in total fundraising activity following a combined haul of over $5B in the prior three weeks. Net lease REIT WP Carey (WPC) raised $400M via an underwritten public offering of five-year senior notes due 2030 at a XXXX% interest rate. Mall REIT CBL Properties (CBL) closed on a $78.0M non-recourse loan secured by Cross Creek Mall in Fayetteville, NC. The new five-year loan bears a fixed interest rate of 6.856%, and proceeds from the loan were used to retire the existing $81.9M loan secured by the property, which bore an interest rate of XXXX% and was scheduled to mature in August 2025. Apartment REIT Veris Residential (VRE) amended its $500M credit facility established in April 2024, noting that the transaction "reflects its continued progress in advancing its 2025 corporate plan to sell non-strategic assets and reduce leverage." The jump in capital-raising activity in recent weeks follows a slow start to 2025 as REITs continue to wait for a significant pullback in interest rates to refinance their longer-term debt.

XX engagements

Related Topics $780m fed rate primary market $400m reit $5b $1b