[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Albert Alan [@_AlbertAlan](/creator/twitter/_AlbertAlan) on x 2829 followers Created: 2025-07-11 22:41:58 UTC Dear $CLOV Investors, Short interest reflects how many shares investors have borrowed and sold, betting the stock price will drop. When short interest jumps significantly, it typically means investors are strongly bearish—each small price increase attracts additional selling pressure. On the other hand, high short interest can also create conditions ripe for a short squeeze, where shorts must rapidly buy shares to cover their positions, causing a sharp upward spike. For Clover Health, recent short interest metrics have surged dramatically, clearly showing aggressive bearish bets. In the last three months, Clover's short interest as a percentage of free float climbed from just X% up to 12.13%. The dollar amount of short interest soared from $XXXX million to $XXXXX million, while the number of shares shorted increased from XXXXX million to XXXXX million. Shares borrowed jumped by more than XXXXX% to XXXXX million, utilization of available shares rose from XXX% to 36.8%, and days-to-cover nearly tripled from XXXX days to XXXX days. Even though borrowing costs remain low at around 0.53%, the overall "Short Score" increased from XXXX to XXXX out of XXX. Together, these figures suggest bears have piled into huge positions, available shares for borrowing are becoming scarce, and the risk of a squeeze is now very real. Three main factors explain this surge in bearish positioning: lingering doubts about Clover’s ability to sustain long-term profitability, traders betting on a pullback after recent gains, and the limited availability of shares that shrinks even further as utilization increases. Despite Clover recently turning free-cash-flow positive in fiscal-year 2024 and expectations for GAAP profitability by 2026, many institutional investors remain skeptical that Clover’s managed-care business model can maintain 30%+ annual growth without sacrificing its medical-loss ratios. From a bearish perspective, any stumble—like slower-than-anticipated member growth, squeezed profit margins, or disappointing forecasts—could unleash significant selling pressure as those XXXX million shorted shares hit the market. With daily trading volume averaging about 9-10 million shares, it would take more than five full trading days to cover all shorts, significantly amplifying potential downward movements. On the flip side, positive news—such as earnings beating estimates, stronger enrollment figures, or raised guidance—could ignite a rapid short squeeze. In this scenario, shorts scrambling to cover positions within a limited float could send shares skyrocketing by 30%-50% or even more within days. Fundamentally, Clover’s turnaround efforts are gaining momentum. The company achieved positive free cash flow in 2024, projects revenue growth of XX% this year, and aims for first-ever GAAP profitability by 2026. Analysts acknowledge this improvement, setting a median price target around $4.50, nearly XX% higher than the current ~$3.00 share price. Notably, this marks the first time analyst consensus targets exceed Clover’s trading price, revealing a striking gap between positive fundamentals and heavily bearish technical positioning. References [1] ORTEX, “Clover Health Investments, Corp. (NASDAQ: CLOV) – Short Interest,” ORTEX. Available [Accessed: Jul. 11, 2025].  XXXXX engagements  **Related Topics** [clov](/topic/clov) [stocks](/topic/stocks) [$clov](/topic/$clov) [Post Link](https://x.com/_AlbertAlan/status/1943802975958577355)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Albert Alan @_AlbertAlan on x 2829 followers

