[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ammar Khan [@rogueonomist](/creator/twitter/rogueonomist) on x 49.6K followers Created: 2025-07-11 03:29:53 UTC Why QRs work in China X. There is a standardised QR across all payments providers. You dont need to have multiple QRs to confuse people X. You can scan QR directly from the most popular app you use, whether chat, or delivery, or whatever. Something you are comfortable with. You do not have to open a clunky ass banking app, login, see an error, login again and look for QR scanner. X. The full transaction completes in 4-5 seconds max, from opening app to paying X. Once transaction is completed, a soundboard at retailer end makes some noise validating the transaction, minimising fraud X. Refunds are processed within XX hours AUTOMATICALLY, and not in XX days or on someone's death X. You scan QR first, then put in your transaction pin -- which massively reduces friction. Unlike a scenario where you log in the app, get an error, log in again, find QR, scan, then add a PIN again to pay XXX rupees. No, thanks. X. A full transaction cycle time of 4-5 seconds mimics that of cash, and with zero cost, digital transactions add more utility for everyone X. Also, no random KYC if you are doing smaller amounts. Everyone gets onboarded even with the Great Firewall -- no one makes excuses of CDD or KYC. Biometric + Facial verification unlocks more limits. If one can do it in a compeltely foreign language and just through a good UI/UX, even argument of literacy ia thrown out of window X. You dont use a physical card anymore, just link it to your payment app, whether credit, or debit. No more stupid card fees. Raast is good, but still a long way to go before P2M payments actually work at scale. Currently all Merchants are served through individual accounts, which is a stupid policy, mainly because it is a pain and a half for a SME to open a business account. Regulators, and SEVP and above in banks, need to start using their own horrible UX first, then maybe visit China and sign-up and see how the process works. Ditch the roundtable, do some actual field work for a change.  XXXXXX engagements  **Related Topics** [login](/topic/login) [banking](/topic/banking) [ass](/topic/ass) [scan](/topic/scan) [china](/topic/china) [Post Link](https://x.com/rogueonomist/status/1943513044942045206)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ammar Khan @rogueonomist on x 49.6K followers

