[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Crypto Observer [@DJ_Bax01](/creator/twitter/DJ_Bax01) on x 3990 followers Created: 2025-07-14 09:34:51 UTC $HBAR Hedera Hashgraph 🧨 Hedera strikes again! 🧨 Tell the world, this ground breaking news needs to be heard. $HBAR 🚀🚀 Digital Assets Breakthrough: UK Pioneers Tokenized Trading with Hedera Hashgraph In a groundbreaking move, Aberdeen Investments, Lloyds Banking Group, and Archax have completed the UK’s first use of digital assets, marking a significant milestone in financial innovation. Announced on July 14, 2025, this landmark collaboration leverages cutting-edge blockchain technology to tokenize real-world assets (RWAs), with a spotlight on the Hedera Hashgraph platform. This initiative saw tokenized units of Aberdeen’s money market fund (MMF) and UK gilts used as collateral in a foreign exchange trade, securely executed on Archax’s UK FCA-regulated digital asset exchange, built on Hedera’s public permissioned blockchain. The trade, valued at $XXX trillion in FX and interest rate derivatives daily, showcases how digital assets can streamline processes, enhance collateral efficiency, and reduce counterparty risk. Hedera Hashgraph’s role is pivotal, providing a robust, scalable infrastructure that supports tokenized collateral solutions. This collaboration, involving two of the UK’s largest financial institutions and a homegrown fintech, reinforces the nation’s ambition to become a global hub for digital asset innovation. Emily Smart, Chief Product Officer at Aberdeen Investments, and Peter Left, Head of Digital Finance at Lloyds, hailed the initiative as a game-changer. Graham Rodford of Archax emphasized Hedera’s permissioned DeFi collateral transfer network, solidifying its importance in building a more efficient financial system. 🚀🚀🚀  XXXXXX engagements  **Related Topics** [hbar](/topic/hbar) [banking](/topic/banking) [$lloyl](/topic/$lloyl) [breaking news](/topic/breaking-news) [$hbar](/topic/$hbar) [coins layer 1](/topic/coins-layer-1) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/DJ_Bax01/status/1944692054585643037)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Crypto Observer @DJ_Bax01 on x 3990 followers