Created: 2025-07-11 22:41:58 UTC

Albert Alan @_AlbertAlan on x 2829 followers

Created: 2025-07-11 22:41:58 UTC

Dear $CLOV Investors,

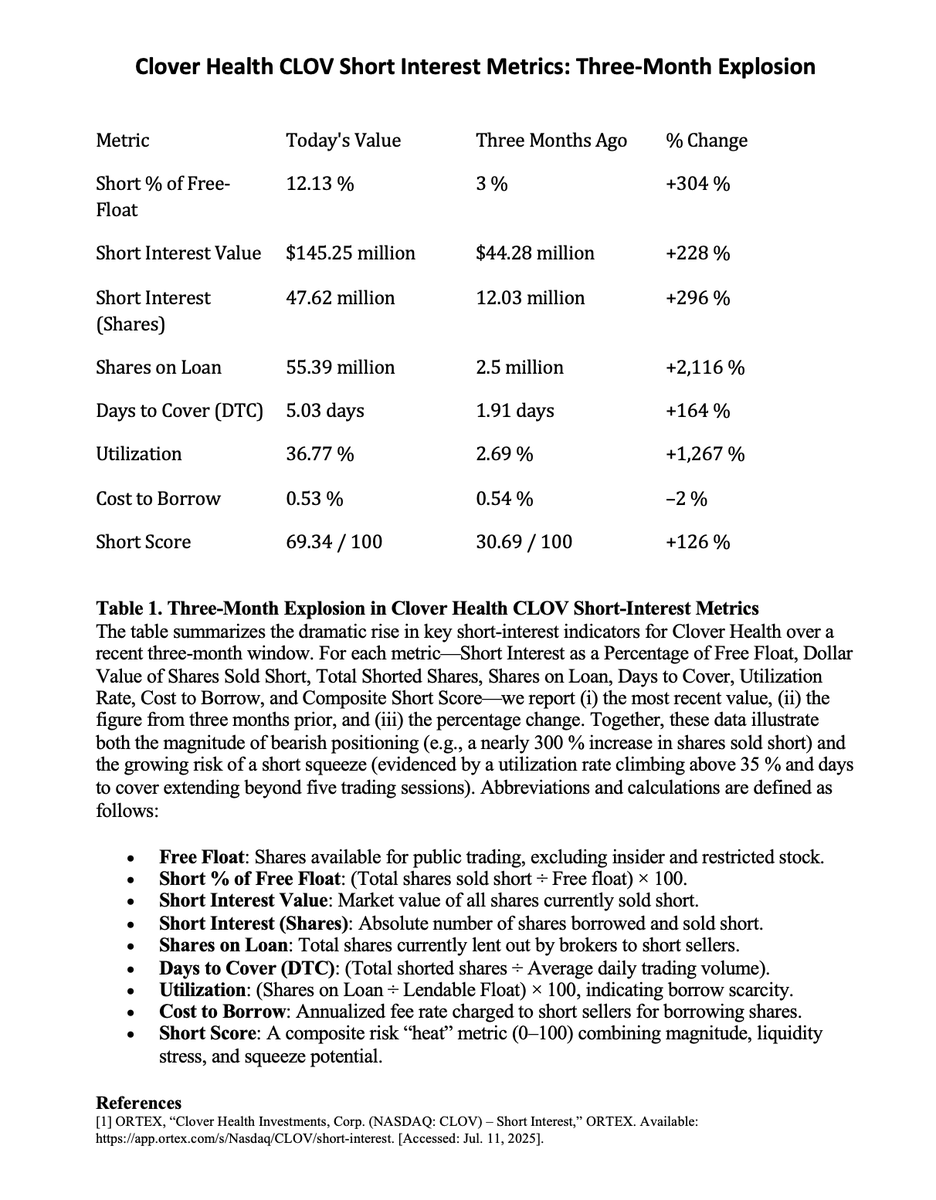

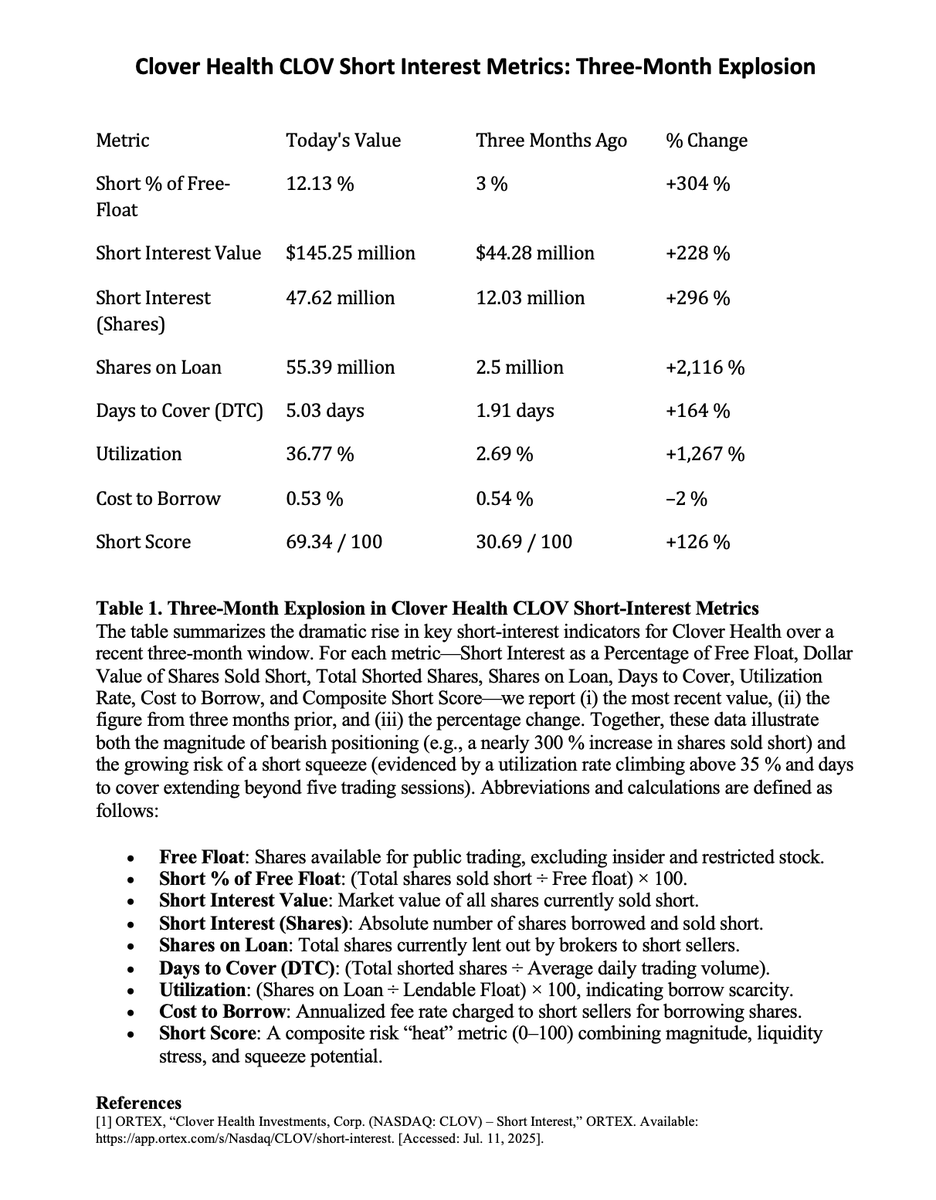

Short interest reflects how many shares investors have borrowed and sold, betting the stock price will drop. When short interest jumps significantly, it typically means investors are strongly bearish—each small price increase attracts additional selling pressure. On the other hand, high short interest can also create conditions ripe for a short squeeze, where shorts must rapidly buy shares to cover their positions, causing a sharp upward spike. For Clover Health, recent short interest metrics have surged dramatically, clearly showing aggressive bearish bets.

In the last three months, Clover's short interest as a percentage of free float climbed from just X% up to 12.13%. The dollar amount of short interest soared from $XXXX million to $XXXXX million, while the number of shares shorted increased from XXXXX million to XXXXX million. Shares borrowed jumped by more than XXXXX% to XXXXX million, utilization of available shares rose from XXX% to 36.8%, and days-to-cover nearly tripled from XXXX days to XXXX days. Even though borrowing costs remain low at around 0.53%, the overall "Short Score" increased from XXXX to XXXX out of XXX. Together, these figures suggest bears have piled into huge positions, available shares for borrowing are becoming scarce, and the risk of a squeeze is now very real.

