[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Neil Sethi [@neilksethi](/creator/twitter/neilksethi) on x 12.4K followers Created: 2025-07-14 12:00:45 UTC Japan's sovereign bond yields (JGBs) continued to push higher led by the 40-yr jumping 17bps and the 20-yr hitting fresh 25-yr highs which BBG attributes to "thin liquidity and increasing worries about higher government spending in Japan... heightened by the looming election on July 20." But that latter concern is a global one. In Germany, long-term borrowing costs were on course to hit their highest since 2011 amid concern over tariffs and extra government spending. In Japan, focus has intensified on the nation’s upper house election, with several local Japanese media polls pointing to the possibility the ruling bloc may lose its majority. Politicians have been wooing voters with promises of more government spending and tax cuts, which would increase the nation’s debt load. The country has a debt-to-GDP ratio of XXX% according to the IMF, the largest among developed economies. Yields also rose in response to a report from Bloomberg that Bank of Japan officials are likely to consider raising at least one of their inflation forecasts at a policy meeting later this month. “Long-ended JGBs are selling off nastily yet again toward the end of Tokyo’s day and that’s casting a shadow on Europe’s morning by reemphasizing concerns that bond markets are fragile heading into critical US inflation data later this week” — Garfield Reynolds, BBG MLIV Team Leader, Sydney.  XXXXX engagements  **Related Topics** [bloomberg](/topic/bloomberg) [germany](/topic/germany) [japan](/topic/japan) [government spending](/topic/government-spending) [fixed income](/topic/fixed-income) [Post Link](https://x.com/neilksethi/status/1944728774689305066)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-14 12:00:45 UTC

Neil Sethi @neilksethi on x 12.4K followers

Created: 2025-07-14 12:00:45 UTC

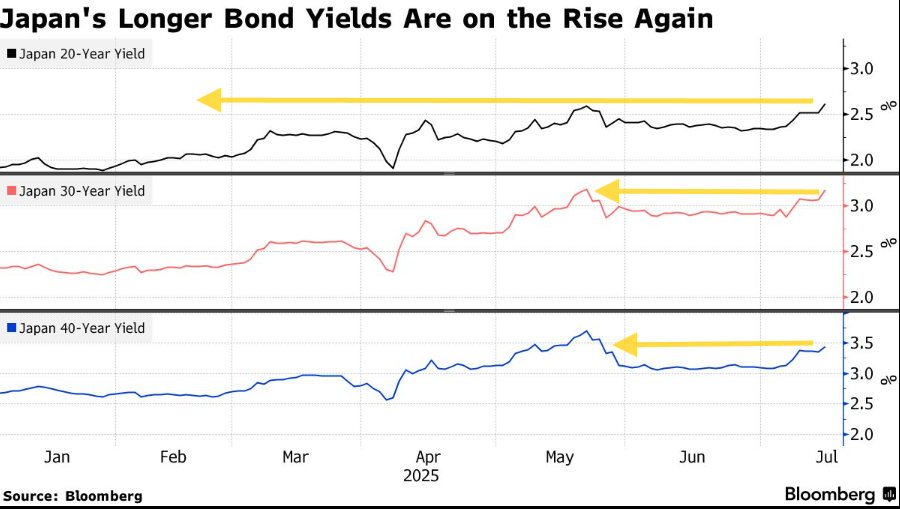

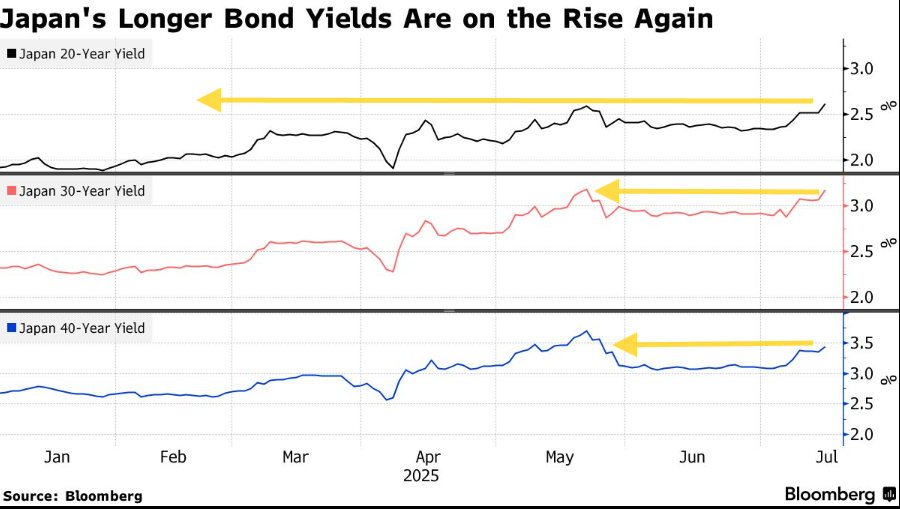

Japan's sovereign bond yields (JGBs) continued to push higher led by the 40-yr jumping 17bps and the 20-yr hitting fresh 25-yr highs which BBG attributes to "thin liquidity and increasing worries about higher government spending in Japan... heightened by the looming election on July 20."

But that latter concern is a global one. In Germany, long-term borrowing costs were on course to hit their highest since 2011 amid concern over tariffs and extra government spending.

In Japan, focus has intensified on the nation’s upper house election, with several local Japanese media polls pointing to the possibility the ruling bloc may lose its majority. Politicians have been wooing voters with promises of more government spending and tax cuts, which would increase the nation’s debt load. The country has a debt-to-GDP ratio of XXX% according to the IMF, the largest among developed economies.

Yields also rose in response to a report from Bloomberg that Bank of Japan officials are likely to consider raising at least one of their inflation forecasts at a policy meeting later this month.

“Long-ended JGBs are selling off nastily yet again toward the end of Tokyo’s day and that’s casting a shadow on Europe’s morning by reemphasizing concerns that bond markets are fragile heading into critical US inflation data later this week” — Garfield Reynolds, BBG MLIV Team Leader, Sydney.

XXXXX engagements

Related Topics bloomberg germany japan government spending fixed income