Created: 2025-07-11 03:29:53 UTC

Ammar Khan @rogueonomist on x 49.6K followers

Created: 2025-07-11 03:29:53 UTC

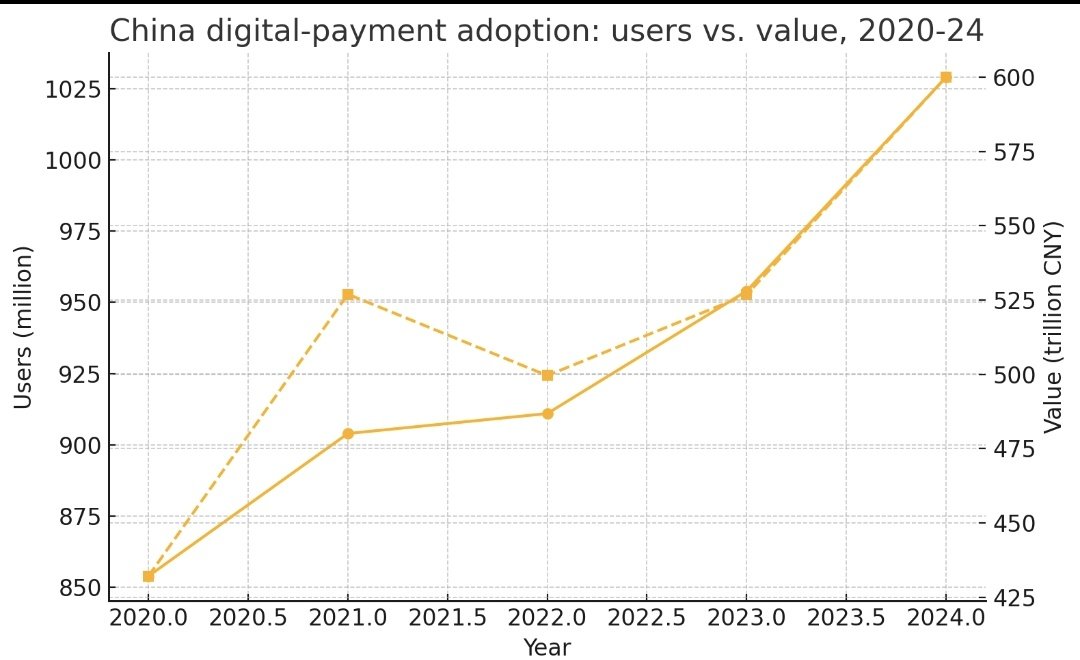

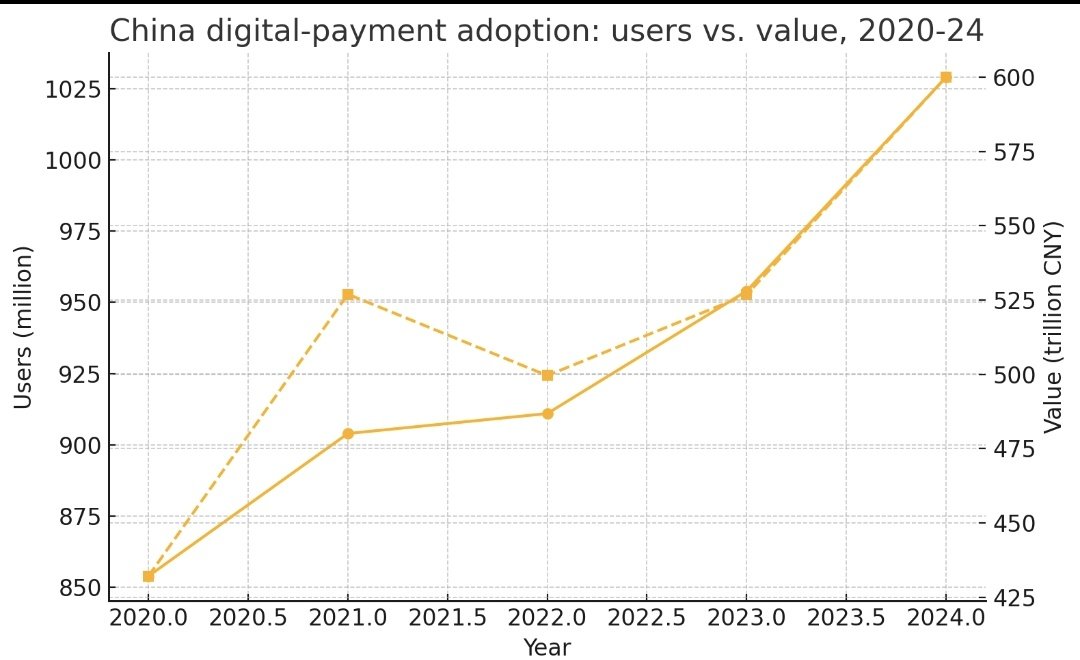

Why QRs work in China

X. There is a standardised QR across all payments providers. You dont need to have multiple QRs to confuse people

X. You can scan QR directly from the most popular app you use, whether chat, or delivery, or whatever. Something you are comfortable with. You do not have to open a clunky ass banking app, login, see an error, login again and look for QR scanner.

X. The full transaction completes in 4-5 seconds max, from opening app to paying

X. Once transaction is completed, a soundboard at retailer end makes some noise validating the transaction, minimising fraud

X. Refunds are processed within XX hours AUTOMATICALLY, and not in XX days or on someone's death

X. You scan QR first, then put in your transaction pin -- which massively reduces friction. Unlike a scenario where you log in the app, get an error, log in again, find QR, scan, then add a PIN again to pay XXX rupees. No, thanks.

X. A full transaction cycle time of 4-5 seconds mimics that of cash, and with zero cost, digital transactions add more utility for everyone

X. Also, no random KYC if you are doing smaller amounts. Everyone gets onboarded even with the Great Firewall -- no one makes excuses of CDD or KYC. Biometric + Facial verification unlocks more limits. If one can do it in a compeltely foreign language and just through a good UI/UX, even argument of literacy ia thrown out of window

X. You dont use a physical card anymore, just link it to your payment app, whether credit, or debit. No more stupid card fees.

Raast is good, but still a long way to go before P2M payments actually work at scale. Currently all Merchants are served through individual accounts, which is a stupid policy, mainly because it is a pain and a half for a SME to open a business account.

Regulators, and SEVP and above in banks, need to start using their own horrible UX first, then maybe visit China and sign-up and see how the process works. Ditch the roundtable, do some actual field work for a change.

XXXXXX engagements