Three main factors explain this surge in bearish positioning: lingering doubts about Clover’s ability to sustain long-term profitability, traders betting on a pullback after recent gains, and the limited availability of shares that shrinks even further as utilization increases. Despite Clover recently turning free-cash-flow positive in fiscal-year 2024 and expectations for GAAP profitability by 2026, many institutional investors remain skeptical that Clover’s managed-care business model can maintain 30%+ annual growth without sacrificing its medical-loss ratios.

From a bearish perspective, any stumble—like slower-than-anticipated member growth, squeezed profit margins, or disappointing forecasts—could unleash significant selling pressure as those XXXX million shorted shares hit the market. With daily trading volume averaging about 9-10 million shares, it would take more than five full trading days to cover all shorts, significantly amplifying potential downward movements. On the flip side, positive news—such as earnings beating estimates, stronger enrollment figures, or raised guidance—could ignite a rapid short squeeze. In this scenario, shorts scrambling to cover positions within a limited float could send shares skyrocketing by 30%-50% or even more within days.

Fundamentally, Clover’s turnaround efforts are gaining momentum. The company achieved positive free cash flow in 2024, projects revenue growth of XX% this year, and aims for first-ever GAAP profitability by 2026. Analysts acknowledge this improvement, setting a median price target around $4.50, nearly XX% higher than the current ~$3.00 share price. Notably, this marks the first time analyst consensus targets exceed Clover’s trading price, revealing a striking gap between positive fundamentals and heavily bearish technical positioning.

References [1] ORTEX, “Clover Health Investments, Corp. (NASDAQ: CLOV) – Short Interest,” ORTEX. Available [Accessed: Jul. 11, 2025].

XXXXX engagements