[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  David Auerbach ⭕️ [@DailyREITBeat](/creator/twitter/DailyREITBeat) on x 3884 followers Created: 2025-07-14 13:14:06 UTC Canadian REIT H&R Real Estate Investment Trust (HR.UN:CA), the 11th largest Canada-listed REIT, surged XX% this week on reports that Blackstone (BX), TPG Inc. (TPG), and one of Canada's largest pension plans are in talks to buy H&R's residential and industrial properties. The company announced that it formed a special committee in February after receiving an unsolicited expression of interest. H&R has since received other proposals and is in discussions over these non-binding offers. As discussed in our article last September, H&R REIT is in the midst of a multiyear portfolio repositioning, seeking to close a steep valuation discount by trimming its portfolio to focus on multifamily and industrial properties while reducing its office and retail exposure. Prior to the strategy shift, the company had XX% exposure to office and XX% in retail (65% combined) but was able to reduce it to roughly XX% and XX% (29% combined) in X years through $2.5B in asset sales, essentially all of which has been allocated towards paying down debt. Management believes the stock still trades with "office REIT valuations" despite nearing the completion of this office divestment strategy.  XX engagements  **Related Topics** [investment](/topic/investment) [housing market](/topic/housing-market) [coins real estate](/topic/coins-real-estate) [reit](/topic/reit) [tpg inc](/topic/tpg-inc) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/DailyREITBeat/status/1944747233225666972)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

David Auerbach ⭕️ @DailyREITBeat on x 3884 followers

Created: 2025-07-14 13:14:06 UTC

David Auerbach ⭕️ @DailyREITBeat on x 3884 followers

Created: 2025-07-14 13:14:06 UTC

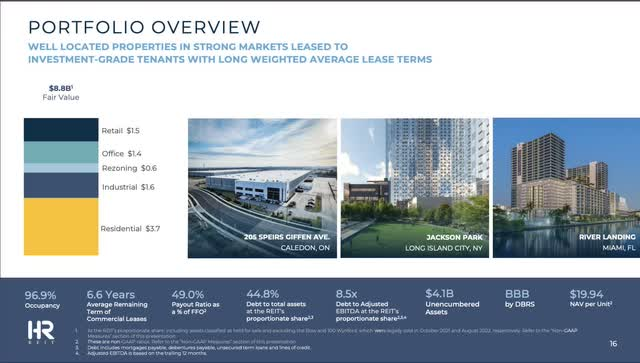

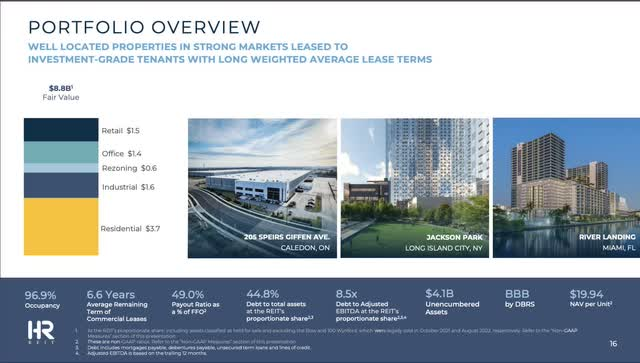

Canadian REIT H&R Real Estate Investment Trust (HR.UN:CA), the 11th largest Canada-listed REIT, surged XX% this week on reports that Blackstone (BX), TPG Inc. (TPG), and one of Canada's largest pension plans are in talks to buy H&R's residential and industrial properties. The company announced that it formed a special committee in February after receiving an unsolicited expression of interest. H&R has since received other proposals and is in discussions over these non-binding offers. As discussed in our article last September, H&R REIT is in the midst of a multiyear portfolio repositioning, seeking to close a steep valuation discount by trimming its portfolio to focus on multifamily and industrial properties while reducing its office and retail exposure. Prior to the strategy shift, the company had XX% exposure to office and XX% in retail (65% combined) but was able to reduce it to roughly XX% and XX% (29% combined) in X years through $2.5B in asset sales, essentially all of which has been allocated towards paying down debt. Management believes the stock still trades with "office REIT valuations" despite nearing the completion of this office divestment strategy.

XX engagements

Related Topics investment housing market coins real estate reit tpg inc stocks financial services