Created: 2025-07-14 09:34:51 UTC

Crypto Observer @DJ_Bax01 on x 3990 followers

Created: 2025-07-14 09:34:51 UTC

$HBAR Hedera Hashgraph

🧨 Hedera strikes again! 🧨

Tell the world, this ground breaking news needs to be heard. $HBAR 🚀🚀

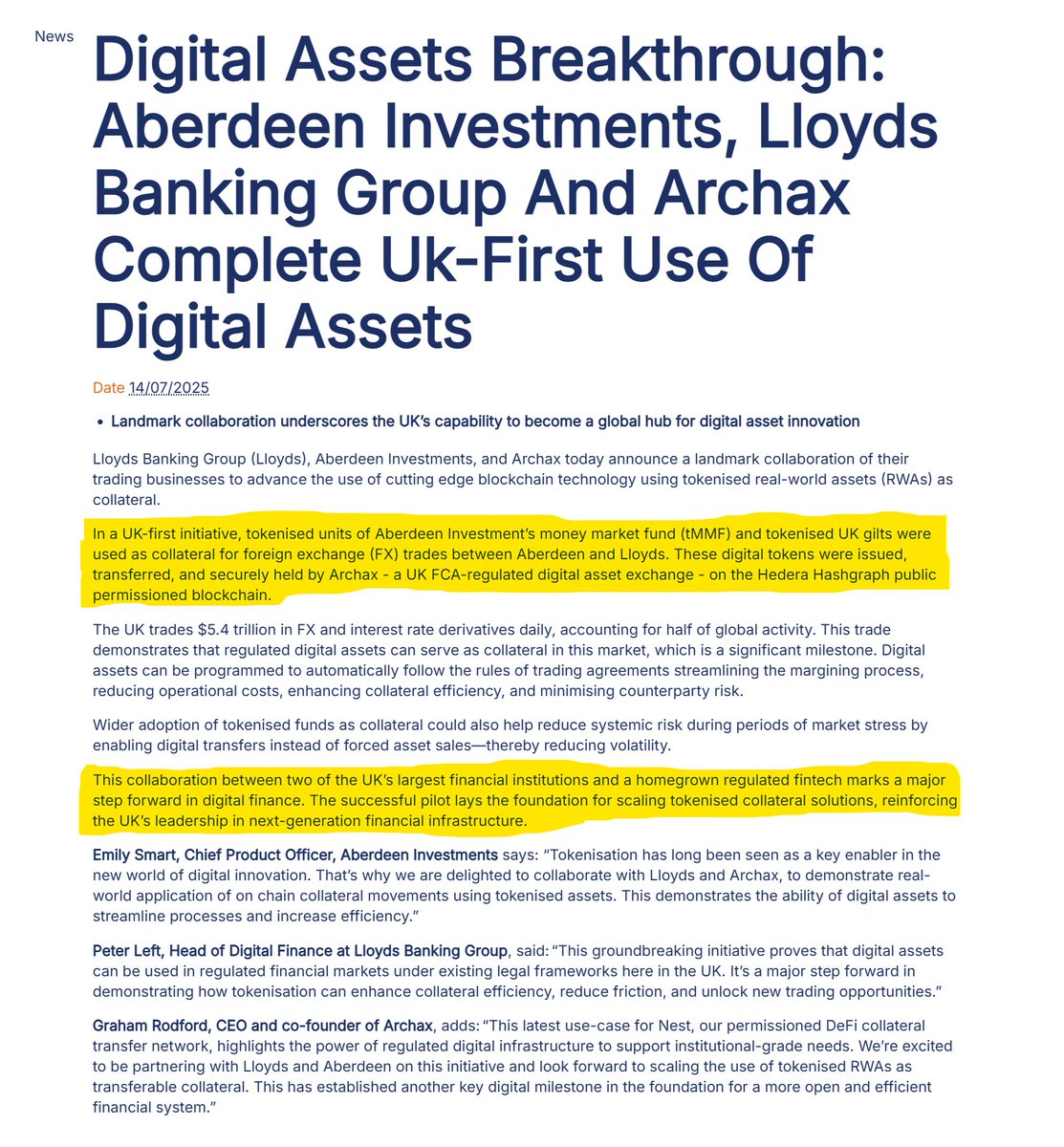

Digital Assets Breakthrough: UK Pioneers Tokenized Trading with Hedera Hashgraph

In a groundbreaking move, Aberdeen Investments, Lloyds Banking Group, and Archax have completed the UK’s first use of digital assets, marking a significant milestone in financial innovation.

Announced on July 14, 2025, this landmark collaboration leverages cutting-edge blockchain technology to tokenize real-world assets (RWAs), with a spotlight on the Hedera Hashgraph platform.

This initiative saw tokenized units of Aberdeen’s money market fund (MMF) and UK gilts used as collateral in a foreign exchange trade, securely executed on Archax’s UK FCA-regulated digital asset exchange, built on Hedera’s public permissioned blockchain.

The trade, valued at $XXX trillion in FX and interest rate derivatives daily, showcases how digital assets can streamline processes, enhance collateral efficiency, and reduce counterparty risk. Hedera Hashgraph’s role is pivotal, providing a robust, scalable infrastructure that supports tokenized collateral solutions.

This collaboration, involving two of the UK’s largest financial institutions and a homegrown fintech, reinforces the nation’s ambition to become a global hub for digital asset innovation.

Emily Smart, Chief Product Officer at Aberdeen Investments, and Peter Left, Head of Digital Finance at Lloyds, hailed the initiative as a game-changer. Graham Rodford of Archax emphasized Hedera’s permissioned DeFi collateral transfer network, solidifying its importance in building a more efficient financial system.

🚀🚀🚀

XXXXXX engagements

Related Topics hbar banking $lloyl breaking news $hbar coins layer 1 coins defi coins made in usa